Private firms, not-for-profits reckon with CECL

CFO Dive

MARCH 18, 2024

Many not-for-profits and private companies are just beginning to grapple with the new rules for current expected credit loss accounting.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MARCH 18, 2024

Many not-for-profits and private companies are just beginning to grapple with the new rules for current expected credit loss accounting.

PYMNTS

AUGUST 11, 2020

With its losses mounting, the London-based digital bank may need to tap into its corporate reserves to keep up with its expansion plans. The company posted a total loss of $139.6 Revolut attributed the losses to its expansion into new markets and the introduction of new products. million (£106.5 million) in 2019 — up from £32.9

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO News

MARCH 18, 2025

If profits are overstated due to unreported losses, the entire financial picture is distorted, cant just look at the net worth, stated former ICAI President Amarjit Chopra.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Fpanda Club

JANUARY 23, 2025

Such tasks as reconciling accounts, monthly closing, preparing financial statements are part of the accounting cycle and are typically managed by accounting departments. This misunderstanding often leads them to make requests that are outside the FP&A scope, such as transactional accounting tasks or detailed data pulls.

Speaker: Debra L. Robinson

By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist. 📊 Profit & Loss and Balance Sheets decoded for max impact.

CFO Plans

MARCH 17, 2025

Flipping real estate properties is an enticing venture, promising substantial profits for those who master its intricacies. This includes employing detailed House Renovation Budget Tips, which not only help in setting a realistic budget but also ensure you stick to it, accounting for unexpected expenses with a contingency fund.

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). Missing a deadline isn’t just embarrassing; it can lead to penalties, delisting threats, or a loss of investor confidence.

Jedox Finance

OCTOBER 6, 2022

The profit and loss statement is one of the main parts of the annual statement that companies must prepare at the end of a financial year, along with the cash flow statement and accounting balance sheet. This article discusses influential factors, advantages, and common problems considering the profit and loss statement.

The Charity CFO

JANUARY 17, 2022

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. with this overview of nonprofit accounting basics. . What is nonprofit accounting? Investopedia defines accounting as “the process of recording financial transactions pertaining to a business.” .

Global Finance

MARCH 2, 2025

Weve got what we think is a rather exciting model, which we describe in a working paper, that helps forecast in advance the likelihood that a firm will go on to commit accounting fraud. But mostwell, allof the research into accounting fraud has focused on detection rather than prevention. Joanne Horton: Yes.

Musings on Markets

JANUARY 31, 2024

Since businesses invest that capital in their operations, generally, and in individual projects (or assets), specifically, the big question is whether they generate enough in profits to meet these hurdle rate requirements. While private businesses are often described as profit maximizers, the truth is that if they should be value maximizers.

PYMNTS

AUGUST 6, 2020

Adidas AG , the global sneaker maker, revealed losses of nearly $400 million in the second quarter (Q2) amid store closures to prevent the spread of the coronavirus. At the same time, Adidas suffered an operating loss of 333 million euros ($394 million). billion euros ($4.3 billion) in the quarter.

CFO Talks

NOVEMBER 29, 2024

Notably, she reversed a decade-long loss at Coca-Cola, doubled profits, and restructured major funding. Accountability is another key component. The AFE lays out clear lines of responsibility, documenting who approved what and ensuring departments are held accountable for financial decisions.

CFO Talks

FEBRUARY 27, 2025

It means making decisions based on what is right rather than what is easy or profitable in the short term. This means leading by example, ensuring policies reflect ethical principles, and holding everyone accountable to high moral standards. b) Accountability Good leaders take responsibility for their actions.

CFO News Room

DECEMBER 10, 2022

What Types of Accounts are Best for Compounding? Banks Savings Accounts. Most savings accounts, money market accounts, and certificates of deposit earn compound interest. Taxable vs. tax-deferred vs. tax-free accounts. It’s also possible to take advantage of tax-free accounts. 3) Money Market Accounts.

The Charity CFO

FEBRUARY 25, 2022

If you’re brand new to nonprofit accounting, the Chart of Accounts might be the best place to start. Because even if you only have one bank account, bill, investment, or expense, you’ll need one. What is a Chart of Accounts? How to Organize a Nonprofit Chart of Accounts . Account Description.

CFO Talks

NOVEMBER 25, 2024

It’s when you’re forced to weigh conflicting priorities—profit versus integrity, loyalty versus legality, or personal values versus organisational goals. What’s at Stake: Misrepresentation might boost short-term results but exposes the company to legal liabilities, loss of investor confidence, and reputational harm.

CFO Talks

FEBRUARY 11, 2025

At its heart, corporate governance is built on four key principles: accountability, transparency, fairness, and responsibility. Accountability: Leaders Must Answer for Their Decisions One of the most important aspects of good governance is accountability. A famous example of poor transparency is the Enron scandal of 2001.

PYMNTS

DECEMBER 9, 2020

That would come on the heels of revenue growth in its most recently reported results, through August of this year, where revenues were up 180 percent but losses tripled. million pounds, but losses were 106.5 Starling said in its recent accounts update that it has 1.8 million pounds.

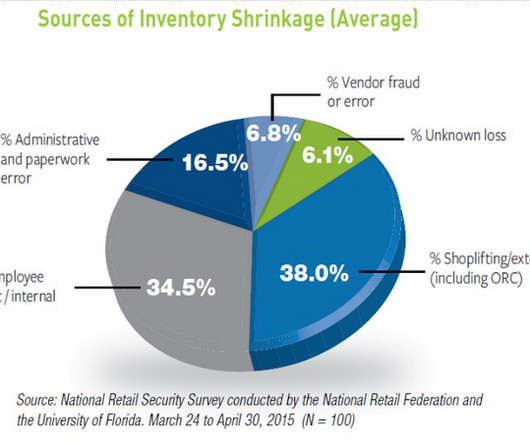

Barry Ritholtz

DECEMBER 11, 2023

billion in retail inventory losses in 2021 was not “attributable to organized retail crime.” retailers retracted its claim that “organized retail crime” accounted for nearly half of all inventory losses in 2021 after finding that incorrect data was used for its analysis.” No, “ nearly half ” of $94.5

The Finance Weekly

JANUARY 13, 2025

Return on Equity (ROE) is one of those go-to metrics that financial leaders and investors love to use when figuring out how well a company turns shareholders' equity into profits. At its core, ROE measures how efficiently a company uses its net assets (shareholders' equity) to generate profit. What Is Return on Equity (ROE)?

The Charity CFO

JANUARY 13, 2022

But accounting for in-kind donations presents its own unique challenges. In this article, we’ll dig into how to account for in-kind donations on your nonprofit’s books. Why accounting for in-kind donations matters. Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. .

The SaaS CFO

APRIL 5, 2022

I talk about the SaaS P&L (profit and loss statement) almost every week with SaaS founders, finance, and accounting teams. The SaaS P&L is critical to the management of your SaaS business. At this point, I’ve reviewed hundreds of SaaS P&Ls (also called an income statement).

Future CFO

MARCH 3, 2025

By 2025, the traditional image of number-crunching accountants confined to back offices will be a relic of the past. CFOs, controllers, and management accountants must embrace agility and foresight to thrive in this dynamic environment. This doesn't necessarily translate to job losses, but rather a shift in required skills.

CFO Thought Leader

OCTOBER 29, 2024

The company operated two businesses: one generating about $30 million in EBITDA, while the other incurred annual losses of roughly $10 million. Gronen proposed a strategy to merge the two operations, consolidating efforts to increase profitability. Gronen: Yooz is an AP (accounts payable) automation and payments company.

CFO News Room

NOVEMBER 7, 2022

billion to account for the deal. Berkshire Hathaway — Shares of Warren Buffett’s conglomerate rose more than 1% after the company posted a 20% increase in operating profits during the third quarter. billion loss on its investments during the third quarter’s market turmoil, however. health-care business to $14.5

CSC Advisors

DECEMBER 17, 2024

Profitability While not all businesses applying for SBA loans must be highly profitable, they must demonstrate the ability to repay the loan. This reassures lenders that they have a way to recover losses in case of default. Pay down debt, address outstanding delinquencies, and ensure all accounts are in good standing.

PYMNTS

JULY 28, 2020

bank profits are at double the risk for loan losses than their European counterparts, according to the Financial Times on Tuesday (July 28). According to consultants with Accenture , European banks are already preparing to follow American ones in massive second-quarter loan loss reporting related to the pandemic. Swiss and E.U.

PYMNTS

FEBRUARY 18, 2019

However, Uber’s revenue increased only 2 percent between Q3 and Q4, reaching $3 billion, a 24 percent increase over the previous year — leading some investors to question the ridesharing firm’s future prospects for profitability. Losses came in at $1.8 billion in losses reported at the same time in 2017. Scooter Battles.

PYMNTS

AUGUST 9, 2020

A Singapore businessman faces charges of falsifying documents that showed more than 100 million euros ($118 million) in three accounts held on behalf of Wirecard AG, The Wall Street Journal (WSJ) reported. Investigators said three escrow accounts purportedly held 143.4 million euros ($169.5 million) at the close of 2015. million).

CFO Simplified

FEBRUARY 17, 2022

But understanding your company’s profitability is critical to making the right decisions. The business’ part-time CFO was providing financials that didn’t match the reports they received from their accountant. Some months had huge profits, which alternated with other months containing huge losses. Initial contact –.

Capital CFO LLC

APRIL 4, 2023

As a business owner, you may have heard various accounting terms thrown around, such as balance sheet, cash flow, and profit and loss statement. However, it is essential to have […] The post Accounting Terms 101: A Beginners Guide for Business Owners appeared first on Capital CFO+.

CFO News Room

NOVEMBER 23, 2022

This provided great grounding, he says, particularly in financial accounting. He joined oil and gas company BG Group in their budgeting and forecasting team to broaden his management accounting and reporting experience. This meant everyone felt empowered to make the appropriate decisions to drive the company’s profitability”. “By

PYMNTS

MAY 22, 2020

A large share of the banking sectors of nine advanced economies, by assets, may not be able to bring in profits higher than their cost of equity in 2025, according to a simulation exercise cited in the “Global Financial Stability Report” by the International Monetary Fund (IMF).

PYMNTS

SEPTEMBER 29, 2020

After Wirecard filed for bankruptcy protection in June, KfW sold the loan to a distressed-debt investor and took an undisclosed loss. Also last month, three of the biggest lenders to the one-time FinTech leader have declared losses. Credit Agricole , the French financial institution, suffered a loss of about 110 million euros ($130.6

CFO Simplified

SEPTEMBER 11, 2022

There are two different ways of performing accounting functions in your business: One is on a cash basis, and the other is on an accrual basis. More often than not, your tax accountant is doing your taxes on a cash basis. Why should you use accrual basis accounting for your business? Cash Basis Accounting. Let’s dive in.

PYMNTS

APRIL 8, 2019

Yet, once a company starts to churn a profit, business owners rarely consider their strategy of an eventual exit or sale. However, the two most critical pieces of information buyers need include a verification of revenue and a profit and loss (P&L) statement. Cloud Accounting, Data Sharing.

CFO Share

MAY 22, 2024

This guide will provide you with financial reporting help and actionable steps to get accounting back in order and working for you. Check out our blog for other accounting tips that help you avoid losses and missed opportunities. Like compound interest on a loan, accounting errors grow and become more complex over time.

PYMNTS

FEBRUARY 17, 2020

The bank is also preparing to try charging customers again to turn a profit. Monzo, a loss-making firm launched in 2015, has burned through cash in its attempt to grow and eventually launch in the U.S. There was also the attempted rollout of a premium paid-for account last September, abruptly canceled after just a few months.

CFO Share

FEBRUARY 22, 2024

Undercapitalization Businesses are undercapitalized when their resources are insufficient to sustain operations, often due to excessive debt, a failure to account for business seasonality or cyclicality, or owners drawing too heavily from the business. Build a reserve fund to cushion against seasonal dips and unexpected downturns.

CFO News

MARCH 30, 2025

The Reserve Bank of India (RBI) allowed lenders (on Saturday) across the spectrum and ownership types to reverse excess provisions in their profit and loss (P&L) accounts if a loan is transferred to an asset reconstruction company (ARC) at a value exceeding its net book value.

CFO News Room

FEBRUARY 4, 2022

Because the rules that govern financial and tax accounting differ, temporary differences arise between the two sets of books. This can result in deferred tax liability , when the amount of tax due according to tax accounting is lower than that according to financial accounting. Source link.

CFO Share

JULY 20, 2021

What does a Forensic Accountant Do? Is your small business not making as much profit as you expect? Are you earning profits but always falling short on cash? Since internal accountants are the most likely employee to be stealing from the company, businesses rely on forensic accounting consultants to investigate potential fraud.

CFO Share

NOVEMBER 18, 2023

To most small business owners, accounting best practices feel like an annoyance and distraction. However, common mistakes can create an accounting mess and impede growth. Solution : Accounting best practices require financials to close by the 15 th each month. If you do not know what that means, you are likely a culprit.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content