Ledge seizes on SVB crisis with multi-bank offering

CFO Dive

APRIL 11, 2023

The Israeli finance tech startup decided to expedite the rollout of its new treasury management tool after the collapse of Silicon Valley Bank.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Global Finance

OCTOBER 22, 2024

A recent survey by EY of more than 1,800 global CFOs and treasurers of corporate and commercial clients was unveiled at Sibos, revealing chances for banks to provide value-added services. Treasuries’ top challenge is securing financial investments focused on environmental, social and governance (ESG) concerns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

FEBRUARY 6, 2024

Bank regulators aim to avert turmoil caused by a slump in the value of commercial real estate, Treasury Secretary Janet Yellen said in testimony to a House committee.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

PYMNTS

JULY 5, 2020

Treasury Department’s financial crime division, the agency said the new guidance is in response to questions related to Bank Secrecy Act/Anti-Money Laundering regulatory requirements for hemp-related business customers. In updated rules from the Financial Crimes Enforcement Network ( FinCEN ), the U.S.

The Reformed Broker

JUNE 11, 2023

The parabolic spike in 2-year Treasury bond rates this winter ended with a crescendo on Thursday, March 9th and Friday March 10th. The post The Day the Treasury Topped appeared first on The Reformed Broker. By Sunday afternoon, March 12th, the FDIC had stepped in and resolved t.

Global Finance

DECEMBER 26, 2024

GTreasurys FX solution achieves this by giving treasury teams the power to consolidate exposure data, automate risk assessments, and execute effective hedging strategies, all from one cohesive interface. Morgans global FX platform, reducing FX settlement risk and accelerating trade settlements.

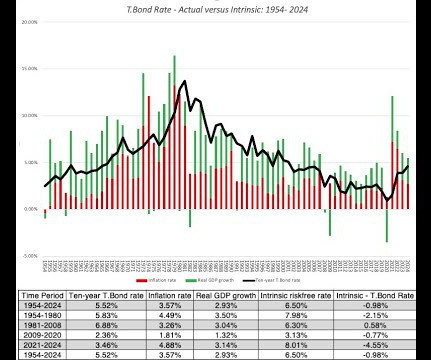

Musings on Markets

JANUARY 28, 2025

It was an interesting year for interest rates in the United States, one in which we got more evidence on the limited power that central banks have to alter the trajectory of market interest rates. In this post, I will begin by looking at movements in treasury rates, across maturities, during 2024, and the resultant shifts in yield curves.

PYMNTS

DECEMBER 18, 2020

Treasury Department proposed sweeping new rules late Friday (Dec. Treasury Secretary Steven Mnuchin said in a prepared statement that the new proposed rule “addresses substantial national security concerns in the CVC market and aims to close the gaps that malign actors seek to exploit in the record-keeping and reporting regime.

CFO Talks

FEBRUARY 18, 2025

Winning the Financial Game with Strategic Treasury Management in Volatile Times Businesses face constant financial ups and downs. Strategic treasury management helps businesses stay financially stable, even when markets are unpredictable. What is Treasury Management? Manages debts carefully to avoid high interest costs.

Global Finance

JULY 26, 2024

Treasury keeps up with the dynamic payments environment. As the dynamic payments landscape presents both challenges and opportunities for corporate treasury, it’s unsurprising that financial institutions are finding new ways to help treasurers leverage new payments trends to improve efficiency, manage risk, and support business growth.

Simply Treasury

JUNE 15, 2020

It is quite legitimate to ask the question: "After such a huge financial crisis, what will become my treasury department?" Each treasurer must think how to "sell" how treasury could have done better and how to strengthen the structure in future. Treasury must provide more support to operations (e.g. Back to the office.

Simply Treasury

JULY 12, 2021

Large MNCs are today using big ERPs, customized to their needs, integrated, or interfaced to many other IT treasury solutions dedicated to certain tasks. These companies are often managing finance and treasury on separate financial systems which are poorly integrated, if integrated at all. Treasury system needs is a huge pound.

Global Finance

SEPTEMBER 9, 2024

Today, the corporate treasury team plays a critical role helping companies navigate a business environment rife with economic uncertainty, geopolitical risks, regulatory change, trade tensions and supply chain disruptions. Not anymore. You have the ongoing wars, conflict with China, high inflation, and [high] interest rates.”

FISPAN

JUNE 8, 2022

This Spring, FISPAN's CEO and Co-Founder Clayton Weir joined Wells Fargo's Greg Hansen , SVP and Head of Product, at Nacha's Smarter, Faster Payments Conference to discuss streamlining treasury management with embedded banking solutions.

Global Finance

MARCH 5, 2025

With its exit from Central America and Colombia, Scotiabank follows the trend of international banks retreating amid rising compliance costs and risks. Scotiabank has officially exited retail banking in Panama, Costa Rica, and Colombia, marking the latest move by a major international lender to scale back in the region.

PYMNTS

SEPTEMBER 3, 2020

McFarland said the problem is with treasury banks — necessary parties to these transactions — struggling to meet the infrastructure requirements. It makes it difficult for [treasury banks] to adapt along with that technology. And [it] gives the banks the ability to support the back-end settlement process.”.

PYMNTS

NOVEMBER 12, 2020

Treasury departments need to modernize as they grapple with the pandemic — streamlining the way cash is handled, how strategic decisions about cash flow are crafted and how payments are made. Morgan , the successful treasury transformation in the Asia Pacific region hinges on digitization — and not simply electronification.

Global Finance

MARCH 27, 2025

From the establishment of its earliest banks in the mid-19 th century to becoming one of the worlds most advanced financial hubs, Singapore’s banking evolution mirrored the countrys journey from a modest colonial entrept for the trade between Asia, Europe, and then the United States to one of the worlds wealthiest and most developed nations.

PYMNTS

DECEMBER 3, 2020

The digital shift brought on by the coronavirus has caused treasury banks to reprioritize their support of digital payments as consumers and merchants increasingly demand fast, easy and secure ways to get their money. The Value Proposition.

Strategic Treasurer

MAY 1, 2023

Episode 251 Fraud in a Changing Treasury Landscape Episode 2: Do You Know Who Is Accessing Your Banking Information? In this episode, Craig Jeffery and Omri Kletter continue the discussion on some of the key findings that came out of the Treasury Fraud & Controls 2023 Survey. Has your security framework been strengthened?

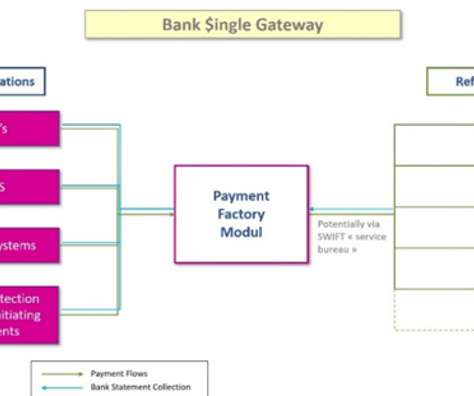

Simply Treasury

AUGUST 3, 2022

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. A “Bank Single Gateway” is no longer a "plus", but a "must" that every fund servicer or fund should have.

PYMNTS

SEPTEMBER 30, 2020

Department of Treasury said Tuesday (Sept. 29) it would soon begin forgiving loans granted under the PPP after borrowers and lenders complained that the Small Business Administration (SBA), the program’s manager, and Treasury employees have failed to respond to forgiveness requests, according to The Wall Street Journal (WSJ).

CFO News Room

FEBRUARY 6, 2022

TIPS have suddenly moved to center stage for investors, as the surge in inflation has drawn new interest in Treasury inflation-protected securities. This has already happened in the past three months; rates on 10-year Treasury notes have risen to 1.930% from 1.431% in early November. on average, Morningstar says.

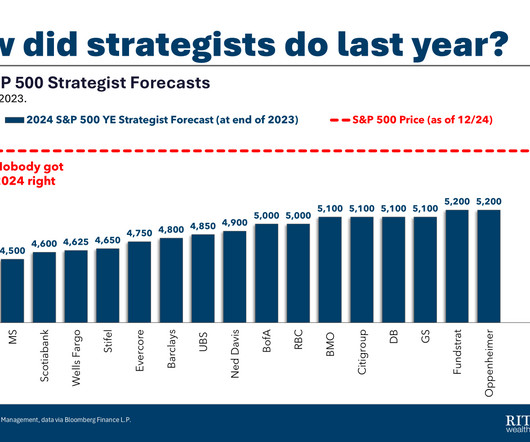

Barry Ritholtz

JANUARY 2, 2025

It is especially true for strategists and forecasters at large brokers and banks. So as strategists at Bank of America Corp., Deutsche Bank AG, Goldman Sachs Group Inc., So as strategists at Bank of America Corp., Deutsche Bank AG, Goldman Sachs Group Inc.,

CFO Talks

AUGUST 29, 2024

The Essentials of Treasury Management in Modern Businesses In today’s fast-paced world, managing a company’s money isn’t just about paying bills and keeping the lights on. What Is Treasury Management? Simply put, treasury management is about keeping a close eye on the company’s cash, debts, and risks.

Global Finance

DECEMBER 26, 2024

In a 2023 Treasury & Risk survey, over 70% of CFOs emphasized the importance of flexible technology in keeping their treasury operations efficient amid increasing volatility. Treasury teams must evaluate the size of the exposures and their potential impact on financial outcomes, often through scenario analysis and stress testing.

Global Finance

DECEMBER 6, 2024

According to Lagos-based FirstBank, our Best Private Bank for Sustainable Investing, the average net worth of affluent customers in Nigeria is estimated at $1 million, who have seen their net worth decline due to high inflation and the devaluation of the local currency. Last year, the banks profitability rose by 129% to $220.4

Future CFO

FEBRUARY 7, 2024

Delving into the key trends shaping the treasury landscape in 2024, the focus is on themes such as staffing challenges, macroeconomic risks, technology adoption, and strategic financial management. The post Navigating treasury trends in 2024: challenges, strategies, and the role of technology appeared first on FutureCFO.

CFO Dive

SEPTEMBER 21, 2023

While most treasury professionals focused on macroeconomic risks, some are taking steps within their organizations to control what they can.

CFO Dive

NOVEMBER 6, 2023

Unlock the power of a single banking relationship for better treasury management and financial security.

PYMNTS

MARCH 4, 2020

Business to business (B2B) application programming interfaces (APIs) are helping smooth the flow of data between companies, including businesses and their financial services software as well as between banks and their corporate clients. Other banking integrations seek to revamp B2B payments. Read the full story in the Tracker.

FISPAN

AUGUST 24, 2023

They have officially reached an incredible milestone of 1000 Corporates on Treasury Ignition, and we couldn't be more proud of this achievement. We are thrilled to announce a major milestone for our valued partner, J.P.

PYMNTS

DECEMBER 30, 2020

As treasury management becomes increasingly digital, a bank’s corporate banking clients face challenges when it comes to modernizing treasury workflows. Embedding banking into ERP systems has been a hot topic as of late — although the buzz surrounding it has been years in the making.

Strategic Treasurer

APRIL 17, 2023

Episode 249 Fraud in a Changing Treasury Landscape Episode 1: Are You Implementing Thoughtful Security? Treasury’s threat of fraud attacks is constantly changing and increasing. Host: Craig Jeffery, Strategic Treasurer Speaker: Omri Kletter, Bottomline Subscribe to the Treasury Update Podcast on your favorite app!

PYMNTS

OCTOBER 14, 2020

One financial institution (FI) that is moving quickly to add digital supports for its clients is PNC Bank. The financial entity has rolled out a push-to-debit feature for its treasury customers with the assistance of a third-party technology partner, according to recent announcements. Around the Disbursements World.

PYMNTS

APRIL 29, 2020

Treasury Department and the Small Business Administration (SBA) said they will temporarily exclude big banks from the loan portal used to submit applications for the SBA’s Paycheck Protection Program (PPP) for eight hours. Instead, national franchises, publicly traded companies and preferred bank customers got the funds.

PYMNTS

JANUARY 27, 2021

The concept of embedded banking has opened up a new frontier for financial service providers to drive holistic, elevated experiences for end-users. Increasingly, businesses want the same benefits of embedded banking that consumers have. Increasingly, businesses want the same benefits of embedded banking that consumers have.

PYMNTS

OCTOBER 19, 2020

Brazilian bank accounts are being hit by a new malware, called Vizom by IBM, that makes use of familiar overlay attack tactics to hijack devices in real time, according to a report by ZDNet. Treasury Office of Terrorism and Financial Intelligence issued an alert about the surge in ransomware attacks. Earlier this month the U.S.

Global Finance

OCTOBER 11, 2024

Global Finance presents its 31st annual list of best banks worldwide. Banks face an uphill battle as supply chains remain disrupted, regional conflicts continue to build, and the fear of bank failure returns. Industry leadership, advancements in digitalization and corporate citizenship also factored in.

PYMNTS

JULY 7, 2020

For more community banks, the latter strategy can fast-track digitization initiatives. This week’s look at the latest bank-FinTech tie-ups shows Banking-as-a-Service and other FinTech players embracing smaller regional and community banks to elevate small- to medium-sized business (SMBs) and corporate banking offerings.

Musings on Markets

SEPTEMBER 20, 2024

As a long-time skeptic about the Fed’s (or any Central Bank’s) capacity to alter much in markets or the economy, I decided now would be as good a time as any to confront some widely held beliefs about central banking powers, and counter them with data.

CS Lucas

NOVEMBER 25, 2024

Treasury management doesn’t have to feel like a balancing act. Making Treasury Simpler and Smarter If you’ve ever wrestled with keeping Excel or Power BI dashboards up to date, you’re not alone. For many teams, keeping up with manual processes, disconnected systems, and ever-evolving demands eats into valuable time.

Tips Watch

SEPTEMBER 22, 2022

By David Enna, Tipswatch.com Back in early July, I wrote an article suggesting a strategy of staggering purchases of short-term Treasurys to boost your gains on cash holdings. I raised this idea because yields on Treasury bills (often called T-bills) … Continue reading →

PYMNTS

DECEMBER 22, 2020

When Stripe announced earlier this month that it was collaborating with the likes of Citigroup, Goldman Sachs and Barclays to embed a range of financial services within its Stripe Treasury offering, it was a big step forward for the Banking-as-a-Service (BaaS) landscape. A Phased Approach. The Corporate Use Case.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content