Pandemic Wake-Up Call Drives Integrated B2B Platforms

PYMNTS

JANUARY 20, 2021

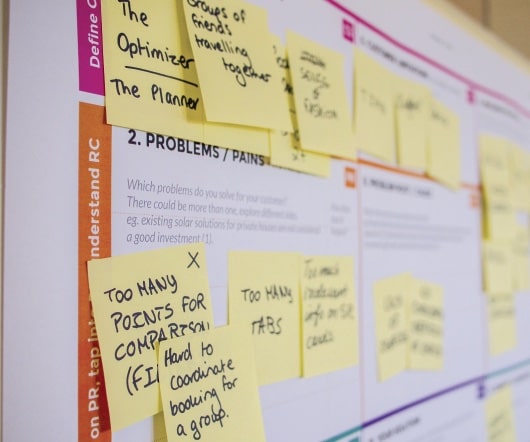

Corporate finance teams were not simply tasked with finding ways to continue operations in a remote work environment as a result of the coronavirus crisis. There were cases where some of these finance teams could not even understand what their cash visibility looked like.”. The Biggest Pain Points, Revealed.

Let's personalize your content