Optimising Budgets: Strategies for Effective Financial Forecasting

CFO Talks

FEBRUARY 12, 2025

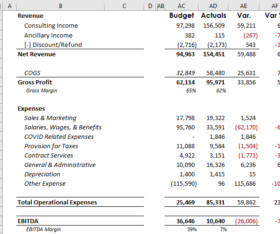

Optimising Budgets: Strategies for Effective Financial Forecasting Financial forecasting plays a crucial role in managing budgets effectively. It allows businesses and organisations to predict future income, expenses, and cash flow, ensuring that they remain financially stable and prepared for challenges.

Let's personalize your content