FASB revisits GAAP cleanup

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

DECEMBER 20, 2023

With its anniversary year drawing to a close, there are signs FASB is stepping up the pace of its standards setting. Some finance executives are wary.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

CFO Dive

AUGUST 2, 2023

CFO Nelson Chai will depart from the ride-share company next year as Uber continues to focus on profitable growth. It reported its first-ever quarterly GAAP operating profit Tuesday.

CFO Dive

JUNE 13, 2024

Like crypto rules FASB recently finalized, the environmental credit accounting standards would provide specific guidance where GAAP is currently silent.

CFO Dive

JUNE 5, 2024

Despite a unanimous vote, some board members expressed concern the proposed improvements to GAAP hedging guidance do not go far enough.

CFO Dive

OCTOBER 29, 2024

In June the FASB voted 7-0 for the more targeted update, even as some expressed concerns about not going far enough to modernize GAAP rules.

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

CFO Dive

NOVEMBER 27, 2024

The new GAAP guidance stems from a request made by Big Four accounting firms and comes as the convertible bond market is regaining steam.

CFO Dive

APRIL 5, 2024

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

CFO Dive

MARCH 1, 2023

Warren Buffett — CEO of Berkshire Hathaway and one of the world’s most renowned investors — didn’t disappoint fans of his folksy, acerbic writing in his latest shareholder letter.

CFO Dive

AUGUST 17, 2022

The accounting changes come as crypto-asset valuations have taken a beating and drawn increasing regulatory scrutiny.

CFO Dive

NOVEMBER 13, 2024

Intangible assets aren’t being captured in the merger review thresholds that federal antitrust agencies rely on, a paper shows.

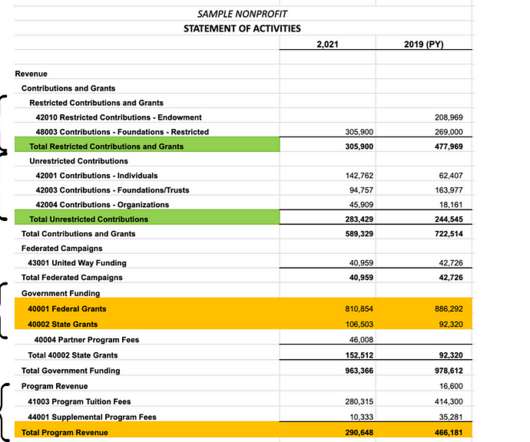

The Charity CFO

JANUARY 22, 2025

Financial Management Moving from basic bookkeeping to GAAP-compliant accounting became necessary as the organization grew. About The Charity CFO We are an accounting partner that truly understands nonprofits. The post Scaling a Nonprofit: Lessons from Southside Blooms’ Rapid Growth appeared first on The Charity CFO.

The Charity CFO

DECEMBER 30, 2021

Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. It shows whether or not your accounting records are accurate per generally accepted accounting principles (GAAP), in the auditor’s professional judgment. The Charity CFO doesn’t conduct nonprofit audits.

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP. How do I maximize tax deductions under section 280E?

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

Financial governance allows your organization to meet compliance requirements, such as IFRS and GAAP updates, by having the right financial controls in place. For single and multiple family offices, governance is key to financial success and is an important element of your organizational structure.

The Charity CFO

MAY 10, 2022

So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. The changes to in kind donation reporting are specifically for organizations that follow generally accepted accounting principles (GAAP) in preparing their financial statements. Get the free guide!

The Charity CFO

MARCH 13, 2023

The way revenue and expenses are recorded can differ for GAAP purposes and tax purposes ( Form 990 ). For tax, this excess amount is reported as a contribution, and for GAAP, it can be reported as either a contribution or special event revenue. The Charity CFO can help you sort out the accounting considerations of hosting a fundraiser.

VCFO

APRIL 27, 2023

vcfo Austin welcomes Richard Buckley, Consulting CFO, to serve all Austin and Central Texas area clients. He served as CFO for H2X LLC and president and CFO for Conch / Druid Oilfield Services. The post Richard Buckley joins vcfo Austin as Consulting CFO appeared first on vcfo.

CFO Thought Leader

MARCH 25, 2025

Read More Today, that spirit of transparent communication fuels Robbinss approach as CFO. Over the last fiscal year, we grew 31% with strong non-GAAP (gross) margins. CFOTL: Looking ahead, what are your key priorities as CFO over the next 12 months? All this is really attributed to (our platforms) integrated approach.

CFO Share

JUNE 27, 2024

How a CFO Ensures Compliance in Financial Reporting Reliable financial statements are crucial for business management, but ensuring compliance may feel like a luxury in the resource-constrained world of small business. Read on to learn how CFOs perform this evaluation and what compliance looks like in small businesses.

The Charity CFO

JANUARY 18, 2022

In doing so, Zack will help ensure that our clients’ financials are prepared in accordance with general accepted accounting principles (GAAP) and their 990s meet IRS guidelines. Please join us in welcoming Zack Meyer to The Charity CFO! He looks forward to continuing to work with nonprofits both in St. Louis and nationwide.

CFO Share

AUGUST 15, 2024

An Outsourced Chief Financial Officer (CFO) can be an invaluable ally in navigating this complex process. Here’s how small business advice from a CFO can help you secure funding for your business while ensuring your interests are protected. How does a CFO secure business funding?

The Charity CFO

APRIL 5, 2022

Cash accounting does not comply with Generally Accepted Accounting Principles (GAAP) for nonprofit organizations. Financial statement audit or review – if you are required to undergo a financial statement audit or assessment, using the accrual method to be in accordance with GAAP will make the process much smoother and less expensive.

The Charity CFO

JULY 19, 2024

What is a Chief Financial Officer (CFO)? A Chief Financial Officer (CFO) is a senior executive in charge of the strategic direction and goal setting of a nonprofit’s accounting and financial management. As an executive-level role, the CFO is in charge of guiding the overall financial strategy of the organization.

The Charity CFO

JANUARY 21, 2022

Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit. And the more transparent your accounting system is, the more accountable you’ll be with the public and GAAP.

The Finance Weekly

MARCH 25, 2024

Big companies used to hog all the CFO action, but now even small and medium-sized businesses are jumping on the bandwagon. Why the sudden CFO craze? In a nutshell, companies are starting to view CFOs as smart investments rather than just expenses. Highest Paid CFOs in the World in 2024 1. As the Director of Amyris Inc.,

The Charity CFO

FEBRUARY 25, 2022

For that reason, your account numbering, category names, and structure should follow standard guidelines and numbering conventions established by Generally Accepted Accounting Principles (GAAP). . If you’re ready to create a Chart of Accounts for your nonprofit, you can start with this template, made for you to customize by The Charity CFO.

CFO Talks

SEPTEMBER 5, 2024

Designing Effective Financial Information Systems: A Guide for South African CFOs In the ever-changing financial landscape, the strength of your financial information system (FIS) plays an important role in determining your organisation’s success. Regular updates to the system to reflect changes in these regulations are also crucial.

The Charity CFO

JANUARY 17, 2022

Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. Accrual accounting is required by Generally Accepted Accounting Principles (GAAP), which means that you’ll need accrual-based reports to complete a nonprofit audit. Get the free guide! Fundraising expenses.

The Charity CFO

OCTOBER 9, 2024

individual and corporation connections), history, donor intent, or soft credits Accounting software tracks financial transactions with strict adherence to GAAP Integrating two systems with fundamentally different data priorities can risk data inconsistencies, inaccuracies, and loss of information. Contact us today to learn more!

The Finance Weekly

DECEMBER 18, 2021

The job description for a financial controller and a CFO are eerily similar. A CFO is the top financial executive in a firm whose responsibilities encompass the controller and include the overall financial strategy and vision of the company. According to Payscale , the average salary for a CFO is 1.5 The case for a CFO.

Boston Startup CFO

OCTOBER 13, 2015

The auditors uncovered a horrific mistake that the previous accountant didn’t catch: We were accounting for our revenue completely wrong (non-GAAP) and we had to re-state our financials, something you never want to do in your business. Attributes of a Great CFO. Do You Need a CFO? Look at Groupon!).

The Charity CFO

JANUARY 31, 2022

To comply with Generally Accepted Accounting Principles (GAAP), you must separate your revenue into at least 2 categories: Restricted Revenue shows funds with donor-placed restrictions on how or when you can spend the money. At The Charity CFO, we help 150+ nonprofits get audit-ready financial reports monthly, like clockwork.

The Charity CFO

JANUARY 13, 2022

Prepare financial statements per Generally Accepted Accounting Principles (GAAP). For the purposes of GAAP, donations of goods and services are valid revenue. The Charity CFO is your best option for outsourced accounting, from bookkeeping and financial statements to accounting for in-kind donations. Submit to an annual audit.

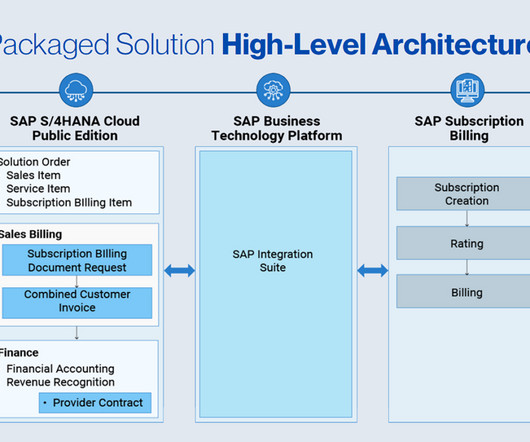

Bramasol

AUGUST 21, 2024

As the SAP partner with the deepest experience serving the Office of the CFO, including compliance requirements, Bramasol can help you navigate the most complex scenarios. SAP offers a wide range of options to select from, all of which take advantage of the seamless nature of the end-to-end SAP ecosystem and its unified data structures.

BlueLight

MAY 1, 2020

Traditionally, the chief financial officer (CFO) is responsible for tracking the company’s past and present financial situation and ensuring on-time and accurate financial reporting. Today, the CFO is expected to inform strategic decisions that drive the success of the company. The CFO takes on the responsibility of FP&A.

CFO Selections

AUGUST 28, 2024

By proactively preparing for GAAP changes, CFOs can position their business for success. As a CFO or Controller, staying at the forefront of accounting best practices and standards is crucial for maintaining financial integrity , advancing innovation in accounting, and ensuring compliance.

The Charity CFO

MAY 2, 2022

The IRS has different reporting requirements than GAAP, so the balance sheet section of your 990 may not match your audited financial statements. The Charity CFO provides expert financial guidance and streamlined and efficient accounting services to 150+ nonprofits throughout the USA. appeared first on The Charity CFO.

Focus CFO

DECEMBER 6, 2021

While they may have a bookkeeper and Tax CPA, they do not have a strong accounting department led by a real CFO. GAAP financials when times get tough, and others manage to survive with street smarts. GAAP based Managerial Financial Statements. GAAP or IFRS based. Don’t leave any money on the closing table!

The Charity CFO

FEBRUARY 4, 2022

Nonprofits must maintain thorough and accurate financial records to comply with both Generally Accepted Accounting Principles ( GAAP ) and maintain their tax-exempt status with the IRS. At The Charity CFO, we handle the books and all of your accounting needs. And it’s impossible to do that without accurate bookkeeping.

CFO Thought Leader

FEBRUARY 19, 2024

text 975: Turning the Tide at Beachbody | Marc Suidan, CFO, The Beachbody Company The post The Mentoring Round | Marc Suidan, CFO, The Beachbody Company appeared first on CFO THOUGHT LEADER, CFO, Finance, Leadership, CPA.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content