Accounts payable: Why CFOs should pay attention

CFO Dive

APRIL 18, 2022

Over one-third of your invoices have errors, and costs to process these may be up to ten times greater than a "clean" invoice.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

APRIL 18, 2022

Over one-third of your invoices have errors, and costs to process these may be up to ten times greater than a "clean" invoice.

CFO Dive

MAY 26, 2023

CFOs are under growing pressure to drive efficiencies at zero cost. Leveraging intelligent automation to process invoices can help, Steven Cronin writes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

FEBRUARY 28, 2022

Keeping your customers and the employees that serve them happy is key for any organization.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

Future CFO

FEBRUARY 2, 2025

Charlie Cheah , managing director, Esker Asia , believes that CFOs and in a bigger context, the Office of the CFO in Asia, face several challenges when integrating AI into financial systems, given the region's diverse technological landscape. "In Regulatory Variations: APACs regulatory environment for AI is still evolving.

https://trustedcfosolutions.com/feed/

MARCH 22, 2023

Are you tired of the countless hours spent managing your accounts payable (AP)? Do you want to streamline your accounting process to save the time and money spent on manual tasks on Quickbooks? With a growing business, it’s easy to outgrow the accounting systems you’ve relied on since the conception of your company.

CFO Dive

APRIL 19, 2024

As leaders of their firms’ accounting operations, many controllers are outsourcing work and using AI to speed accounts payable and receivable tasks.

CFO Dive

JANUARY 31, 2022

Aligning accounts payable and accounts receivable can reduce fraud, increase agility and spark profit-boosting insights. Yet few companies are seizing on the opportunity.

CFO Thought Leader

JANUARY 29, 2025

For Matt Collis, CFO of PairSoft, storytelling is more than a skillits a strategic tool for aligning teams and scaling businesses. ” Matt Collis, CFO, PairSoft CFO TL: Tell us about PairSoftwhat does the company do, and what are its offerings today? The first is our accounts payable automation solution.

CFO Plans

OCTOBER 29, 2024

A case in point is a mid-sized manufacturing company that saw its accounts receivable days drop by 30% after adopting automated invoicing and digital tracking tools, bolstering their liquidity and paving the way for strategic investments. Get Started with CFO Plans Today to unlock your business’s full financial potential.

CFO Thought Leader

OCTOBER 29, 2024

Now serving as CFO of Yooz, Gronen draws on this experience to focus on scaling the company through automation, AI-driven processes, and product expansion. ” —John Gronen, CFO, Yooz CFOTL: Tell us about what this company does and its offerings today. Gronen: Yooz is an AP (accounts payable) automation and payments company.

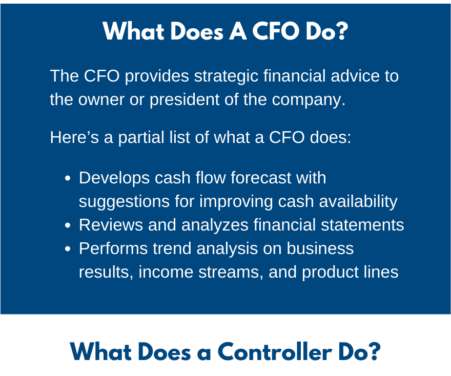

CFO Simplified

JUNE 23, 2022

It’s not unusual in a small company for the accounting manager to become the controller and then become the CFO. Let’s look at these two roles: CFO vs. Controller: What’s the difference? At the basic level, a controller is tactical, whereas a CFO is strategic. Codes and processes Accounts Payable invoices.

PYMNTS

DECEMBER 10, 2020

Increasingly, FinTechs and the businesses they serve are pulling double duty with solutions that tackle both accounts receivable and accounts payable friction for each end of the B2B transaction. Digitizing and modernizing B2B payments cannot be a one-sided effort. Wells Fargo, Bill.com Pull Double Duty With Partnership.

CFO Share

DECEMBER 14, 2022

What is accounts payable ? What is accounts payable? Accounts payable is short-term obligations (aka bills) due to vendors for services or goods received. What are examples of accounts payable? Every vendor bill you receive in email or paper mail is part of your accounts payable.

CFO Simplified

JULY 17, 2022

At CFO Simplified, our President Larry Chester receives the same question over and over: “What does it take to become a great CFO?” Or, what about people who don’t themselves want to become a CFO, but perhaps are business owners looking to hire one permanently or on a fractional basis? A CFO needs to understand operations.

Future CFO

JULY 1, 2020

There are specialists handling accounts payables, accounts receivables, performing reconciliation, financial planning and analysis, etc. In the case of procurement and accounts payable (AP), this rings especially true. The post Unifying procurement and accounts payable appeared first on FutureCFO.

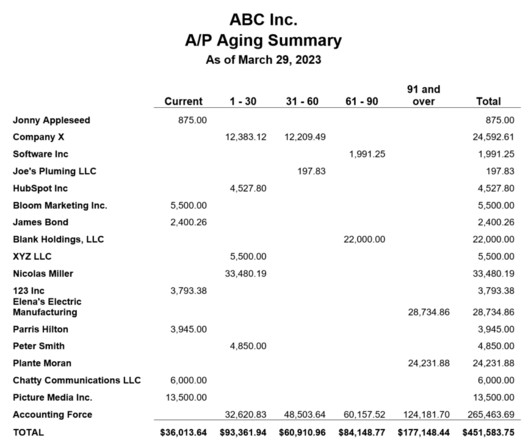

CFO Share

MARCH 31, 2023

The accounts payable aging (AP) report shows when and how much you owe vendors. Why is an Accounts Payable Report valuable? When managing cash flow problems, your accounting team or accounts payable service will know what vendors might stop services or put you on credit hold. Pay appropriate bills.

CFO Share

JULY 19, 2023

The biggest challenges facing accounts payable are chaos, maintenance cost, and fraud. Bring order to Accounts Payable. Accounts payable is a non-revenue-generating expense which best in class businesses minimize. Minimize fraud risk Accounts payable is the number one source of fraud in small businesses.

Future CFO

AUGUST 14, 2024

AP (Accounts Payable) automation empowers organisations to regain control over their finances by automating tedious manual tasks that burn through staff time, such as line-item matching for invoices, payment reviews, and approvals, Sanford says.

Future CFO

FEBRUARY 11, 2024

As a result of ongoing inflation, economic disruption, and the lowest growth project from The International Monetary Fund (IMF) since 1990, many Accounts Payable (AP) departments are being tasked with driving cost reductions and improving operational efficiency to increase company profitability and workforce productivity.

CFO Share

JULY 16, 2024

When building your back office, you may consider whether you need a financial controller or a CFO. The skills and responsibilities of these roles overlap, and to make matters more confusing, an underqualified CFO (yes, there are plenty out there) will perform similar to or worse than an excellent controller.

Future CFO

JANUARY 26, 2024

The outcome is boosted efficiency, increased accuracy, cost reduction, and stronger supplier relationships—a game-changer in Accounts Payable that allows finance leaders to navigate uncertain economic conditions and elections with confidence. The post Transforming accounts payable operations through AI appeared first on FutureCFO.

Future CFO

APRIL 6, 2022

The post Four quarters to accounts payable efficiency appeared first on FutureCFO. This white paper details: The four stages of successfully adapting to a new AP automation solution The steps to take in each stage for AP, suppliers, and the overall business How to affect change in adjacent process areas to maximize benefits.

Future CFO

JUNE 16, 2021

Organizations that adopt accounts payable (AP) automation can experience significant benefits including greater control over cash management, reduction in processing costs, fraud mitigation and improved compliance. DOWNLOAD NOW The post The benefits of accounts payable – a finance perspective appeared first on FutureCFO.

Future CFO

MARCH 29, 2021

FutureCFO spoke to Marcus Rex, managing director for Asia-Pacific, xSuite, for his perspective on how finance automation in general, and accounts payable in particularly, can help transform finance into a profit centre. Myths around accounts payable (AP) automation. Recurring pain points in accounts payables.

Future CFO

APRIL 6, 2022

A common thread among these initiatives is the urgent shift to a more contemporary, digitally savvy, and data-driven accounts payable function. Making this goal a reality will require accounts payable departments to: Standardize processes Make greater use of emerging technologies Deliver more real-time operational insights.

CFO Share

MARCH 13, 2023

Managing accounts payable is critical for any business to maintain healthy cash flow and vendor relationships. Financial ratios are essential tools that help companies evaluate their financial performance, including their ability to manage accounts payable effectively. What is accounts payable in ratio analysis?

Future CFO

MARCH 27, 2023

To curb rogue spending, businesses need to rethink how the accounts payable (AP) process can be improved. A phased approach to automate accounts payable, reduce rogue spending, and conserve cash certainly would be a good start. The post Rein in rogue spending by automating accounts payable appeared first on FutureCFO.

Future CFO

APRIL 6, 2022

Accounts Payable is responsible for so much more than just paying incoming bills and invoices, particularly given today's global challenges. In partnership with Kofax , SSON ran an industry-wide AP Automation Maturity survey, gaining insights from all over the world into how companies are growing their payables efficiency.

CFO Dive

MARCH 14, 2024

The card network giant wants to simplify payment processes for CFOs, accounts payable staff and procurement professionals, via the new tie.

CFO Talks

JANUARY 8, 2025

Allowing someone who primarily works in accounts payable to gain experience in forecasting or treasury provides them with a broader understanding of finance operations. As CFO, you can drive this by introducing tools that streamline processes and improve decision-making.

CFO Share

MAY 31, 2023

Accounts payable is an annoyance at best, a disaster at worst. More and more businesses use accounts payable outsourcing as a solution to this problem. What to look for in an accounts payable company. Accounts payable outsourcing should include setting your business up with an automated solution.

https://trustedcfosolutions.com/feed/

DECEMBER 21, 2021

Video Webinar: 5 Questions Every CFO Should Be Asking In Uncertain Times (55 Minutes). Report: Critical Capabilities for Cloud Core Financial Management Suites for Midsize, Large, and Global Enterprises |The report will help you compare accounting systems to determine which product is the best fit for your business.

PYMNTS

SEPTEMBER 24, 2020

Accounts payable (AP) teams are now taking a fresh look at the potential of tools such as virtual cards to ease their transaction frictions. The September CFO Guide To Digitizing B2B Payments explores how corporate buyers are streamlining their B2B transactions with digital payments and supplier onboarding tools.

CFO Simplified

OCTOBER 24, 2022

As a business owner, you must understand the importance of reconciling your accounts—and no, not just your checking accounts! Do you know what accounts you need to be reconciling regularly? Read on to find out from Larry Chester , President of CFO Simplified. Do You Know What Business Accounts You Must Reconcile?

Future CFO

APRIL 21, 2021

So, what does the New Accounts Payable department look like? The new accounts payable department has a more intense focus on cash flow and payment terms and takes a more disciplined approach to its financial processes to work toward optimising the cash conversion cycle. What has changed, and what changes are here to stay?

PYMNTS

DECEMBER 24, 2020

For years — decades, even — B2B payment leaders and innovators had been talking about the digitization of corporate payments within accounts receivable (AR) and accounts payable (AP) departments. Manual checks don't exist in a COVID environment," Chegg CFO Andy Brown told PYMNTS last month.

CFO Share

JUNE 18, 2024

Purchasing – validates accounts payable invoices. By involving department heads in the quality assurance process, you enhance the accuracy of your financial data and build a culture of accountability and teamwork. This is where a fractional CFO can be invaluable. Operations – validates inventory records.

PYMNTS

DECEMBER 3, 2020

Speaking with PYMNTS for this week's Voice of the CFO report, 6Sense Chief Financial Officer Rob Goldenberg said there were many impacts from the coronavirus crisis on the company's back-office financial processes. The CFO As The Financial 'True North'. Some, he said, were anticipated, while others caught the company off guard.

https://trustedcfosolutions.com/feed/

APRIL 14, 2022

With a shared chart of accounts, your firm can perform consolidations quickly. Accounts payable functionality allows you to create automated processes that save hundreds of hours by eliminating manual workflows. We have your next CFO. . You can also set spending limits to ensure your costs stay within budget. .

Future CFO

DECEMBER 5, 2022

While it is common to find a chief finance officer (CFO) helming a large or multinational organisation, the costs associated with having one in-house can be a hurdle for smaller organisations. According to payscale , the average base salary of a CFO in Hong Kong is HK$1,351,820 per year. Hiring a CFO when money is the problem.

PYMNTS

NOVEMBER 18, 2020

That's important, not only to the accounts receivable team, but to any CFO or CEO needing to maximize cash flow and increase growth capacity," Pinato said. The firm's “model is unique in that it not only matches but also extracts data, resulting in dramatic match rate increases.

Future CFO

AUGUST 31, 2022

When it comes to CFO technology priority, back-office automation is seen as the key to cost reduction in the face of ongoing inflation, said Gartner recently. Gartner’s survey on CFOs’ investment priorities also revealed the areas most vulnerable to cost cuts over the next 12 months.

PYMNTS

NOVEMBER 25, 2020

This could mean adopting new accounts payable (AP), accounts receivable (AR) and other treasury strategies and technologies, for example. The November CFO’s Guide To Digitizing B2B Payments explores how businesses are navigating these technology adoptions and finding secure, cost-effective ways to upgrade their B2B transactions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content