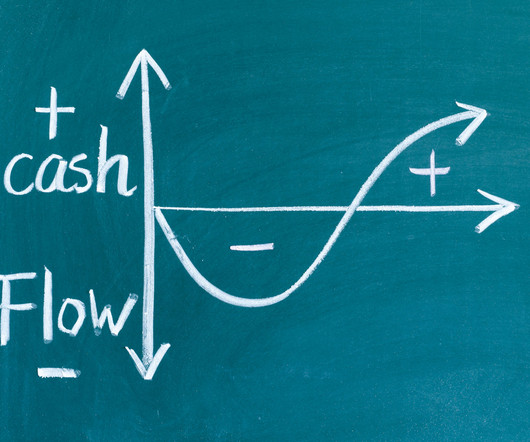

Cash-Flow Forecasting remains KING

Simply Treasury

SEPTEMBER 9, 2020

“If you have to forecast, forecast often” (Edgar R. Need for reliable forecasts. Nobody could deny the importance of having accurate and reliable Cash-Flow Forecasts (CFF). Often, we heard “ cash is king”. However, knowing if you will get cash and how much is even more important.

Let's personalize your content