Automate & Simplify Bank and Credit Card Reconciliation - Webinar

Navigator SAP

OCTOBER 24, 2022

Automate & Simplify Bank and Credit Card Reconciliation | Powered by Alluvia.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Navigator SAP

OCTOBER 24, 2022

Automate & Simplify Bank and Credit Card Reconciliation | Powered by Alluvia.

The Finance Weekly

DECEMBER 1, 2024

Let’s talk about something every business owner and accountant deals with— account reconciliation. If you’ve ever wondered what account reconciliation is all about or how to do it effectively, this guide has got you covered. What Is Account Reconciliation? Bank Reconciliation This is the most common type.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Global Finance

MARCH 1, 2025

Chinas financial sector, from banks to brokerages, is rapidly incorporating DeepSeek, the nations champion in AI, for customer service, data analysis, and email sorting. Postal Savings Banks mobile app, Xiaoyou Assistant, answers account holder questions and Haain Banks chatbot specializes in marketing queries.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

PYMNTS

SEPTEMBER 28, 2020

Intuit has announced a new integration between its QuickBooks software and Amazon Business to allow small businesses to automate purchase reconciliation, according to a press release. This integration will automate the data entry and reconciliation small businesses need to do to keep their books up to date.".

PYMNTS

JANUARY 26, 2021

marked its third anniversary of adopting its open banking framework, making it the leading market to drive the concept of unlocking customers’ bank account data for integration with third-party solution providers. where there is no open banking regulatory mandate. HashCash Brings Blockchain Tech To Unnamed Bank.

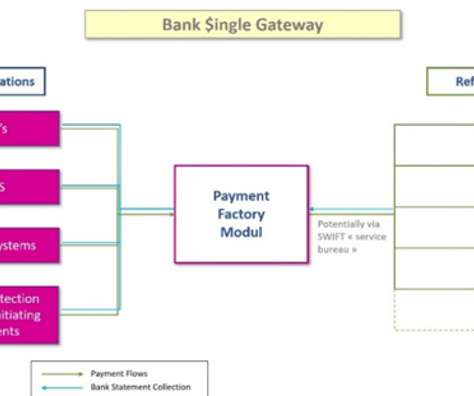

Simply Treasury

AUGUST 3, 2022

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. A “Bank Single Gateway” is no longer a "plus", but a "must" that every fund servicer or fund should have.

The Finance Weekly

MAY 20, 2024

What Is Bank Reconciliation? Bank reconciliation is a process companies use to ensure that their recorded cash balances align with the actual cash held in their bank accounts. For example, a small retail company makes sure every month the cash it has matches what the bank says.

CS Lucas

MAY 9, 2024

Bank reconciliation is a crucial process that ensures the accuracy of a company’s financial records against the bank’s account statements. A reconciliation statement serves to validate that payments have been processed and deposits correctly recorded. Please see CS Lucas user guide on bank reconciliation.

The Finance Weekly

OCTOBER 30, 2024

One of the major trends in this space is the ability to connect bank accounts seamlessly, providing real-time visibility into your financial status. Known for its advanced features, Datarails offers a seamless experience by connecting directly with your existing bank accounts, providing real-time visibility into your finances.

FISPAN

AUGUST 5, 2022

Bring the bank to your Oracle NetSuite environment with FISPAN’s bank-branded embedded app.

PYMNTS

MARCH 11, 2020

The reconciliation process is traditionally viewed in the context of financial transactions: Does the value of a company payment match with what the company was billed, and what the company had purchased? Yet the reality is that the reconciliation process is rarely ever straightforward. Beyond Data Matching. Payment Rail Confusion.

PYMNTS

DECEMBER 30, 2020

As treasury management becomes increasingly digital, a bank’s corporate banking clients face challenges when it comes to modernizing treasury workflows. Embedding banking into ERP systems has been a hot topic as of late — although the buzz surrounding it has been years in the making.

PYMNTS

APRIL 7, 2020

The program can be used for everything from intercompany transactions, accounts payable and receivable, travel and entertainment (T&E) reporting, bank clearing and lockbox to general ledger cash accounts. The Transaction Matching software goes hand-in-hand with OneStream’s existing Account Reconciliation.

PYMNTS

NOVEMBER 10, 2020

Banks must understand that shift in order to uncover the most valuable B2B use cases, he said – and that means not only embracing new payments technology, but also adopting new business models that can address the shifting needs of corporates. It’s the culture that is changing.”.

The Finance Weekly

NOVEMBER 3, 2021

Account reconciliation is the matching and validating of balances in the general ledger (GL) to internal and external sources or other independent calculations to accurately close month-ends and year-ends. Defining Account Reconciliation The basic steps involved in reconciliation transactions include the following: 1.

PYMNTS

SEPTEMBER 23, 2020

In today’s top news in digital-first banking, the Office of the Comptroller of the Currency (OCC) has issued stablecoin guidance, and Deutsche Bank intends to decrease the size of its brick-and-mortar footprint. Federal Banks, Savings Associations Win Approval For Some Crypto Activities. Bank Instant Card.

PYMNTS

JANUARY 21, 2021

based bank to help them finance their corporate trade owing to a sophisticated blockchain platform for B2B payments, a press release says. HashCash's HC Corporate Payment will come with immediate reconciliation, real-time document sharing and automation via smart contacts, in order to enable quicker, more effective B2B payments.

PYMNTS

SEPTEMBER 27, 2020

HighRadius , a FinTech working in automation for order-to-cash and treasury management, has announced an expanded strategic relationship with Commerce Bank , according to a press release. The agreement made all of HighRadius' products available for Commerce Bank clients.

PYMNTS

JULY 27, 2020

In other news, across Italy, banks have been using Corda ‘s blockchain tech to help speed up the double-checking of transaction logs, according to CoinDesk. Eighty-five percent of the country’s banks, or 55 banks total, have made use of the solution to help switch up the process of interbank reconciliation.

PYMNTS

JANUARY 8, 2021

Even so, there’s still plenty of work to be done to raise awareness about how sending or receiving RTP transactions can improve the banking client experience. To facilitate this transition in handling 24/7 cash flow, Whisler said TCH offers services such as intraday reconciliation.

PYMNTS

OCTOBER 6, 2020

Bank of America is rolling out three new application programming interfaces (APIs) as it supports the growing demand for up-to-the-moment data and processing in business treasury. Our clients can transact and see real-time banking data directly from their own enterprise software, giving them an advantage in the digital, always-on economy.”.

PYMNTS

APRIL 8, 2020

Banks are continually working to provide their business customers with more streamlined, impactful services. This enables banks to support their clients’ ventures in more robust and flexible ways, according to Abdul Raof Latiff, group head of the digital institutional banking group at Singapore-based DBS Bank.

PYMNTS

APRIL 17, 2020

Open banking regulations across Europe kicked open the door for a wave of FinTech competition, with consumer-facing personal finance management (PFM) right in the crosshairs of innovators’ efforts. Small businesses and corporate end-users have emerged as powerful drivers of exploring new use-cases for open banking and PSD2 regulations.

PYMNTS

OCTOBER 14, 2020

"Unlike solutions on the market today that only offer a handful of ERP integrations and require a manual intervention to complete a payment, RegalPay One offers a bank-branded platform that connects directly to their corporate customers' ERP system," Ed Wertzberger , vice president of solution delivery for Regal Software, said in the announcement.

PYMNTS

AUGUST 12, 2020

In this week’s roundup of open banking initiatives and bank-FinTech tie-ups, PYMNTS finds a renewed push to strengthen SMB banking experiences including financing, account management and more. Funding Circle Takes A Closer Look At Open Banking. WaFd Bank Bolsters SMB Financing Via nCino. Over in the U.K.,

PYMNTS

JANUARY 17, 2021

Cloud-based accounting software solution provider AlignBooks will be working with ICICI Bank , a private-sector bank, to deliver a new, simple digital banking experience for small- to medium-sized businesses (SMBs), CRN India reported. We are delighted to partner with AlignBooks.

PYMNTS

JULY 15, 2020

. “Having experienced continued growth and commitment to its credit union and bank clients during this pandemic, CheckAlt is delighted to work with Tru Treasury to provide our suite of turnkey treasury payment solutions that accelerate payments and simplify reconciliation for credit union members,” he said, according to the release.

PYMNTS

JULY 17, 2019

More than 50 of the world’s largest companies have already started using a new service that enhances payment flows, allowing a single view of transactions across multi-banked corporates. The service allows a single, centralized view across all banking partners in real-time, facilitating accurate reconciliation.

PYMNTS

JUNE 24, 2019

These professionals are entering the market with a demand for digitization, and it’s driving the emergence of digital- and mobile-first banks built for small businesses. Among this community is Novo , a mobile-first bank connecting entrepreneurs with bank account and debit card services. and Europe.

PYMNTS

NOVEMBER 12, 2020

Contextual banking will change the way traditional financial institutions (FIs) interact with their business clients. Today, a bank simply receives a payment instruction from its customer. This lets the bank have its brand and services front and center, even when it comes to embedded banking. Building The Infrastructure.

PYMNTS

JULY 3, 2020

People’s United Bank Senior Vice President of Treasury Management Cris Sigovitch told PYMNTS that while access to payables FinTech solutions is important, perhaps even more essential is access to a trusted partner that can guide firms toward a resilient and future-proof AP department. . ” Offering the Right Tools.

PYMNTS

NOVEMBER 18, 2020

The pandemic has exposed glaring points of friction in any number of verticals – including banking, where it’s apparent that legacy systems and processes were not designed to handle real-time anything, and certainly not payments. Is real-time ready for prime time?

PYMNTS

JANUARY 21, 2021

Today in B2B payments, European banks grow wary of small business loans, and Xero collaborates on API bank connectivity. SMB Loans Pose Potential Big Risk for European Banks. Euro area banks have cut back on lending, as the pandemic continues to threaten the economy. Xero, Nedbank Team on API-Enabled Bank Feed for SMBs.

FISPAN

JANUARY 12, 2022

Financial institutions (FIs) are under pressure to drive innovation in financial data access for the commercial banking space. Banking customers are seeking more control over their banking data than ever before. How data will be delivered and received from FISPAN and the third-party partners we work with.

PYMNTS

MAY 6, 2020

In an interview with Karen Webster, Simon Barker, CEO of Conferma Pay, explained that the announcement heralds the first time key attributes of virtual commercial cards — including expense controls and seamless data reconciliation — are being tied to tap-and-go payments, with the ease of use that mark contactless consumer payments.

PYMNTS

FEBRUARY 28, 2020

As such, B2B FinTech firms continue to embrace collaboration and data integration between each other, particularly as the financial services world at large continues its migration toward unlocking data in an Open Banking framework. Going Further With Open Banking. Cichy said he sees the opposite happening today, though.

PYMNTS

DECEMBER 22, 2020

The Italian Banking Association (ABI) is running experiments for a digital euro, CoinDesk reported. The experiments aim to examine a digital euro’s technical feasibility as well as its “programmability” as a coin separate from a central bank digital currency, (CBDC) according to CoinDesk.

PYMNTS

MARCH 9, 2020

FinTechs are keeping an eye on the needs of banks and their corporate clients in today’s market. Treasurers, in one case, may have deposits at multiple banks as some institutions may provide services to help them collect deposits. However, they are seeking ways to consolidate all of those deposits into one primary bank.

PYMNTS

MARCH 16, 2020

In addition, the deal will allow better reconciliation of payments with the matching invoices. Hari Moorthy, global head of Transaction Banking at Goldman Sachs, said the bank wanted to put clients first and create a “frictionless” experience when exchanging payments.

FISPAN

OCTOBER 17, 2023

FISPAN and Sage partner to help businesses remove complexity from their accounts payable and reconciliation processes by integrating banking directly into their Sage Intacct ERP system.

PYMNTS

SEPTEMBER 26, 2018

The latest corporate banking offering by Citi aims to virtualize treasurer accounts for more personalized, streamlined services. The bank said in an announcement Tuesday (Sept. Users can view transaction activity and manage online banking entitlements, the bank explained.

PYMNTS

DECEMBER 16, 2020

Commercial cards have seen an increased adoption in both large and small Indian businesses as an option to protect and digitize supplier payments, drive savings and simplify reconciliation, according to the release. Corporates will have improved compliance and security in strategic purchases and larger payments.

PYMNTS

DECEMBER 29, 2020

APIs have similarly become valuable tools to automate reconciliation and accounting via interconnectivity between AR, AP and accounting systems. It's a concept that involves the seamless, automated movement of documents and data between parties and through workflows, from purchase order to invoicing to payment to reconciliation.

PYMNTS

JUNE 10, 2020

Credorax , the smart payments provider and FinTech, has announced a partnership with Samsung to develop blockchain technology to offer open banking services, according to a press release. Digitization in banking is on the rise due to the pandemic, which has seen people and businesses flocking to digital forms of financial services.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content