How AI is raising the bar for CFO budget planning

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

CFO Talks

FEBRUARY 5, 2025

How to Create Accurate Budgets for Business Units Budgeting is one of the most important things a business can do to stay financially healthy. A good budget helps a company plan its spending, control costs, and make smart decisions. Each department or business unit within a company needs its own budget.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Talks

FEBRUARY 12, 2025

Optimising Budgets: Strategies for Effective Financial Forecasting Financial forecasting plays a crucial role in managing budgets effectively. It allows businesses and organisations to predict future income, expenses, and cash flow, ensuring that they remain financially stable and prepared for challenges.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

The Charity CFO

FEBRUARY 20, 2025

Nonprofit budgeting may be a source of dread for many, but there are ways to make the process (and outcome!) A well-crafted budget is a reflection of your mission and a roadmap to financial sustainability. Start with Your Mission Your nonprofits budget exists to advance your mission. much better.

The Finance Weekly

FEBRUARY 22, 2025

Did you know that 47% of businesses still rely on spreadsheets for financial planning, despite the risks of errors and inefficiencies? Workday Adaptive Planning aims to solve this problem by offering a cloud-based Financial Planning & Analysis (FP&A) solution with AI-powered forecasting, budgeting, and workforce planning tools.

Centage

DECEMBER 7, 2022

the maker of QuickBooks Online Advanced, to bring automated budgeting, forecasting, reporting and analytics capabilities to QuickBooks Online Advanced customers and mid-market organizations looking for more robust and streamlined budgeting capabilities. Key Priorities & Requirements for Finance in 2023. Seamless Integration.

Centage

JANUARY 17, 2023

Between a volatile stock market, high interest rates, supply chain issues, inflation, and a possible recession, having a solid financial planning process in place is an important piece of sustaining your business through challenging times. Budget vs Actual Statement – What It Is and What It Isn’t.

Centage

JANUARY 18, 2022

While spreadsheets have long reigned supreme as the foundation of budgeting and forecasting for many organizations, the shortcomings of this legacy, siloed tool have become too hard to ignore. Do we have the data we need readily available? Accuracy is the critical to the budgeting and forecasting process.

Centage

SEPTEMBER 14, 2021

When it comes to business budgeting and planning, traditional spreadsheets are labor-intensive, prone to errors, and static, so it can be difficult to get a clear view on your current and future financial position. And gone are the days when you could wait for a quarterly budget review to make decisions about corporate spending.

Navigator SAP

MARCH 4, 2022

Implementing an enterprise resource planning (ERP) system has become a matter of survival for startups that want to scale fast or involve complex manufacturing operations, as the process efficiencies and data transparency ERP delivers can make or break such businesses.

The Finance Weekly

FEBRUARY 23, 2025

Did you know that 35% of organizations identify data quality and timeliness as significant barriers to effective financial planning and analysis (FP&A)? Bad data, inaccessible information, and outdated processes make FP&A more difficult. Create a Budget - Estimate costs for hiring, training, and licenses.

Centage

JULY 25, 2023

Though some businesses rely on Excel for budgeting and financial management needs, the software has some notable disadvantages that may make it a less-than-optimal solution for your business. To maintain multiple spreadsheets, you will be required to perform manual data entry.

Centage

SEPTEMBER 11, 2023

Staying on top of your financial performance is vital for running your business. Unfortunately, creating a perfect budget doesn’t mean that you’ll follow it. Budget vs actuals analysis is one of the most effective ways to maintain a clear picture of your company’s performance. Gather the Data. Take Action.

Jedox Finance

JANUARY 12, 2022

The answer to these questions and more: a solid financial plan. What is the corporate financial planning process? What is the goal of corporate financial planning? The importance of financial planning for your company. Types of corporate financial planning. Table of Contents.

E78 Partners

SEPTEMBER 9, 2024

Under these pressures, one aspect often underestimated is the power of strategic budget planning. It’s not just about managing numbers—it’s about aligning financial strategies with business goals to unlock value at every stage of the investment cycle. This is where scenario and sensitivity analyses come into play.

Centage

OCTOBER 17, 2022

As you start your financial planning for 2023 and beyond, follow these steps to solidify your three-year strategic plan and boost the odds of achieving your business’ goals. If you want to forecast your financial future, start by looking back at past performance. Financial planning comes with numerous challenges.

CFO Talks

MARCH 13, 2025

Now, picture the opposite: instant access to real-time financial insights, automated compliance checks, and AI-driven forecasts guiding your next move. This is the power of Financial Information Systems (FIS). This shift allows businesses to move from reactive decision-making to proactive planning.

Centage

SEPTEMBER 13, 2022

There is some risk to using past performance to inform your long-term plans, and this can be compounded during times of economic uncertainty. Your company needs to make plans for the future. What Is Financial Forecasting? Forecast vs. Budget Though similar, a budget and a forecast serve different purposes.

CFO Simplified

MARCH 27, 2022

This, however, does not necessarily mean that strategic planning is off the table. A proactive way for business owners to mitigate their risk is through contingency planning. So, what is contingency planning, and what is a CFO’s role in creating this strategy? What is Contingency Planning? What alternatives are available?

CFO Talks

JANUARY 8, 2025

Understand Your Teams Starting Point Before planning for growth, its essential to know where your team currently stands. This understanding helps you identify training needs and create tailored development plans. For instance, if one team member has mastered a new budgeting tool, they can lead a session to help others learn it too.

The Finance Weekly

SEPTEMBER 22, 2024

Every budgeting season brings a chance to push your business forward into the new year. With 2024 coming to a close and the 2025 budgeting season around the corner, the pressure is really on you and your finance team! Of course, there are plenty of challenges to juggle as you balance all your company's needs and goals.

E78 Partners

SEPTEMBER 9, 2024

Download our free budget planning checklist For private equity firms, success isn’t just about acquiring companies; it’s about transforming them. Under these pressures, one aspect often underestimated is the power of strategic budget planning. This is where scenario and sensitivity analyses come into play.

Collectiv

JANUARY 24, 2025

Did you know that 96% of finance teams still rely on spreadsheets for planning and 93% rely on them for reporting? If youre stuck in a vicious cycle of manual updates and outdated insights, its time to rethink your approach to planning and financial reporting. Centralize Financial Data Data silos are the enemy of efficiency.

The Finance Weekly

FEBRUARY 26, 2025

Political shifts, rising inflation, and unpredictable market trends are forcing businesses to rethink their financial planning strategies. Prophix aims to address these challenges by offering advanced, cloud-native financial planning solutions. Investment Planning Evaluate potential investments through dynamic modeling.

The Finance Weekly

JANUARY 5, 2025

Assisting Financial Planning Finance AI chatbots are excellent tools for budgeting and financial planning. They analyze spending habits and recommend adjustments to help individuals or businesses achieve their financial goals. Real-time data consolidation and anomaly detection. Affordable pricing.

Future CFO

AUGUST 23, 2019

The days of manual, spreadsheet-based budgeting, planning and forecasting processes are numbered.

Spreadym

NOVEMBER 8, 2023

Collaborative budgeting is an approach to financial planning and management that involves the active participation of multiple individuals or teams within an organization. It goes beyond the traditional top-down budgeting process, where senior management sets financial targets and allocates resources.

The Finance Weekly

MAY 25, 2022

Planning, Budgeting, Forecasting. A company’s plan, budget, and forecast are usually talked about all together, whether it be in the boardroom, in a company goal-setting sheet, or in general talk about FP&A. Financial Planning. We hear the 3 terms being thrown around a lot- oftentimes interchangeably.

The Charity CFO

JANUARY 22, 2025

But what if the key to financial clarity and stability lies in sharing the load? The truth is, many successful nonprofits empower leaders to manage their own department budgets. In this article, well explore why financial management is a shared responsibility and how nonprofits can use this strategy to drive their missions forward.

Jedox Finance

SEPTEMBER 29, 2021

While that wouldn’t make much sense these days, think about revenue planning, data, and processes. Sales Performance Management (SPM) is a unified approach to analyze, plan, and optimize sales processes withing an organization. In this eBook about 360° Planning you can learn more about the shift to xP&A.

CFO Talks

NOVEMBER 27, 2024

Review existing data: Look at your company’s historical trends, current financial data, and market research. Even if the data isn’t perfect, it can give you a starting point. What’s your plan in each case? What’s important is to show that you have a plan. Ask questions: What information do you have now?

Jedox Finance

MARCH 16, 2022

When choosing the right budgeting method for your business, the management style and corporate structure of an organization have a significant influence on the design and implementation of corporate budgeting processes. What is Corporate Budgeting? Corporate Budgeting in need of Agility and Flexibility. Table of Contents.

Spreadym

JUNE 8, 2023

Planning, budgeting and forecasting for a business are three distinct financial management tools used in business, each serving a different purpose. Key differences between planning, budgeting and forecasting for a business Here are key difference between planning, budgeting and forecasting for a business.

Fpanda Club

SEPTEMBER 2, 2021

The growing variety and complexity of tasks within the finance function has resulted in the creation of a discipline that is supposed to become a bridge between the finance and business to support decision-making process by leveraging data and technology. This relates to FP&A which stands for financial planning and analysis.

Spreadym

SEPTEMBER 12, 2023

Budget preparation is the process of creating a detailed financial plan that outlines an organization's expected income and expenses for a specific period, typically for a fiscal year. Here are the key steps involved in budget preparation: Define Objectives and Goals : Begin by establishing clear financial objectives and goals.

Spreadym

DECEMBER 1, 2023

The annual budgeting process refers to the series of steps an organization undertakes to plan, prepare, and allocate financial resources for the upcoming fiscal year. These goals will guide the budgeting process. These goals will guide the budgeting process.

Centage

MAY 3, 2022

the maker of QuickBooks Online Advanced, to bring automated budgeting, forecasting, reporting and analytics capabilities to QuickBooks Online Advanced customers and mid-market organizations looking for cloud-based FP&A solutions. Better Communicate Your Financial Story.

Spreadym

SEPTEMBER 19, 2023

Budgeting and forecasting in business are both financial planning tools used by businesses, but they serve different purposes and have distinct characteristics. Here's an overview of the key differences between budgeting and forecasting. They help businesses make informed decisions and adapt to changing circumstances.

Spreadym

OCTOBER 10, 2023

Variance reporting is a financial and management accounting process used to analyze the differences between budgeted or expected figures and actual performance results. Key aspects of variance reporting include: Budget or Target Figures: This is the baseline against which actual performance is compared.

Centage

SEPTEMBER 6, 2022

As a business owner or chief financial officer (CFO), spreadsheets may be an important part of your financial forecasting, planning, and budgeting processes. With its widespread use, some businesses may see Excel as their only solution for corporate financial planning.

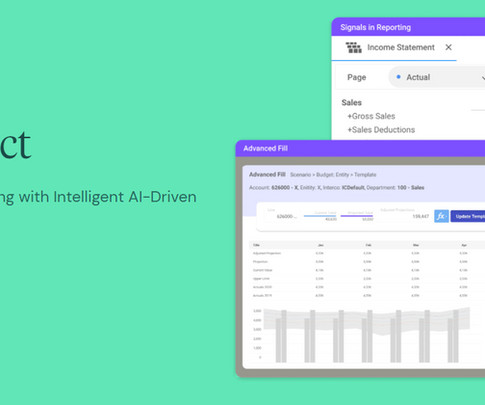

The Finance Weekly

JUNE 17, 2024

Financial planning and analysis (FP&A) is important in automating all of the manual tasks in the finance department and giving everyone greater insights into the data. Planful is one of these top FP&A software solutions , and this article will review their features, reviews, and customer feedback.

Future CFO

MARCH 3, 2025

This is forcing finance leaders to integrate ESG considerations into their financial planning, reporting, and investment decisions. The ability to analyse data, identify insights, and communicate those insights effectively is highly valued.

The Finance Weekly

MAY 29, 2024

Financial planning and analysis (FP&A) solutions provide a complete platform for organizational planning, which is important for all businesses. Understanding their financial status and performance is key for business growth. Two of these companies, Planful and Vena are popular for many reasons.

Collectiv

MARCH 5, 2025

Welcome to a brand new episode of Modernized Planning, where were turning traditional planning strategies on their head, in favor of a more modern, efficient, and connected approach. deFacto Planning helps businesses unify financial and operational planning into a single, high-performance platform.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content