Financial Planning for Efficient Financial Management

Spreadym

NOVEMBER 3, 2023

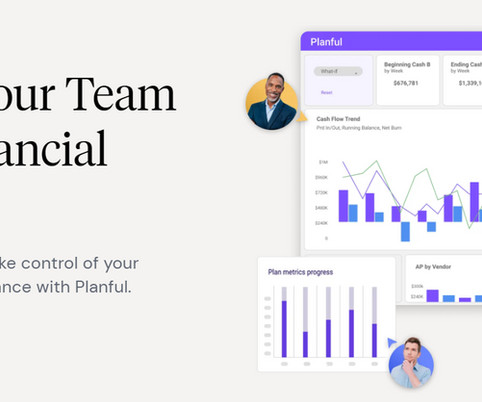

Financial planning is the process of assessing your current financial situation, setting financial goals, and creating a strategy to achieve those goals. It involves evaluating your income, expenses, assets, and liabilities to develop a comprehensive plan for managing your finances effectively.

Let's personalize your content