M&A slump drives 49% decline in sale leasebacks

CFO Dive

SEPTEMBER 12, 2023

This year’s slow mergers and acquisitions market is having a knock-on effect on certain commercial real estate deals.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

SEPTEMBER 12, 2023

This year’s slow mergers and acquisitions market is having a knock-on effect on certain commercial real estate deals.

CFO Dive

AUGUST 3, 2023

The mergers and acquisitions boom is long over. The best CFOs are cleaning up their books and arming their CEOs with key data to win offers anyway.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

APRIL 24, 2024

Despite a recent uptick in mergers and acquisitions, some buyers are nonetheless growing more guarded about tapping their retention bonus budgets.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

What Your Financial Statements Are Telling You—And How to Listen!

CFO Talks

FEBRUARY 26, 2025

Understanding the M&A Process Before Making a Deal Mergers and Acquisitions (M&A) are some of the biggest decisions a business can make. To make M&A work, companies must carefully analyse the target business, negotiate the right price, and successfully combine both businesses.

CFO News

AUGUST 8, 2023

Due diligence, optimized technology, the ability to integrate organizational capabilities, and proper consideration of acquisition risks are the critical factors for fruitful M&A transactions.

Future CFO

MARCH 15, 2022

Refinitiv estimates that as of January 2022, the global M&A volume stood at US$5,160 billion , each with an aggregate value of US$100M or more. Rob Kindler , global head of M&A at Morgan Stanley , said the environment remains very good for M&A in 2022. Commitment essential to M&As amid the pandemic.

CFO Thought Leader

OCTOBER 29, 2024

At the time, Gronen was vice president of finance, responsible for assessing acquisitions and analyzing their outcomes. The merger cut $10 million in expenses, turning the combined business into a more profitable operation that was ultimately sold to a public company. Automation shortens this process to just a minute or two.

CFO News

MARCH 18, 2024

Vaibhav Choukse, Partner & Head - Competition Law at JSA Advocates & Solicitors, said the draft rules enlist certain kinds of M&A (Merger & Acquisition) transactions which will not require approval from the CCI.

Future CFO

SEPTEMBER 26, 2022

According to S&P Global , APAC M&A activity in Q1 2022 retreated from 2021’s highs, with deal value for the quarter ending at $73.8B, a decline of 44% quarter-on-quarter (QoQ) or 18% year-on-year (YoY). The financial services sector topped M&A activities in Q1 2022 with 14.6 ESG and the CFO.

Future CFO

MAY 26, 2022

Automation in M&A. According to Reuters, global mergers and acquisitions (M&A) volumes hit a record high in 2021 , breaching the $5 trillion mark for the first time. Large companies typically have subsidiary businesses that sell to each other. Source: Dimensional Research, BlackLine 2022.

VCFO

NOVEMBER 18, 2021

Merger & Acquisition Integration Plans. The M&A term sheet has been negotiated, due diligence has been completed and the valuation plus the timing has been agreed upon by both sides. Why Mergers & Acquisitions Fail. Lack of an acquisition integration strategy is a sure-fire way to fail.

CFO Talks

SEPTEMBER 10, 2024

Navigating Mergers and Acquisitions: A Strategic Guide for CFOs in South Africa Mergers and acquisitions (M&A) are powerful tools for growth, diversification, and innovation in today’s competitive business landscape. However, they come with inherent risks and complexities.

CFO News

DECEMBER 20, 2024

Large private equity (PE) deals, high-profile corporate mergers such as RelianceDisney, AdaniACC and Ambuja, and Mankinds acquisition of Bharat Serums, along with a surge in IPO activity, have fuelled the M&A boom.

Future CFO

JANUARY 6, 2025

Key recommendations include clarifying and amending tax rules, such as the deductibility of costs for carbon offsets and conditions for tax allowances for mergers and acquisitions (M&A), which have been viewed as limiting for businesses," says Rohan Solapurkar , business tax leader at Deloitte Singapore. "A

Future CFO

AUGUST 9, 2021

In Q1 2021, Mergers and Acquisitions (M&A) activity in APAC-ex Japan was up by 55%, the highest level since 2015. PwC ’s M&A 2020 Review and 2021 Outlook , reported a similar observation in China with M&A activities up 30% to US$733.8 The need for M&A insurance.

Future CFO

MAY 12, 2024

FutureCFO: From your bio I learnt that you became passionate about M&A at a young age. Sophie Fischer (SF): I first became passionate about merger and acquisition transactions in my teenage years in high school. I would watch my father, who worked on different M&A projects, and think: “Wow, that’s such an exciting job!”

Future CFO

NOVEMBER 26, 2023

There are five key M&A trends for 2024 while AI would reignite the global market, said WT W recently. However, the potential for disruption in 2024 remains considerable and the outlook for the M&A market hard to predict, with high borrowing costs, geopolitical conflict, and a packed election calendar around the world, WTW said.

E78 Partners

JULY 3, 2023

Over the past decade, the mergers and acquisitions (M&A) landscape has evolved significantly, driven by changing economic conditions, technological advancements, and evolving strategic objectives of companies. In terms of rapid growth, M&A can provide immediate access to new markets, technologies, and customer bases.

CFO Leadership

JANUARY 28, 2022

In addition, digitalization will become a greater priority in unexpected areas of the business, such as M&A and succession planning. . Mergers & acquisitions. Digital transformation can help to accelerate M&A deals and make companies more attractive acquisition targets. Succession planning.

Future CFO

NOVEMBER 21, 2021

During the launch of BCG's recent Global M&A Report, Dr. Jens Kengelbach shed light on how the M&A market responds to COVID-19 generally. The post 2021 M&A report: Mastering the art of breaking up | The M&A market responds to COVID-19 appeared first on FutureCFO.

Future CFO

FEBRUARY 5, 2023

Bold moves in global M&A might appear in 2023 — a year full of uncertainties, said Bain & Company recently when releasing its 5th annual Global Mergers & Acquisitions Report. This can be measured in the superior shareholder return of M&A active companies, the firm said.

Future CFO

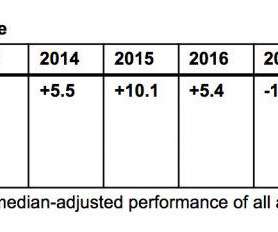

JANUARY 18, 2024

Global M&A is set to grow again after losing steam in the final three months of 2023, said WTW recently. According to WTW’s Quarterly Deal Performance Monitor (QDPM), companies completing M&A deals in the fourth quarter of 2023—based on share price performance—underperformed the wider market by –13.6

CFO News

FEBRUARY 20, 2024

According to a recent report by Growthpal, there has been a marginal decline in mergers and acquisitions in the fintech space in 2023, with lending leading the acquisitions with about 30 per cent, followed by payments and wealthtech. Here's what the report revealed:

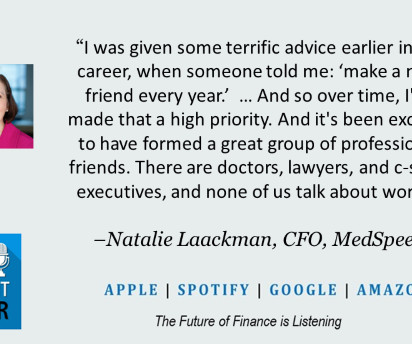

CFO Thought Leader

NOVEMBER 7, 2023

For corporate finance executives, few professional experiences are as adeptly converted into social currency as those manifested inside the realm of mergers and acquisitions (M&A). Laackman did not disappoint us, and what she shared reveals as much about herself as it does the human side of enterprise.

Future CFO

NOVEMBER 19, 2023

There are several top M&A trends in 2004, according to advisory firm Gartner. The top M&A trends in 2024 identified by the research firm are as follow. The top M&A trends in 2024 identified by the research firm are as follow.

Future CFO

OCTOBER 13, 2022

Global M&A performance bounced back in the third quarter of this year, said WTW recently when releasing its research on completed deals from the Quarterly Deal Performance Monitor (QDPM). Based on share price performance, buyers outclassed the wider market by +3.9 Research highlights.

CFO Share

SEPTEMBER 18, 2024

Whenever you invest more money in sales and marketing, keep an eye on your Customer Acquisition Cost (CAC) by channel to avoid wasting money on inefficient tactics. Whenever you invest more money in sales and marketing, keep an eye on your Customer Acquisition Cost (CAC) by channel to avoid wasting money on inefficient tactics.

Future CFO

FEBRUARY 1, 2022

M&A deal momentum is set to continue in 2022 after registering unparalleled growth in deal values and volumes in 2021, said PwC recently when releasing its Global M&A Industry Trends: 2022 Outlook. trillion, 14% higher than the start of the year – providing plenty of fuel for M&A activity in 2022. Report highlights.

Future CFO

JANUARY 31, 2023

Global M&A activity will likely rise in the second half of 2023 as investors and executives look to balance short-term risks with their long-term business transformation strategies, said PwC recently when releasing its PwC’s 2023 Global M&A Industry Trends Outlook.

CFO Talks

JUNE 15, 2023

The current MD of AWCape shared his thoughts in a CFOClub Podcast on how CFOs should approach AI, what managing an acquisition is like and what he learned from his early career experiences as a game ranger. So which is tougher, managing M&A or game ranging? “I I think I’d rather do a merger. And it’s a major win.”

Future CFO

DECEMBER 18, 2022

When it comes to global M&A trends in 2023, WTW said that deals will be smaller while pace will be slower. As we move into 2023, economic uncertainty will continue to define and challenge M&A activity, but there will also be opportunities, said Massimo Borghello, Head of Human Capital M&A Consulting, Asia Pacific at WTW. . “In

Future CFO

FEBRUARY 8, 2022

There are three M&A success factors that dealmaking executives must understand to thrive in the sizzling M&A market that saw a record high value of US$5.9 trillion in 2021, said Bain & Company recently when releasing its fourth annual M&A report based on a global survey of more than 280 executives.

Future CFO

JANUARY 17, 2023

Global M&A has a positive start in 2023 as global dealmakers achieved a second consecutive quarter of market outperformance in the last three months of 2022, said WTW recently. Global M&A highlights. In Asia Pacific, deal volumes have been more stable with a marginal increase in M&A activity during the last 12 months.

CFO Thought Leader

OCTOBER 29, 2023

For corporate finance executives, few professional experiences are as adeptly converted into social currency as those manifested inside the realm of mergers and acquisitions (M&A). ” -Natalie Lacckman, CFO, MedSpeed On the practical side, we look at our business as time and miles.

Future CFO

JANUARY 9, 2022

Global M&A to remain strong in 2022 as valuations reach historic highs, said Willis Towers Watson (WTW) recently. Based on share-price performance, companies making M&A deals outperformed the World Index[1] by +1.4pp (percentage points) on average, the firm added. Highlights. Source: Willis Towers Watson.

Future CFO

JUNE 21, 2022

The optimism in M&A might be sustainable though activity level would not be the same as that in 2021, said AON recently when releasing a study by the firm and Mergermarket. The outlook is particularly strong for M&A in sectors such as Technology, Media and Telecom (TMT) and Asia Pacific, AON added.

Future CFO

MAY 30, 2023

Cross-border M&A is an important way that Asia Pacific’s top 50 consumer product companies (CP 50) adopt to expedite growth, said Bain recently. Cross-border M&A thus becomes the fastest way for Asia Pacific CPs to build business overseas, Dizon noted. International M&A activity is still heating up among CPs.

Future CFO

AUGUST 11, 2022

Asia Pacific M&A activity remains robust in 2022 despite major geopolitical and financial headwinds, said EY recently when releasing results of an analysis. Elevated deal volumes and values and an increased focus within the APAC region suggests that APAC companies are leveraging M&A as a vehicle to transform their businesses.

Future CFO

AUGUST 31, 2023

When it comes to the latest M&A trend, business leaders expect to see a rebound into 2024, according to EY. In addition, 59% of respondents look to M&A, while 47% look to divest and 63% look to enter strategic alliances or joint ventures, survey results indicated.

Beacon CFO Plus

NOVEMBER 11, 2024

To view it please enter your password below: Password: The post Protected: Identifying Red Flags in M&A Deals appeared first on BeaconCFO Plus. This content is password protected.

CFO Alliance

NOVEMBER 29, 2022

The post The Best Way to Build is to Buy: Business Acquisitions in a Recession appeared first on CFO Alliance.

Future CFO

JUNE 4, 2020

If you happen to read the Asia Pacific M&A Review 2020 by Herbert Smith Freehills you will easily conclude that the report while earmarked 2020 was written much earlier as there was no mention of any major macroeconomic disruption other than the percolating US-China Trade war. Describe the M&A landscape in 2019.

PYMNTS

OCTOBER 31, 2018

During the firm’s earnings call, Clarke pointed to initiatives across Fleetcor’s four core business units — fuel, corporate payments, tolls and lodging — via collaborations, mergers and acquisitions (M&A) to drive incremental growth in each area. Total revenues were up 7 percent year over year to $619.6

Future CFO

JULY 12, 2021

In a February 2021 report , Morgan Stanley ’s global head of M&A, Rob Kindler said: “All the elements are there for an active M&A market in 2021, from corporations looking for scale and growth to private equity firms and special-purpose acquisition companies (SPACs) looking to invest capital.”. COVID-19 is no different.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content