AP/AR automation: securing cashflow, enriching partnerships

CFO Dive

MAY 1, 2023

Automating accounting processes is like irrigating your financial garden.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MAY 1, 2023

Automating accounting processes is like irrigating your financial garden.

CFO News Room

FEBRUARY 2, 2023

Investing in a guaranteed interest account is a great way to secure your money, as there is very little risk. Guaranteed interest accounts provide reliable, consistent returns and can be used for short-term savings or to supplement other investments in your portfolio. Guaranteed interest accounts offer a stable rate of return.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Crafting Impact: Revenue Growth And Efficiency For Finance Professionals

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

From Start to Scale: Driving Growth Through Seamless Payments Implementation

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

CFO News Room

FEBRUARY 6, 2022

TIPS have suddenly moved to center stage for investors, as the surge in inflation has drawn new interest in Treasury inflation-protected securities. But how much do investors really know about these securities, other than their alluring name? And those results don’t account for changes in the securities’ market price.

Crafting Impact: Revenue Growth And Efficiency For Finance Professionals

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

From Start to Scale: Driving Growth Through Seamless Payments Implementation

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Nerd's Eye View

SEPTEMBER 11, 2024

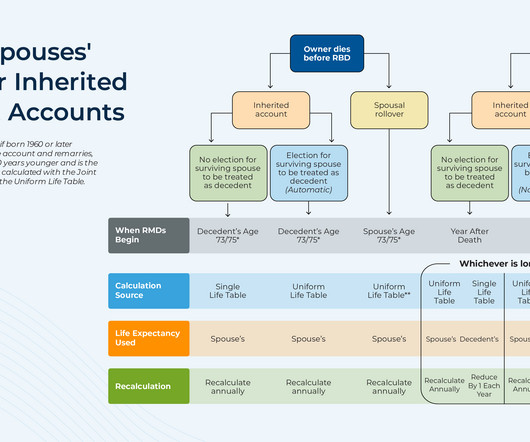

Among all the different types of retirement account beneficiaries, those who are the surviving spouse of the original account owner receive the most preferential tax treatment when it comes to distributing the account's assets after the owner's death. But the SECURE 2.0

CFO News Room

DECEMBER 10, 2022

What Types of Accounts are Best for Compounding? Banks Savings Accounts. Most savings accounts, money market accounts, and certificates of deposit earn compound interest. Treasury securities, municipal bonds, and bond funds. Taxable vs. tax-deferred vs. tax-free accounts. 3) Money Market Accounts.

CFO News Room

JANUARY 17, 2023

Social Security payroll taxes are not collected on earnings over a set cap. In 2021, this cap was $142,800 , so workers making more than this enjoyed the benefit of zero Social Security taxes on all earnings in excess of this cap. Social Security’s payroll tax—of which employees pay 6.2% and employers 6.2%

Future CFO

FEBRUARY 27, 2024

For the accountancy profession, transformation has always been a part of the process, let alone the manner of life. For Harding, the accountancy profession, through its history, has continually adapted and seized future opportunities. “A

https://trustedcfosolutions.com/feed/

MARCH 22, 2023

Are you tired of the countless hours spent managing your accounts payable (AP)? Do you want to streamline your accounting process to save the time and money spent on manual tasks on Quickbooks? With a growing business, it’s easy to outgrow the accounting systems you’ve relied on since the conception of your company.

The Charity CFO

APRIL 20, 2023

How can nonprofit accounting software help your organization with efficiency? In today’s digital age, technology has revolutionized almost every aspect of business operations, including accounting and finance. For-profit companies have long used accounting software to track their financial transactions and monitor their bottom lines.

CFO News Room

JANUARY 14, 2023

The Department of Homeland Security took a positive step by clarifying and streamlining the process to protect migrant workers in labor disputes. Posted January 13, 2023 at 3:18 pm by Daniel Costa. Today, the U.S. This will make workplaces safer for all workers.

CFO Talks

OCTOBER 2, 2024

Chinese Study highlights limitations on IAS 38, accounting for intangible assets A recent study from China highlighted the limitations of IAS 38 —the International Accounting Standard that governs intangible assets—and its impact on innovation, particularly in high-tech industries.

CFO Leadership

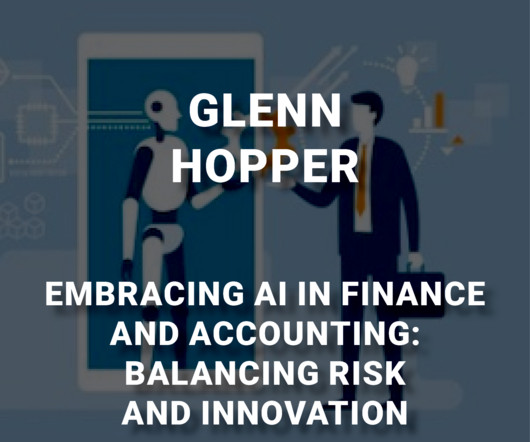

OCTOBER 10, 2023

AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals. However, they still have a place in corporate finance and accounting.

CFO News

FEBRUARY 20, 2024

As part of its investigation into the Zee founders, the Securities and Exchange Board of India, or Sebi, found that about 20 billion rupees ($241 million) may have been diverted from the company, said people familiar with the matter who did not want to be identified as the information is not public yet.

Nerd's Eye View

MAY 15, 2024

On April 25, 2024, the Department of Labor (DoL) issued the final version of its Retirement Security Rule (the "Final Rule"), which imposes an ERISA fiduciary standard "that applies uniformly to all investments that retirement investors may make with respect to their retirement accounts ".

Nerd's Eye View

AUGUST 9, 2023

The original SECURE Act, signed into law in December 2019, changed many of the long-standing rules governing IRAs and other retirement accounts, and no single measure in the legislation had a more seismic impact on planning than the changes to the post-death distribution rules for retirement accounts.

CFO Share

JANUARY 2, 2025

Despite securing over $100 million in venture capital and employing over 600 individuals, Bench abruptly and inexplicably ceased operations on December 27, 2024, leaving thousands of small business clients scrambling for alternatives. For example, Bench ranked #1 in accounting SEO thanks to its professional marketing department.

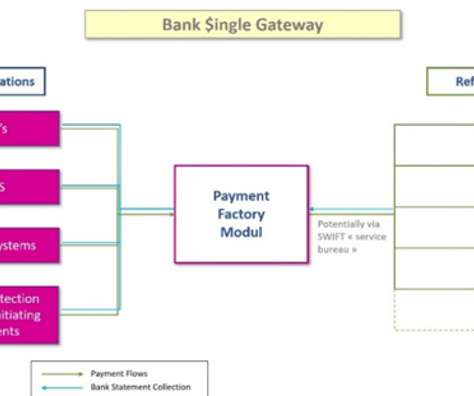

Simply Treasury

AUGUST 3, 2022

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. The approver receives an email alert and can connect to the secure payment tool. Virtuous bank connectivity.

CFO News Room

DECEMBER 12, 2022

So, is M1 Finance secure? Additionally, the company’s website states that it uses “industry-leading security protection” and is FDIC insured. The company is FDIC insured and uses “industry-leading security protection.”. There are no fees for opening an account, transferring money, or managing your portfolio. What is SIPC?

Nerd's Eye View

JANUARY 15, 2025

For most people, Social Security benefits are calculated using a single formula, which takes into account the individual's history of earning income on which they paid Social Security tax. In response, Congress passed the Social Security Fairness Act at the end of 2024, repealing the WEP and GPO in full.

E78 Partners

SEPTEMBER 27, 2024

Data privacy and security are at the forefront of concerns for most organizations. Information security can be especially complex to implement and monitor across portfolio companies and sponsors. Stakeholders and decision makers should be fully committed to the process, prioritizing data security across all departments.

CFO News Room

NOVEMBER 3, 2022

But securing this “soft landing” will require patience. In short, the “soft landing,” wherein inflation normalizes without sabotaging today’s strong labor market, is still possible and the Fed should try hard to secure it. . from the National Income and Product Accounts (NIPA) of the Bureau of Economic Analysis (BEA).

CFO Dive

AUGUST 2, 2022

The Public Company Accounting Oversight Board (PCAOB) doesn’t have the authority to remove foreign companies from U.S. exchanges but a 2020 law gives the Securities and Exchange Commission authority to do that if the PCAOB isn’t getting cooperation.

CFO News Room

JANUARY 19, 2023

But questions remain about how secure and reliable it is when compared to traditional brokerages. These protections help safeguard investors’ funds and securities in the event of a brokerage firm’s failure or other financial losses. SIPC stands for the Securities Investor Protection Corporation. Is Robinhood Safe to Use?

CFO News Room

FEBRUARY 5, 2022

Roth IRAs are popular accounts for investors to leave to their heirs because of these accounts’ tax-free status and lack of required minimum distributions (RMDs) during the original owner’s lifetime. Your beneficiaries can continue to enjoy this tax-free status for a period of time after they inherit the account.

https://trustedcfosolutions.com/feed/

JULY 19, 2022

QuickBooks is recognized for being a great basic accounting tool, and it is used by a lot of small businesses because it is user-friendly and affordable. Still, it is not an accounting solution that can handle business processes apart from financials. Sage Intacct is a cloud-based accounting solution that offers much, much more.

CFO News Room

DECEMBER 5, 2022

In our interactive webinar, we demonstrate how you can use LucaNet to make your financial processes secure and efficient within the shortest possible time. Who is this for: For finance and accounting specialists and managers who prepare the consolidated financial statements and reporting for the company.

CFO News Room

JANUARY 24, 2023

The 401(k) plan is the largest asset many investors own accounting for 36.2% Regularly checking your 401(k) account can help you stay on top of your investments, and make sure that your money is working for you in the best way possible. of their total net worth according to the U.S. Census Bureau. What is a 401k?

CFO News Room

DECEMBER 23, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”, a series of measures that will have significant impacts on the world of retirement planning. And notably, while no single change in SECURE 2.0

PYMNTS

JANUARY 26, 2021

marked its third anniversary of adopting its open banking framework, making it the leading market to drive the concept of unlocking customers’ bank account data for integration with third-party solution providers. Last week, the U.K. where there is no open banking regulatory mandate. Temenos Targets Banks With Digital Transformation Tools.

CFO News Room

JANUARY 6, 2023

In any case, the investment options below will help you protect the principal of your investment while securing some return. High-Yield Savings Account. High-yield savings accounts come with FDIC insurance , meaning your deposits are federally protected in amounts up to $250,000 per depositor per account. FDIC insured.

PYMNTS

JANUARY 8, 2021

billion during a financing round in September and has more than 13 million user accounts, said Bloomberg. 16, Massachusetts securities regulators filed a complaint against Robinhood alleging that the company aggressively marketed to inexperienced investors and failed to implement controls to protect them, violating state laws and regulations.

CFO News Room

JANUARY 23, 2023

You can open an account in 3-5 minutes. Manage all of your accounts from a single dashboard. SaveBetter pools high-interest savings accounts and CDs from financial institutions nationwide, giving customers access to high-yield accounts they otherwise wouldn’t know about. High-Yield Savings Account. No Penalty CD.

CFO News Room

DECEMBER 30, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that the passage of “SECURE Act 2.0” How advisors are increasingly purchasing individual bonds rather than bond funds in client accounts. In fact, while no single change in SECURE 2.0 To start, SECURE 2.0

The Charity CFO

MAY 6, 2022

You could even find yourself in worse shape than if you’d never secured the funding. The UCG is too extensive to explain here, but these are a few requirements you should consider: You must have an accounting system in place. You must be closing your books each month ; that means reconciling all of your bank accounts and credit cards.

CFO News

JUNE 30, 2023

Attra, was appointed to SBI as CFO on October 2020, had previously worked as a Partner at EY India and held a senior executive position at ICICI Securities. He was also a partner in SR Batliboi & Associates LLP and GM and chief Accountant in ICICI Bank.

CFO Share

MAY 22, 2024

These reports are the backbone of evaluating business performance – crucial for making informed decisions, attracting investors, and securing loans. This guide will provide you with financial reporting help and actionable steps to get accounting back in order and working for you. Step 1: Team up with an accounting professional.

CFO News Room

DECEMBER 16, 2022

Job security is always a concern when choosing a career, but some fields are more recession-proof than others. They may work in various industries, such as investment firms, accounting firms, banks, or the government. Chief compliance officers often have a degree in finance, law, accounting, or business administration.

CFO News Room

JANUARY 13, 2023

Also in industry news this week: A study suggests that simplification is the top reason consumers combine their investment accounts, signaling that the onboarding process for new advisory client assets is a value-add in itself.

CFO News Room

DECEMBER 29, 2022

If you can secure a return of 10% over that time, you’ll end the 20 years with $201,825. High-Yield Savings Accounts . Open a Health Savings Account (HSA) . Your investment into index funds is also entirely passive, meaning you can open a brokerage account, invest your $30,000, and leave it to grow and compound over time.

CFO News

MARCH 7, 2024

The article claimed that the Securities & Exchange Board of India (SEBI) had apparently "found a discrepancy of more than USD 240 million in the accounts of Zee Entertainment Enterprises Ltd" In response to a query, Aggarwal said no question of truth as a defence could arise as SEBI had not rendered any finding against ZEEL.

CFO News Room

FEBRUARY 6, 2022

However, this was later revised to Rs 98,000 crore on account of higher demand for the work. Finance Minister Nirmala Sitharaman had allocated Rs 73,000 crore for the Mahatma Gandhi National Rural Employment Guarantee Programme in last year’s budget too.

Navigator SAP

JULY 15, 2022

And securing these endpoint devices is a must. Your ERP platform should be able to unify different modules for different areas of the business, including payroll, bills of material, inventory, accounting, customer relationship management, supply chain management, and others, helping these different departments communicate. IoT support.

Future CFO

JULY 21, 2024

Given the advent of artificial intelligence and machine learning, the accounting profession faces challenges in talent as it continues to navigate its way around digitisation and shifts in the market. AI allows room for improvement like focusing on higher-level tasks and upskilling," he notes.

Barry Ritholtz

MAY 28, 2023

Binance customers shouldn’t “need a forensic accountant to find where their money is,” said John Reed Stark, a former chief of the Securities and Exchange Commission’s Office of Internet Enforcement. A world which is turning to its own Red-State-America-style demagogues and fanatics for a measure of security in a troubled world.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content