Inflation cools, reassuring Fed after unexpectedly hot gains in Q1

CFO Dive

MAY 15, 2024

The yield on the benchmark 10-year Treasury note fell on investor speculation that slower inflation will prompt the Fed to sooner cut borrowing costs.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MAY 15, 2024

The yield on the benchmark 10-year Treasury note fell on investor speculation that slower inflation will prompt the Fed to sooner cut borrowing costs.

CFO Dive

JANUARY 10, 2025

The yield on the benchmark 10-year Treasury bond rose as investors bet the Federal Reserve will pause monetary easing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

OCTOBER 6, 2023

The yield on the benchmark 10-year Treasury note surged after the September payrolls report on expectations of strong economic growth.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO News Room

FEBRUARY 4, 2022

Shorter-term Treasury notes led the yield gains following the jobs report. The Treasury Department building in Washington. In recent trading, the yield on the benchmark 10-year U.S. Treasury note was 1.883%, according to Tradeweb, compared with 1.825% Thursday. Photo: Stefani Reynolds/Bloomberg News.

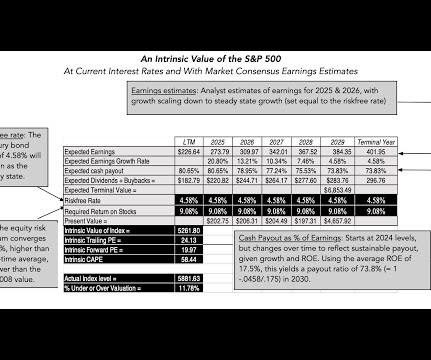

Musings on Markets

JANUARY 17, 2025

The hopeful note was that the Fed would lower the Fed Funds rate during the course of the year, triggering (at least in the minds of Fed watchers) lower interest rates across the yield curve, Clearly, the market not only fought through those concerns, but did so in the face of rising treasury rates, especially at the long end of the spectrum.

Global Finance

OCTOBER 22, 2024

Treasuries’ top challenge is securing financial investments focused on environmental, social and governance (ESG) concerns. The three subsequent challenges are digitizing treasury functions, managing real-time data feeds for accurate reporting and benchmarking performance. “I

PYMNTS

OCTOBER 14, 2020

The head of the country’s only licensed and publicly traded cryptocurrency broker says tighter regulation and exponentially higher yields are causing corporate treasury and cash management accounts to seriously consider this alternative asset class. With the treasury market for S&P 500 companies valued at $2.3

Strategic Treasurer

APRIL 17, 2023

Survey Results Treasury Perspectives For the 5th year running, Strategic Treasurer and TD Bank are proud to present the findings from the Treasury Perspectives Survey with data from over 350 respondents operating primarily across North America and Europe. Upon submission, you will be sent an email with access to your report.

Strategic Treasurer

JANUARY 19, 2022

Treasury Perspectives. For the 4th year running, Strategic Treasurer and TD Bank are proud to present the findings from the Treasury Perspectives Survey with data from over 250 respondents operating primarily across North America and Europe. Treasury Operations & Benchmarks. Survey Results.

CFO News Room

FEBRUARY 3, 2022

In bond markets, the yield on the benchmark U.S. 10-year Treasury note ticked up to 1.847% from 1.825% Thursday. Oil prices climbed, with the global benchmark Brent crude up 0.5% “Every investor is so spooked now, and nobody really has a compass to figure out where exactly we are in this cycle.”. a barrel. .

CFO News Room

FEBRUARY 4, 2022

The benchmark 10-year U.S. Treasury yield, which helps set borrowing costs on everything from mortgages to corporate loans, settled at 1.930%, its highest close since December 2019. Government bond yields surged world-wide after a strong report on the U.S. It was at 1.25% at the start of the week. on Friday.

Strategic Treasurer

MARCH 23, 2023

2023 Treasury Perspectives Survey Results April 20 | 11:00 AM EDT Register Now Date Thursday, April 20, 2023 Time 11:00 AM – 12:00 PM EDT Where This is an online event Speakers Michael Gordon, TD Bank Tom Gregory, TD Bank Craig Jeffery, Strategic Treasurer Sponsored By Hosted By 1.2 Eager to learn? Explore these free resources.

Strategic Treasurer

FEBRUARY 28, 2022

Treasury Perspectives Survey Results. The post Webinar: AFP Utah – Treasury Perspectives Survey Results | March 17 appeared first on Strategic Treasurer. Register Now. This webinar will cover the survey’s results and will discuss the primary implications of this data for organizations in 2022 and beyond. Eager to learn?

CFO News Room

FEBRUARY 6, 2022

Domestic yields have risen more than 15 basis points in the past few days, driven largely by a sharp rise in Brent crude oil prices in the international market and an uptick in US Treasury yields on the expectation that Fed will hike rates more aggressively than expected.

PYMNTS

DECEMBER 4, 2020

Our Payment Optimization Framework provides a data-driven approach to continuously monitoring, benchmarking and optimizing payment acceptance,” Smith said. . He added that the company's clients also have the ability to combine payment data with treasury tools for improved “cash flow reporting, forecasting and utilization.”.

CFO News Room

FEBRUARY 6, 2022

In the bond market, the benchmark 10-year U.S. Treasury yield declined to 1.903%, according to Tradeweb. Valuations of Hong Kong-listed stocks are now quite reasonable, Mr. Ru said, adding that he doesn’t expect China’s internet sector to be hit with major regulatory changes this year. . Yields and prices move inversely.

PYMNTS

APRIL 14, 2020

The digital transformation of corporate treasury is not a destination; it’s a journey. Against that backdrop, JPMorgan is already collaborating with multiple treasury management systems to create a “plug and play” banking experience inside its own offerings, he told Webster. “And

PYMNTS

MARCH 6, 2020

We have deep dives into treasury application programming interfaces (APIs) and buy now, pay later (BNPL), as well as a report on Robinhood ’s trading app outage that occurred earlier this week. HSBC on the Next Phase of Treasury APIs (B2B API Tracker). Trackers and Reports. In a feature story, Diane S.

CFO News Room

FEBRUARY 4, 2022

It’s the latest in a series of recent fiscal and monetary benchmarks received with increasing blitheness. That matters, because rising rates will increase the debt service (interest payments the US government must pay on the outstanding Treasury securities). I counted only a handful of headlines reporting on it.

Strategic Treasurer

MAY 12, 2022

Benchmarking: Personal Best. The rest largely benchmark against companies in similar industries, while some also benchmark against those of a comparable size or complexity level. This survey is designed as a benchmarking guide for corporate treasury. The vast majority were North American corporates (91%).

CFO News

MAY 3, 2023

The increase lifted the Fed’s benchmark federal funds rate to a target range of 5% to 5.25%, the highest level since 2007, up from nearly zero early last year. US equities maintained gains, while Treasury yields and the dollar declined. The vote was unanimous.

CFO News

NOVEMBER 1, 2023

The decision left the target range for the benchmark federal funds rate unchanged at 5.25% to 5.5%, the highest since 2001, as part of a strategy to slow the pace of rate increases as the central bank nears the end of its tightening campaign.

PYMNTS

OCTOBER 6, 2020

The panel included Kivanc Onan , head of B2B Payments, Financing and Protection, North America for Alibaba ; Rob Rosenblatt , CEO of Behalf ; Sarfraz Nawaz , Digital Transformation, Supply Chain at Johnson & Johnson ; Tony Uphoff , CEO of Thomas ; and Trish Fisher , senior director, Treasury Operations at WeWork. The Supply Chains.

PYMNTS

MARCH 6, 2020

The benchmark 10-year U.S. Treasury yield also fell further into record-low territory, dropping 0.244 percent to 0.682 percent. Stocks resumed their coronavirus-related fall Friday morning (March 6), with the Dow Jones Industrial Average down 681.62 points at 25,439.66 shortly after 10 a.m.

PYMNTS

OCTOBER 12, 2018

Its most recent rollout is the launch of Dynamic Benchmarking, an initiative that aggregates company data, anonymizes it and allows businesses to see how their key procurement metrics compare against others over time. “The benchmarks they see are often not surprising. Sievo provides businesses with procurement analytics software.

PYMNTS

JUNE 21, 2019

“We are pleased to roll out an innovative solution that enables the full digitization of cross-border payments, which we view as a milestone, and one that addresses our clients’ specific needs amid a rapidly evolving treasury landscape.

PYMNTS

FEBRUARY 24, 2020

Stocks were down Monday, with the yield on the benchmark 10-year U.S. note Treasury traded near its lowest point ever, according to the Wall Street Journal. Officials with the Federal Reserve don’t know yet precisely how severe the impact from the coronavirus will be, and on Monday (Feb.

PYMNTS

MARCH 6, 2018

New research from Asset Benchmark Research suggests ties with regulators and even reputation are not the number one priority for corporate treasurers looking for a cash management provider. Treasury leaders should not assume that others are connecting the dots and reading between the lines.”.

Global Finance

SEPTEMBER 5, 2024

As such, they are looking for ways to tie their treasury management to their organizational sustainability objectives,” states Sandrine Jourdainne, global head of Deposits and Liquidity Management for Standard Chartered. The post Bank Offers Cash For ESG Goals appeared first on Global Finance Magazine.

PYMNTS

SEPTEMBER 16, 2016

Treasuries prices were mixed. The Fed’s benchmark overnight interest rate increased for the first time in nearly a decade at the end of 2015, but it has not changed this year due to persistently low inflation. Economists had forecasted that the CPI would move up by 0.1 percent last month, and the core CPI would move up by 0.2

PYMNTS

MARCH 3, 2017

2) that results from its Risk Management analysis , provided by its Citi Treasury Diagnostics benchmarking solution, suggest corporate treasurers’ approach to FX risk mitigation have remained largely unchanged “despite unprecedented recent market conditions.”. The bank said Thursday (Mar. Yet, status quo prevails.

Finvisage

MARCH 10, 2020

Saudi Arabia has drastically cut its official price benchmarks. The world is in search of yield and treasury bonds and gold does not provide that. Saudi Arabia and Russia have both instructed their state-controlled organisations to produce as much oil as possible and flood the market.

PWC UK

JANUARY 26, 2021

by Christopher Raftopoulos Director, Treasury Advisory and Assurance. LIBOR transition has been a hot topic for the corporate treasury community for at least the past year. by Christopher Raftopoulos Director, Treasury Advisory and Assurance. Email +44 (0)7753 928134. More articles by Christopher. Email +44 (0)7753 928134.

PYMNTS

DECEMBER 20, 2019

Modern Treasury. based Modern Treasury will continue to bolster its treasury and corporate finance solutions. The Series A funding was led by Benchmark, the company said in a press release , though they did not elaborate on exact plans for the funds. With $10 million in new funding, U.S.-based

PYMNTS

MARCH 4, 2020

The Federal Reserve, said Tuesday that it cut its federal funds rate — which typically is used as a “benchmark” rate by lenders, who take that rate and layer on a premium — by 50 basis points. On one hand, it’s fair to ask just how much lower mortgage rates can go.

PYMNTS

SEPTEMBER 26, 2018

By the end of the decade, 71 percent of firms expect their AP departments to be collaborating in a functional capacity with other areas of the enterprise, like procurement and treasury management. Other benchmarks of progress will take longer.

PYMNTS

JULY 16, 2018

According to Reuters , the rise of risk premiums on investment-grade corporate bonds over comparable Treasuries, which have been increasing since February, is one factor that has analysts worried. Market watchers have sent out a warning that the U.S. economy might be heading toward a recession. Other possible warning signs: U.S.

Future CFO

NOVEMBER 5, 2023

These include controllership, Financial Planning and Analysis (FP&A), Investor Relations (IR), financial operations (FinOps), business finance, tax, treasury, and more. A crucial aspect of the CFO’s role is benchmarking the company’s profitability against both local and global peers.

Barry Ritholtz

DECEMBER 14, 2022

. • The Fed is Dead : Its interest rate hikes are hurting consumers and workers while bypassing the main source of inflation ( Robert Reich ) see also Unpredictable 10-Year Treasury Yield Poses Puzzle for Investors, Fed : Recent declines in critical borrowing benchmark have come despite expectations for higher short-term interest rates.

Barry Ritholtz

OCTOBER 1, 2023

It’s Also Deeply Flawed : The designers of other popular indexes don’t charge exchange-listing fees to be included in their benchmark. Now that their son stands accused of one of the largest financial frauds in U.S. history, they’re scrambling for legal escape routes. ( New Yorker ) • The Nasdaq 100 Is Wildly Popular.

PYMNTS

APRIL 2, 2018

The bank offers corporate banking, retail banking, treasury management, capital markets, credit cards and wealth management services in a range of consumer and corporate offerings. An F-1 registration statement revealed the bank’s plans for an IPO in the U.S., seeking $100 million in share sales.

PYMNTS

JANUARY 1, 2021

The Trackers use a number of creative methodologies and frameworks that measure and benchmark an ever-changing landscape. This report looked at what treasury leaders and financial executives must know about the shifting dynamics of digital commerce — and how they can make the most of these emerging opportunities. Buy Now, Pay Later.

PYMNTS

JULY 2, 2018

“Consumer expectations are coming to individuals within the treasury department, and they’re looking toward banking partners to provide ease of use and commentary on the mobile device for treasury activity.” On top of speed, treasurers are seeking more insight from their banks regarding performance and benchmarking.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content