When Does a Business Need a CFO?

CFO Selections

NOVEMBER 20, 2024

As such, their responsibilities include: budgeting and forecasting, managing mergers or acquisitions, and handling compliance issues.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Selections

NOVEMBER 20, 2024

As such, their responsibilities include: budgeting and forecasting, managing mergers or acquisitions, and handling compliance issues.

CFO Plans

NOVEMBER 10, 2024

Consider a mid-sized tech company that expanded its workforce by 30%—initially, they underestimated their onboarding expenses, leading to budget overruns. By revisiting their workforce expansion budgeting and refining their hiring strategy, they optimized the recruitment process, reducing costs while improving hire quality.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Plans

SEPTEMBER 24, 2024

Discover expert tax planning and accounting services designed to help you thrive. Effective tax planning and accounting are not just about compliance; they are about unlocking opportunities for growth and stability. In conclusion, effective tax planning and accounting are vital for the success of small businesses.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Plans

OCTOBER 29, 2024

Strategic Budget Planning as a Success Blueprint The journey to financial stability begins with strategic budget planning. A well-structured budget serves as a roadmap, guiding businesses toward prudent financial decisions and sustainable growth.

Nerd's Eye View

SEPTEMBER 25, 2024

tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon.

CFO News

MARCH 15, 2023

The Indian government is unlikely to make changes to its budget proposal of taxing the total returns on high-value life insurance policies, two government officials said on Wednesday, amid demands by insurance companies to reconsider the move.

E78 Partners

MARCH 3, 2025

Implement budgeting and forecasting processes that withstand market scrutiny. Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations. Ensure their finance team has public company reporting expertise.

Planful

SEPTEMBER 22, 2016

What are some of the biggest problems with the annual budget, and how can teams improve budget planning? Budgets Are Simple and Yet So Complex. Budgets can be strange. After all, a budget is simply a financial plan for a set duration of the company, including the projected income and expenses of the business.

CFO Plans

AUGUST 9, 2024

For instance, a mid-sized manufacturing company saw a 15% increase in profitability within a year of engaging an outsourced CFO who streamlined their budgeting and forecasting processes. Strategic Tax Planning and Preparation Services Effective tax planning is essential for minimizing liabilities and maximizing returns.

CFO Plans

AUGUST 23, 2024

For many companies, particularly small to mid-sized enterprises, hiring a full-time Chief Financial Officer (CFO) isn’t always feasible due to budget constraints. This model allows businesses to access high-quality financial advisory and management services tailored to their specific needs and budget.

Spreadym

APRIL 27, 2023

Financial analysis and planning (or FA&P) software is a type of business software that helps companies manage their finances and operational activity by analyzing financial data and providing tools to plan, forecast and make budgets for efficient business growth.

CFO Plans

SEPTEMBER 24, 2024

Whether you need part-time CFO services, fractional CFO services, or full-time financial oversight, a bespoke plan can be created to align with your business goals. This flexibility ensures that you receive the level of support that suits your growth stage and budget.

CFO Plans

JUNE 13, 2024

They excel in areas like financial planning, budgeting, cash flow management, and strategic financial analysis. Fractional CFO services offer a budget-friendly alternative, allowing companies to pay only for the expertise they need.

CFO Plans

JUNE 7, 2024

They excel in areas like financial planning, budgeting, cash flow management, and strategic financial analysis. Fractional CFO services offer a budget-friendly alternative, allowing companies to pay only for the expertise they need.

CFO Plans

JUNE 27, 2024

Expert Tax Planning and Preparation for Savings Navigating the complexities of tax regulations can be daunting for any business. Certified public accountants (CPAs) within outsourced accounting firms offer expert tax planning and preparation services. Get expert tax planning and maximize your savings.

CFO Plans

SEPTEMBER 24, 2024

From budgeting to financial forecasting, having an expert team by your side ensures that your startup is set on a path to profitability. Get Customizable Accounting Packages Tax Optimization Strategies Maximize Savings Effective tax planning can significantly impact your bottom line.

CFO Plans

JUNE 14, 2024

These services include cash flow analysis, tax planning, and risk management, ensuring that your real estate portfolio remains profitable and sustainable. Virtual CFO services provide you with access to experienced financial professionals who can guide your business through financial planning, budgeting, and forecasting.

Spreadym

NOVEMBER 3, 2023

Financial planning typically includes the following key components: Setting Financial Goals: Identify and prioritize your short-term and long-term financial objectives, such as saving for retirement, buying a home, paying off debt, or funding your children's education. Understanding CLV can guide customer retention and marketing strategies.

CFO Plans

JULY 18, 2024

Certified public accountants (CPAs) with expertise in real estate can offer invaluable insights into managing cash flow, budgeting, and financial forecasting. By partnering with a CPA specializing in real estate, they implemented a robust financial management system that included detailed budgeting and forecasting.

CFO Plans

SEPTEMBER 24, 2024

These services provide valuable insights into cash flow management, budgeting, and financial forecasting, helping SMEs make informed decisions and achieve long-term success. For instance, a boutique marketing agency might use strategic financial planning to expand its service offerings.

VCFO

NOVEMBER 1, 2023

Alternatively, if expenses are running over budget, are there line items that can be cut or deferred to pull overall expenses back in line with budget? Tax Planning is Beneficial and Essential A wise person once said that failing to plan is planning to fail.

Boston Startup CFO

OCTOBER 13, 2015

Company founders and CEOs are rarely equipped to handle financing strategies, budgets and dealing with investors. Accounting Manager - Oversees a bookkeeper or staff accountant, might help with tax planning and payroll, and can provide basic financial reporting. It’s a growing pain that many small businesses have.

CFO Plans

SEPTEMBER 24, 2024

Focus on Business Performance Optimization Optimizing business performance is at the heart of effective tax consulting. This includes tax planning techniques that align with the business’s growth objectives. A tech startup might benefit from R&D tax credits, reinvesting savings into further innovation.

CSC Advisors

MAY 30, 2022

Whether you need help with budgeting, investing, tax planning, or even paying off your outstanding debts, you can find a financial advisor to help! While this isn't necessarily the most important tip, finding a financial advisor that fits within your budget is very important!

CFO Plans

SEPTEMBER 6, 2024

This is particularly beneficial for startups and small businesses with limited budgets. Get expert financial planning with CFO Plans. Fractional CFOs usually have a network of professionals providing outsourced tax preparation services, business tax planning services, and accounting and finance consulting.

CFO Plans

SEPTEMBER 24, 2024

Yet, many budding entrepreneurs face the challenge of budget constraints, making it difficult to hire a full-time CFO. Whether it’s financial reporting, budgeting, or financial analysis, these bespoke services ensure that startups receive the precise support they need for their unique financial scenarios.

Michigan CFO

NOVEMBER 1, 2021

But come funding time, many SaaS companies find in organizing their finances that their budgeting system is a mess. Budget Forecasting With SaaS CFO Metrics. Tax Planning With Your SaaS CFO. You might be wondering, “Okay, but can my SaaS CFO handle taxes?” This is when it’s time to turn to a SaaS CFO.

CFO Plans

MAY 30, 2024

Consider the case of a growing tech startup that utilized fractional CFO services to develop a robust financial plan, which helped secure additional funding and scale operations efficiently. These experts assist with budgeting, forecasting, and financial planning, ensuring your business remains financially sound and poised for growth.

CFO Plans

SEPTEMBER 24, 2024

An outsourced CFO offers expert advice on fundraising, budgeting, and financial planning, ensuring that your startup is on a path to sustainable growth. Expert Startup Financial Consulting Startups face unique financial challenges, and startup financial consulting is essential for navigating these hurdles.

CFO Plans

SEPTEMBER 24, 2024

Get Started with CFO Plans Today Small Business Financial Advisory as Your Strategic Partner Navigating the financial landscape can be daunting for small business owners. From budgeting to financial planning, expert advisors provide the insights necessary to steer your business towards success.

CFO Plans

OCTOBER 21, 2024

Regularly Reviewing Financial Plans The financial landscape is ever-changing, making regular reviews of your financial plans crucial. An e-commerce company revisited their budget planning for startups quarterly, allowing them to adjust to seasonal trends and stay competitive.

CFO News Room

DECEMBER 30, 2022

Given that a firm’s technology needs change over time, and that AdvisorTech software tools frequently add new features, conducting an annual tech stack audit can help ensure firms are getting the most out of their technology budget. by a staff member, or by an outside consultant. Bob Veres | Advisor Perspectives).

CFO Share

MARCH 9, 2021

Although nobody knows exactly how regulators may change the tax landscape, we know enough at CFOshare to advise our clients on some major things to be aware of when planning business taxes in 2021. Sales tax risk is on the rise for small businesses. The fallout of South Dakota v.

CFO Share

JULY 13, 2023

Growth planning should include your executive team and a CPA for tax planning purposes. Once published, you should meet with your managers and fractional CFO to study the statements, variance from budget, and forecast. Determine KPIs and financial reporting to measure progress. If not, your feedback loop is too slow.

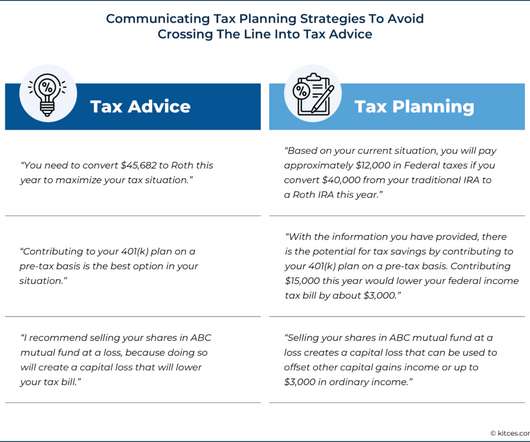

CFO News Room

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong. Affects how much can be saved to pre- and after-tax accounts !

The CFO College

APRIL 8, 2021

You want to talk about the value or benefits you can offer them, explaining how you can ease their pain points, such as how you can save them money in the long run by helping them with tax planning or minimizing their tax burden.

CFO News Room

NOVEMBER 22, 2022

But then during what are we actually doing for clients, and we’re going… I view things as retirement planning, education planning, general tax, budget cash flow. And we make sure we have a plan for those things, and those are always updated. So, for example, we have CPA info and tax notes.

Future CFO

SEPTEMBER 14, 2020

Tam noted that FP&A professionals will then need to “revisit their financing and liquidity strategies, centralize decisions for cash release upon the applications of government stimulus, and implement tax planning strategies that can reduce cash expenditures and preserve budget.”.

CFO Plans

SEPTEMBER 24, 2024

By predicting future financial outcomes based on historical data, market trends, and economic indicators, small businesses can navigate uncertainty, plan for growth, and ensure long-term sustainability. In the fast-paced world of small business, precise financial forecasting is not merely advantageous—it’s essential.

CFO News Room

DECEMBER 20, 2022

And one of the flyers that came out said that I did estate planning, and tax planning, and business succession planning, and all these things I didn’t know anything about. And so, ultimately, I… Michael: Not actually that deep on your business succession planning experience as a 20-year-old.

CFO News Room

NOVEMBER 28, 2022

When consumers think about cash flow management, the word ‘budget’ might come to mind. Tax Planning. In addition to managing investments, tax planning is another area where advisors can demonstrate their value in dollar terms. whether to bunch contributions ) as well as location planning for charitable giving (e.g.,

Nerd's Eye View

MARCH 10, 2023

While the budget almost certainly will face stiff resistance in a divided Congress, proposals that could affect financial advisors and their clients include increasing the top income and capital gains tax rates, raising the Net Investment Income Tax rate and applying it to pass-through income, and increasing the amount of the child tax credit.

Barry Ritholtz

AUGUST 15, 2023

It’s part of their own tax planning. And what’s their budget like a fraction of it, right? RITHOLTZ: But some of these guys are sitting with a lot more than a billion dollars, and why not? Unless they have their own foundation. I could give you a list of 30 billionaires. They all set up their own foundations.

Nerd's Eye View

MARCH 15, 2024

Also in industry news this week: CFP Board this week announced changes to its Sanctions Guidelines and revisions to its Fitness Standards that clarify the factors that determine how potential sanctions are determined and revise the framework use to determine whether a candidate is eligible to become a CFP certificant The Financial Services Institute (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content