When Does a Business Need a CFO?

CFO Selections

NOVEMBER 20, 2024

As such, their responsibilities include: budgeting and forecasting, managing mergers or acquisitions, and handling compliance issues.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Selections

NOVEMBER 20, 2024

As such, their responsibilities include: budgeting and forecasting, managing mergers or acquisitions, and handling compliance issues.

CFO Plans

NOVEMBER 10, 2024

For businesses poised for expansion, understanding and strategically planning for these costs isn’t just advantageous—it’s essential for success. Consider a mid-sized tech company that expanded its workforce by 30%—initially, they underestimated their onboarding expenses, leading to budget overruns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Plans

SEPTEMBER 24, 2024

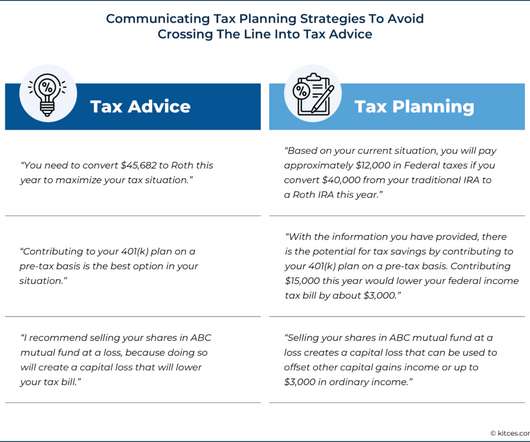

Discover expert tax planning and accounting services designed to help you thrive. Effective tax planning and accounting are not just about compliance; they are about unlocking opportunities for growth and stability. In conclusion, effective tax planning and accounting are vital for the success of small businesses.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Plans

OCTOBER 29, 2024

Strategic Budget Planning as a Success Blueprint The journey to financial stability begins with strategic budget planning. A well-structured budget serves as a roadmap, guiding businesses toward prudent financial decisions and sustainable growth.

Nerd's Eye View

SEPTEMBER 25, 2024

tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon.

E78 Partners

MARCH 3, 2025

Implement budgeting and forecasting processes that withstand market scrutiny. Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations. Refine Financial Planning and Analysis (FP&A): Develop robust forecasting models and scenario planning tools.

CFO News

MARCH 15, 2023

The Indian government is unlikely to make changes to its budget proposal of taxing the total returns on high-value life insurance policies, two government officials said on Wednesday, amid demands by insurance companies to reconsider the move.

Spreadym

NOVEMBER 3, 2023

Financial planning is the process of assessing your current financial situation, setting financial goals, and creating a strategy to achieve those goals. It involves evaluating your income, expenses, assets, and liabilities to develop a comprehensive plan for managing your finances effectively.

Planful

SEPTEMBER 22, 2016

What are some of the biggest problems with the annual budget, and how can teams improve budget planning? Budgets Are Simple and Yet So Complex. Budgets can be strange. After all, a budget is simply a financial plan for a set duration of the company, including the projected income and expenses of the business.

CFO Plans

AUGUST 9, 2024

Discover how CFO Plans can transform your financial management and set your business on the path to success. For instance, a mid-sized manufacturing company saw a 15% increase in profitability within a year of engaging an outsourced CFO who streamlined their budgeting and forecasting processes.

Spreadym

APRIL 27, 2023

Financial analysis and planning (or FA&P) software is a type of business software that helps companies manage their finances and operational activity by analyzing financial data and providing tools to plan, forecast and make budgets for efficient business growth. Planning: this is the first stage of every business activity.

CFO Plans

AUGUST 23, 2024

For many companies, particularly small to mid-sized enterprises, hiring a full-time Chief Financial Officer (CFO) isn’t always feasible due to budget constraints. This model allows businesses to access high-quality financial advisory and management services tailored to their specific needs and budget.

CFO Plans

SEPTEMBER 24, 2024

Small Business Financial Advisory: Your Strategic Partner for Growth Small businesses thrive on strategic planning and informed decision-making. Whether you need part-time CFO services, fractional CFO services, or full-time financial oversight, a bespoke plan can be created to align with your business goals.

VCFO

NOVEMBER 1, 2023

Identify opportunities for operational improvement and incorporate strategic adjustments in the planning for the year ahead. It seems obvious, but actively reviewing actual vs. planned results and understanding the variables at play is imperative to identifying areas of improvement.

CFO Plans

SEPTEMBER 24, 2024

By predicting future financial outcomes based on historical data, market trends, and economic indicators, small businesses can navigate uncertainty, plan for growth, and ensure long-term sustainability. This proactive approach is vital for strategic planning and long-term success.

CFO Plans

JUNE 7, 2024

They excel in areas like financial planning, budgeting, cash flow management, and strategic financial analysis. Fractional CFO services offer a budget-friendly alternative, allowing companies to pay only for the expertise they need. This tech-driven approach keeps businesses agile and responsive in a rapidly changing market.

CFO Plans

JUNE 13, 2024

They excel in areas like financial planning, budgeting, cash flow management, and strategic financial analysis. Fractional CFO services offer a budget-friendly alternative, allowing companies to pay only for the expertise they need.

CFO News Room

DECEMBER 30, 2022

has brought a wide range of changes to the world of retirement planning. And given the variety of planning opportunities created by the legislation – from the raising of the beginning age for RMDs to the ability to transfer funds from 529 plans to Roth IRAs – advisors have a significant opportunity to demonstrate value for their clients!

CFO Plans

JUNE 27, 2024

Expert Tax Planning and Preparation for Savings Navigating the complexities of tax regulations can be daunting for any business. Certified public accountants (CPAs) within outsourced accounting firms offer expert tax planning and preparation services. Get expert tax planning and maximize your savings.

CFO Plans

SEPTEMBER 24, 2024

From budgeting to financial forecasting, having an expert team by your side ensures that your startup is set on a path to profitability. Whether it’s optimizing your capital structure or planning for future investments, strategic consulting ensures that your growth is sustainable and aligned with your long-term goals.

CFO Plans

JUNE 14, 2024

These services include cash flow analysis, tax planning, and risk management, ensuring that your real estate portfolio remains profitable and sustainable. Virtual CFO services provide you with access to experienced financial professionals who can guide your business through financial planning, budgeting, and forecasting.

CFO Plans

SEPTEMBER 24, 2024

The need for strategic financial planning and real-time financial reporting has never been more critical. Strategic Financial Planning for SME Success Strategic financial planning is crucial for the success of small and medium-sized enterprises (SMEs). Discover strategic financial planning solutions.

CFO Plans

JULY 18, 2024

Here, we explore how expert real estate accounting services can optimize your property management, streamline rent collection, and ensure compliance with tax regulations for sustained financial success. Discover how CFO Plans can help you achieve financial success. Ensuring compliance requires meticulous tax preparation and planning.

CFO Plans

SEPTEMBER 24, 2024

This accessibility ensures that business owners and financial advisors can collaborate seamlessly, leading to more effective financial planning and tax strategy formulation. Business tax consultants can provide valuable insights into optimizing cash flow, ensuring businesses have the liquidity needed to meet their obligations.

CFO News Room

NOVEMBER 22, 2022

Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth , a turnkey wealth management services provider supporting thousands of independent financial advisors. In 2010, Michael was recognized with one of the FPA’s “Heart of Financial Planning” awards for his dedication and work in advancing the profession.

CFO Plans

SEPTEMBER 6, 2024

This approach allows businesses to leverage top-tier financial strategy and planning without the overhead costs of a full-time executive. Discover how CFO Plans can help your business grow. This is particularly beneficial for startups and small businesses with limited budgets. Get expert financial planning with CFO Plans.

CFO Plans

SEPTEMBER 24, 2024

Yet, many budding entrepreneurs face the challenge of budget constraints, making it difficult to hire a full-time CFO. This accuracy not only maintains financial integrity but also simplifies financial analysis and reporting, making it easier to track progress and plan for the future.

CFO News Room

DECEMBER 20, 2022

Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth , a turnkey wealth management services provider supporting thousands of independent financial advisors. In 2010, Michael was recognized with one of the FPA’s “Heart of Financial Planning” awards for his dedication and work in advancing the profession.

Boston Startup CFO

OCTOBER 13, 2015

Company founders and CEOs are rarely equipped to handle financing strategies, budgets and dealing with investors. Accounting Manager - Oversees a bookkeeper or staff accountant, might help with tax planning and payroll, and can provide basic financial reporting. It’s a growing pain that many small businesses have.

CFO Plans

MAY 30, 2024

Consider the case of a growing tech startup that utilized fractional CFO services to develop a robust financial plan, which helped secure additional funding and scale operations efficiently. These experts assist with budgeting, forecasting, and financial planning, ensuring your business remains financially sound and poised for growth.

CFO Plans

OCTOBER 21, 2024

Start mastering your debt management today with expert insights from CFO Plans. Regularly Reviewing Financial Plans The financial landscape is ever-changing, making regular reviews of your financial plans crucial. Explore expert financial guidance with CFO Plans today.

CSC Advisors

MAY 30, 2022

This is an advisor that can help with general financial planning, not just corporate. Whether you need help with budgeting, investing, tax planning, or even paying off your outstanding debts, you can find a financial advisor to help! For example, you may be able to find a Certified Financial Planner, also known as a CFP.

CFO Plans

SEPTEMBER 24, 2024

Get Started with CFO Plans Today Small Business Financial Advisory as Your Strategic Partner Navigating the financial landscape can be daunting for small business owners. From budgeting to financial planning, expert advisors provide the insights necessary to steer your business towards success.

Michigan CFO

NOVEMBER 1, 2021

But come funding time, many SaaS companies find in organizing their finances that their budgeting system is a mess. The SaaS CFO can help plan and strategize for growth with actionable goals and key performance indicators. Budget Forecasting With SaaS CFO Metrics. Tax Planning With Your SaaS CFO.

CFO Plans

SEPTEMBER 24, 2024

An outsourced CFO offers expert advice on fundraising, budgeting, and financial planning, ensuring that your startup is on a path to sustainable growth. The post Why Outsourced CFO Services Are Essential for Your Small Business appeared first on CFO PLANS | Blog. Visit cfoplans.com to get started.

CFO Share

MARCH 9, 2021

Although nobody knows exactly how regulators may change the tax landscape, we know enough at CFOshare to advise our clients on some major things to be aware of when planning business taxes in 2021. Sales tax risk is on the rise for small businesses. Plan for repayment of deferred social security taxes.

CFO Share

JULY 13, 2023

At our fractional CFO firm , we believe there are three primary financial issues that small businesses face: Planning growth through uncertainty. Growth planning through uncertainty Business owners struggle to forecast new business growth due to uncertainty. Develop a cash flow management plan to improve the runway.

Future CFO

SEPTEMBER 14, 2020

The virus continues to ravage the global population, effect changes in consumer behavior, unearth workforce planning challenges, precipitate demand drops, and create supply chain shocks across the business world. The truth of the matter is that COVID-19 is exposing gaps in current financial planning across the region.

CFO News Room

NOVEMBER 30, 2022

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden. Team Kitces.

The CFO College

APRIL 8, 2021

Valuable Expert : Becoming a valuable expert can mean expanding your accounting and tax knowledge in your niche, or adding CFO-level services, tools, and skills to serve clients in any industry. You’ll also want to grow your niche knowledge, if you practice within one.

CFO News Room

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. Combined with growing advisor (and consumer) interest in comprehensive financial planning services, the number of ways advisors can add value for their clients has expanded greatly. Executive Summary. Team Kitces.

CFO News Room

DECEMBER 23, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”, a series of measures that will have significant impacts on the world of retirement planning. Adam is an Associate Financial Planning Nerd at Kitces.com.

Barry Ritholtz

AUGUST 15, 2023

Was that the plan or was he just going to announce it? That was never part of the plan, didn’t happen. It’s part of their own tax planning. And what’s their budget like a fraction of it, right? ” One about five years ago, I’m planning a trip to Silicon Valley. SEIDES: Oh no.

Nerd's Eye View

MARCH 10, 2023

While the budget almost certainly will face stiff resistance in a divided Congress, proposals that could affect financial advisors and their clients include increasing the top income and capital gains tax rates, raising the Net Investment Income Tax rate and applying it to pass-through income, and increasing the amount of the child tax credit.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content