Holding Onto Your Marketing Budget in a Downturn

CFO News Room

NOVEMBER 13, 2022

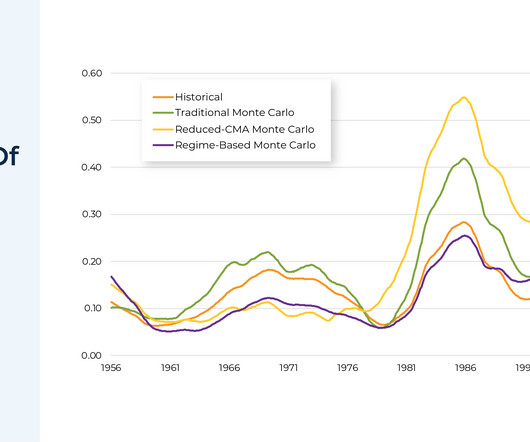

The Mobile Marketing Association (MMA) has demonstrated the tight correlation between advertising spend and economic indicators like GDP growth by looking at historical data. Make sure you have the right math and language to explain results driven by direct and indirect marketing spend. Build a tight relationship with your CEO and CFO.

Let's personalize your content