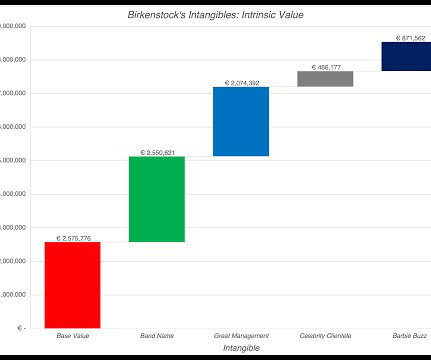

Invisible, yet Invaluable: Valuing Intangibles in the Birkenstock IPO!

Musings on Markets

OCTOBER 6, 2023

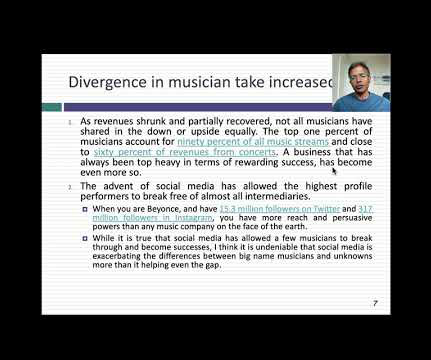

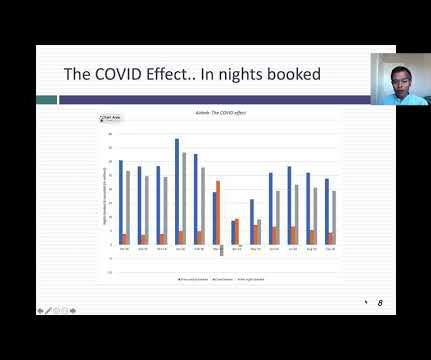

While companies that were listed for much of the twentieth century waited until they had established business models to go public, the dot-com boom saw the listing of young companies with growth potential but unformed business models (translating into operating losses), and that trend has continued and accelerated in this century.

Let's personalize your content