At the Money: Benefits of Quantitative Investing

Barry Ritholtz

MARCH 20, 2024

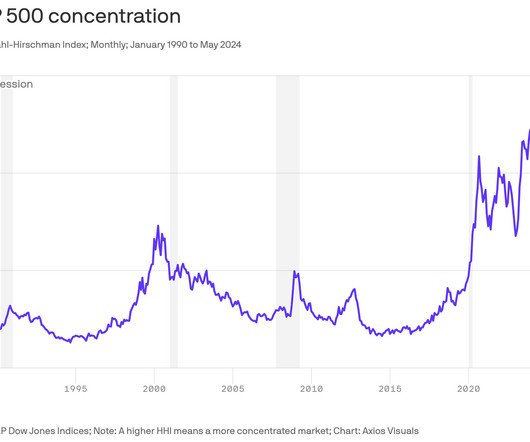

As it turns out, there are ways you can use data to your advantage, even if you’re not a math wizard. For example, you can see what’s the biggest drawdown, how long did it last, how long and how often did a strategy beat its benchmark, and by what magnitude. Explain why P/E isn’t the best way to measure valuation.

Let's personalize your content