SEC accepts crypto update to GAAP taxonomy

CFO Dive

AUGUST 17, 2022

The accounting changes come as crypto-asset valuations have taken a beating and drawn increasing regulatory scrutiny.

CFO Dive

AUGUST 17, 2022

The accounting changes come as crypto-asset valuations have taken a beating and drawn increasing regulatory scrutiny.

Global Finance

MARCH 2, 2025

Weve got what we think is a rather exciting model, which we describe in a working paper, that helps forecast in advance the likelihood that a firm will go on to commit accounting fraud. But mostwell, allof the research into accounting fraud has focused on detection rather than prevention. Joanne Horton: Yes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022.

E78 Partners

MARCH 3, 2025

Strong public market valuations in key sectorsespecially technology and healthcareare attracting growth-driven businesses. Non-GAAP Measures and Key Performance Indicators (KPIs) Non-GAAP financial measures and KPIs play a crucial role in shaping investor perceptions and demonstrating a companys value proposition.

Bramasol

JUNE 10, 2022

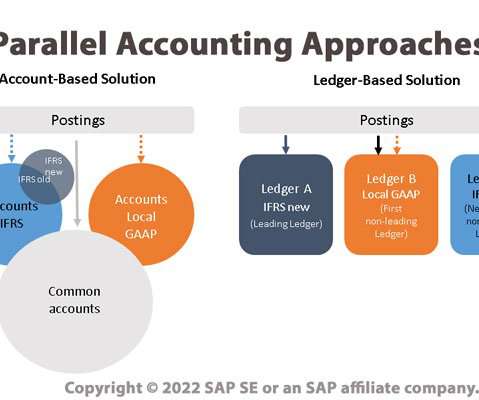

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

Musings on Markets

OCTOBER 6, 2023

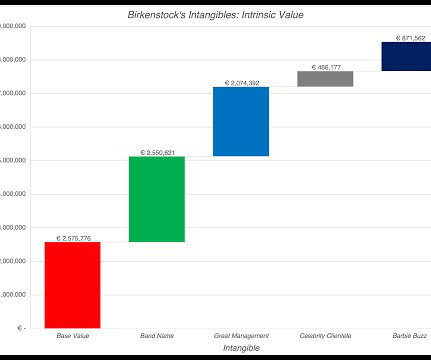

The Value of Intangible Assets Accounting has historically done a poor job dealing with intangible assets, and as the economy has transitioned away from a manufacturing-dominated twentieth century to the technology and services focused economy of the twenty first century, that failure has become more apparent.

The Charity CFO

FEBRUARY 2, 2022

In fact, as a nonprofit organization, the expectations for transparency and accountability are higher than those for for-profit businesses. It’s a tool for ensuring transparency, disclosure, and accountability to the public. Full accounting of income, expenses, and donors. Why do nonprofits need to file Form 990? Full Form 990.

Let's personalize your content