How AI is raising the bar for CFO budget planning

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

Jedox Finance

JANUARY 23, 2025

Long budgeting cycles, errors, and delays in accessing accurate datawith traditional budgeting and forecasting, Finance professionals are unable to keep up with modern demands. Real-time financial data is your key to turning the tide and unlocking faster, smarter forecasting and budgeting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Talks

FEBRUARY 5, 2025

How to Create Accurate Budgets for Business Units Budgeting is one of the most important things a business can do to stay financially healthy. A good budget helps a company plan its spending, control costs, and make smart decisions. Each department or business unit within a company needs its own budget.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

The Charity CFO

FEBRUARY 20, 2025

Nonprofit budgeting may be a source of dread for many, but there are ways to make the process (and outcome!) A well-crafted budget is a reflection of your mission and a roadmap to financial sustainability. Start with Your Mission Your nonprofits budget exists to advance your mission. much better.

CFO Talks

FEBRUARY 12, 2025

Optimising Budgets: Strategies for Effective Financial Forecasting Financial forecasting plays a crucial role in managing budgets effectively. It allows businesses and organisations to predict future income, expenses, and cash flow, ensuring that they remain financially stable and prepared for challenges.

Centage

SEPTEMBER 14, 2021

When it comes to business budgeting and planning, traditional spreadsheets are labor-intensive, prone to errors, and static, so it can be difficult to get a clear view on your current and future financial position. With the fast pace of business change, CFOs need accurate financial information to make informed decisions on the fly.

Centage

JANUARY 18, 2022

While spreadsheets have long reigned supreme as the foundation of budgeting and forecasting for many organizations, the shortcomings of this legacy, siloed tool have become too hard to ignore. Do we have the data we need readily available? Accuracy is the critical to the budgeting and forecasting process.

Centage

SEPTEMBER 11, 2023

Staying on top of your financial performance is vital for running your business. Unfortunately, creating a perfect budget doesn’t mean that you’ll follow it. Budget vs actuals analysis is one of the most effective ways to maintain a clear picture of your company’s performance. Gather the Data. Monitor and Repeat.

Centage

JULY 25, 2023

Though some businesses rely on Excel for budgeting and financial management needs, the software has some notable disadvantages that may make it a less-than-optimal solution for your business. To maintain multiple spreadsheets, you will be required to perform manual data entry.

Navigator SAP

MARCH 4, 2022

Next, budget usually plays a critical role in the selection of a system. Some businesses only need operational support that streamlines financial data and processes. Manufacturers, however, likely need a system that can help coordinate and allocate resources for tracking materials, orders, and production.

Centage

DECEMBER 7, 2022

the maker of QuickBooks Online Advanced, to bring automated budgeting, forecasting, reporting and analytics capabilities to QuickBooks Online Advanced customers and mid-market organizations looking for more robust and streamlined budgeting capabilities. Real-time reporting – specifically around variance reporting, and alerting.

The Finance Weekly

FEBRUARY 23, 2025

Strong FP&A practices help finance teams improve data accuracy , use technology effectively, and make well-informed financial decisions. This leads to better budgeting, more reliable forecasting, and stronger financial stability. Improve steps by doing this: Monitor real-time financial performance to stay on track.

The Finance Weekly

SEPTEMBER 22, 2024

Every budgeting season brings a chance to push your business forward into the new year. With 2024 coming to a close and the 2025 budgeting season around the corner, the pressure is really on you and your finance team! Of course, there are plenty of challenges to juggle as you balance all your company's needs and goals.

Centage

JANUARY 17, 2023

As part of this process, the office of finance and department heads spend an immense amount of time creating, reviewing and approving the business’s budget for the fiscal year ahead – but it’s important that financial management doesn’t stop there. Budget vs Actual Statement – What It Is and What It Isn’t.

CFO Talks

NOVEMBER 7, 2024

In a role filled with financial data, strategic meetings, and high-stakes decisions, active listening can drive better outcomes and turn tough conversations into collaborative wins. Examples from the CFO World Dealing with Teams CFOs frequently negotiate with internal teams over budgets, resources, and targets.

CFO Talks

JANUARY 8, 2025

For instance, if one team member has mastered a new budgeting tool, they can lead a session to help others learn it too. Delegating significant responsibilities, such as leading a budget review or preparing a report for senior leadership, helps them build confidence and skills. Constructive feedback is equally important.

Spreadym

NOVEMBER 8, 2023

Collaborative budgeting is an approach to financial planning and management that involves the active participation of multiple individuals or teams within an organization. It goes beyond the traditional top-down budgeting process, where senior management sets financial targets and allocates resources.

CFO Talks

MARCH 13, 2025

Now, picture the opposite: instant access to real-time financial insights, automated compliance checks, and AI-driven forecasts guiding your next move. This is the power of Financial Information Systems (FIS). Often, finance teams work separately from sales, operations, and HR, leading to inconsistent financial data.

E78 Partners

SEPTEMBER 9, 2024

Under these pressures, one aspect often underestimated is the power of strategic budget planning. It’s not just about managing numbers—it’s about aligning financial strategies with business goals to unlock value at every stage of the investment cycle.

The Finance Weekly

FEBRUARY 26, 2025

Prophix aims to address these challenges by offering advanced, cloud-native financial planning solutions. Prophix is an enterprise financial management software designed to streamline budgeting, planning, reporting, and analysis. Self-service Reporting Empower stakeholders with easy access to real-time financial data.

The Finance Weekly

JANUARY 5, 2025

Assisting Financial Planning Finance AI chatbots are excellent tools for budgeting and financial planning. They analyze spending habits and recommend adjustments to help individuals or businesses achieve their financial goals. Real-time data consolidation and anomaly detection. Best Finance AI Chatbots 1.

Jedox Finance

MARCH 16, 2022

When choosing the right budgeting method for your business, the management style and corporate structure of an organization have a significant influence on the design and implementation of corporate budgeting processes. What is Corporate Budgeting? Corporate Budgeting in need of Agility and Flexibility. Table of Contents.

Spreadym

DECEMBER 1, 2023

The annual budgeting process refers to the series of steps an organization undertakes to plan, prepare, and allocate financial resources for the upcoming fiscal year. These goals will guide the budgeting process. These goals will guide the budgeting process.

The Finance Weekly

FEBRUARY 22, 2025

Did you know that 47% of businesses still rely on spreadsheets for financial planning, despite the risks of errors and inefficiencies? Workday Adaptive Planning aims to solve this problem by offering a cloud-based Financial Planning & Analysis (FP&A) solution with AI-powered forecasting, budgeting, and workforce planning tools.

Spreadym

OCTOBER 10, 2023

Variance reporting is a financial and management accounting process used to analyze the differences between budgeted or expected figures and actual performance results. Key aspects of variance reporting include: Budget or Target Figures: This is the baseline against which actual performance is compared.

Cube Software

MAY 20, 2024

Why spring cleaning is essential to finance Spring cleaning your financial data is more than a routine check—it's a critical practice that ensures healthy, efficient finance operations.

PYMNTS

NOVEMBER 17, 2016

The CFPB notes that these financial records are often key to emerging services aimed at making it easier, cheaper, or more efficient for consumers to manage their financial lives. The services range from tax help to budgeting advice. The CFPB has concerns that information and control are not uniformly provided across the market.

The Charity CFO

JANUARY 22, 2025

But what if the key to financial clarity and stability lies in sharing the load? The truth is, many successful nonprofits empower leaders to manage their own department budgets. In this article, well explore why financial management is a shared responsibility and how nonprofits can use this strategy to drive their missions forward.

Spreadym

SEPTEMBER 12, 2023

Budget preparation is the process of creating a detailed financial plan that outlines an organization's expected income and expenses for a specific period, typically for a fiscal year. Here are the key steps involved in budget preparation: Define Objectives and Goals : Begin by establishing clear financial objectives and goals.

E78 Partners

SEPTEMBER 9, 2024

Download our free budget planning checklist For private equity firms, success isn’t just about acquiring companies; it’s about transforming them. Under these pressures, one aspect often underestimated is the power of strategic budget planning.

Collectiv

JANUARY 24, 2025

For example, automate a variance analysis report or create a simple budget forecasting dashboard to save time and improve accuracy. Centralize Financial Data Data silos are the enemy of efficiency. This is particularly valuable for creating unified plans and reports based on consistent data.

Spreadym

SEPTEMBER 19, 2023

Budgeting and forecasting in business are both financial planning tools used by businesses, but they serve different purposes and have distinct characteristics. Here's an overview of the key differences between budgeting and forecasting. They are meant to provide a current and dynamic view of expected financial performance.

CFO Talks

NOVEMBER 27, 2024

Review existing data: Look at your company’s historical trends, current financial data, and market research. Even if the data isn’t perfect, it can give you a starting point. Use visuals, like charts or dashboards, to explain financial data. Create a “priority budget” that focuses on essential spending.

The Charity CFO

MARCH 13, 2025

Master Your Budgeting Process Know exactly what your grants and funding coverand what they dont. Maintain strict budget oversight and ensure spending aligns with your organizations mission and restrictions. Do You Struggle to Make Sense of Your Financial Statements? Download it for later.

Spreadym

AUGUST 8, 2023

An operating budget is a financial plan that outlines the projected revenues and expenses of an organization or business for a specific period, typically a fiscal year. It serves as a detailed guide for managing day-to-day operations, allocating resources, and achieving financial goals.

KG Virtual CFO

OCTOBER 8, 2020

A budget provides the financial data that support your company’s vision, mission, and goals. It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. Don’t forget to factor those expenses into your budget as well.

KG Virtual CFO

OCTOBER 12, 2020

Your business budget puts you in control of your company. It helps you avoid overspending and track financial goals. But with the coronavirus in full swing, you may have had to throw your business budget out the window to stay afloat. Maybe you had no choice but to temporarily close your business due to new regulations.

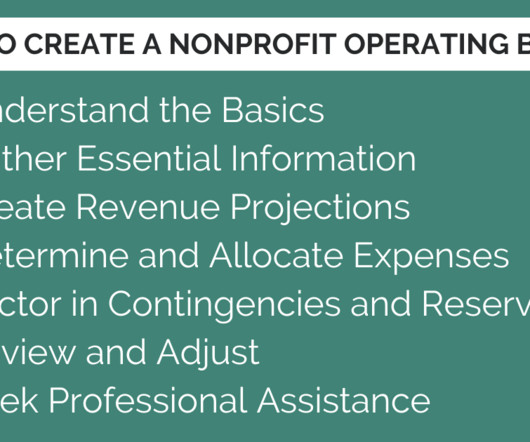

The Charity CFO

JUNE 26, 2023

Whether you’re a new organization or an established one working to get its finances under better control, there are few more important things to get right than your nonprofit operating budget. Nonprofit operating budgets differ from regular for-profit business budgets in key ways.

Centage

MAY 3, 2022

the maker of QuickBooks Online Advanced, to bring automated budgeting, forecasting, reporting and analytics capabilities to QuickBooks Online Advanced customers and mid-market organizations looking for cloud-based FP&A solutions.

Centage

NOVEMBER 1, 2023

Financial planning is a crucial part of sustaining and growing your business. The office of finance, department heads, and C-suite executives spend much of their time making, checking, and approving the yearly budget. And financial management doesn’t stop once the annual budget is approved.

Future CFO

AUGUST 23, 2019

The days of manual, spreadsheet-based budgeting, planning and forecasting processes are numbered.

Centage

SEPTEMBER 6, 2022

As a business owner or chief financial officer (CFO), spreadsheets may be an important part of your financial forecasting, planning, and budgeting processes. Unfortunately, Excel has very defined limits that can make it challenging for businesses to publish their financial reports more quickly and efficiently.

Jedox Finance

SEPTEMBER 29, 2021

Therefore, an SPM solution should follow the different activities of sales operations: Budget & Target Setting is the starting point where the organization aligns between the revenue goals and go-to-market plans. This term, set by Gartner, overlooks financial and non-financial business processes, data, and technology tools.

The Finance Weekly

MAY 25, 2022

Planning, Budgeting, Forecasting. A company’s plan, budget, and forecast are usually talked about all together, whether it be in the boardroom, in a company goal-setting sheet, or in general talk about FP&A. Finance leaders and executives build teams and make decisions based on the financial data and the goals that result from it.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content