FASB backs off bigger software accounting revamp

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

OCTOBER 29, 2024

In June the FASB voted 7-0 for the more targeted update, even as some expressed concerns about not going far enough to modernize GAAP rules.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

CFO Dive

JUNE 5, 2024

Despite a unanimous vote, some board members expressed concern the proposed improvements to GAAP hedging guidance do not go far enough.

CFO Dive

JUNE 13, 2024

Like crypto rules FASB recently finalized, the environmental credit accounting standards would provide specific guidance where GAAP is currently silent.

CFO Dive

NOVEMBER 27, 2024

The new GAAP guidance stems from a request made by Big Four accounting firms and comes as the convertible bond market is regaining steam.

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

CFO Dive

APRIL 5, 2024

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

CFO Dive

AUGUST 17, 2022

The accounting changes come as crypto-asset valuations have taken a beating and drawn increasing regulatory scrutiny.

PYMNTS

AUGUST 7, 2017

When it comes to earnings, a bit of accounting can make all the difference. The key element deserving of scrutiny here, the Times pointed out, comes with the way PayPal — and, to be fair, other tech companies — account for employee stock-based compensation. The implication here is that doing so would lower corporate profits.

Cube Software

APRIL 3, 2025

The consolidation process typically includes aggregating financial results, eliminating intercompany transactions, handling currency conversions, and ensuring compliance with accounting standards like the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles GAAP.

CFA Institute

MARCH 5, 2021

You can find significant alpha in the mechanics that drive GAAP accounting.

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. Get the free guide!

The Charity CFO

JANUARY 21, 2022

And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face. This accounting system is called fund accounting. This accounting system is called fund accounting. Who’s Required to Use Fund Accounting? .

E78 Partners

NOVEMBER 19, 2024

Navigating Impairment Analyses and Accounting for Complex Transactions Impairment testing for intangible assets and goodwill, and accounting for complex transactions such as debt refinancings and business combinations, can be among the most challenging aspects of audit readiness.

Global Finance

MARCH 2, 2025

Weve got what we think is a rather exciting model, which we describe in a working paper, that helps forecast in advance the likelihood that a firm will go on to commit accounting fraud. But mostwell, allof the research into accounting fraud has focused on detection rather than prevention. Joanne Horton: Yes.

The Charity CFO

APRIL 5, 2022

If you’re like many people, you probably think that there is a single set of accounting rules that every company must follow. . But that’s not quite true—nonprofits face a decision between 2 different accounting methods for tracking their financial activity: cash accounting vs. accrual accounting.

The Charity CFO

JANUARY 17, 2022

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. with this overview of nonprofit accounting basics. . What is nonprofit accounting? Investopedia defines accounting as “the process of recording financial transactions pertaining to a business.” .

The Charity CFO

FEBRUARY 25, 2022

If you’re brand new to nonprofit accounting, the Chart of Accounts might be the best place to start. Because even if you only have one bank account, bill, investment, or expense, you’ll need one. What is a Chart of Accounts? How to Organize a Nonprofit Chart of Accounts . Account Description.

The Charity CFO

JANUARY 13, 2022

But accounting for in-kind donations presents its own unique challenges. In this article, we’ll dig into how to account for in-kind donations on your nonprofit’s books. Why accounting for in-kind donations matters. Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. .

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

Choosing the right accounting software is important. Financial governance allows your organization to meet compliance requirements, such as IFRS and GAAP updates, by having the right financial controls in place. However, there are exceptional cloud accounting software programs that can take that complexity and make it simple.

E78 Partners

MARCH 3, 2025

Non-GAAP Measures and Key Performance Indicators (KPIs) Non-GAAP financial measures and KPIs play a crucial role in shaping investor perceptions and demonstrating a companys value proposition. Common non-GAAP metrics include EBITDA, adjusted EBITDA, free cash flow, and revenue growth metrics.

E78 Partners

NOVEMBER 12, 2024

Start with high-priority items like accounts receivable (A/R) aging, inventory details, and accrued liabilities—elements that form the basis of early audit steps. Staying compliant with the latest industry regulations—whether related to ASC 606, ASC 842, or other GAAP standards—is crucial for audit success.

Bramasol

JULY 31, 2023

This new post provides a deeper look at how the leasing of medical equipment along with other bundled services or products presents particular challenges for meshing contracts and lessor accounting with DSE management and revenue recognition. According to Allied Market Research, "The global medical equipment rental market was valued at $56.0

Bramasol

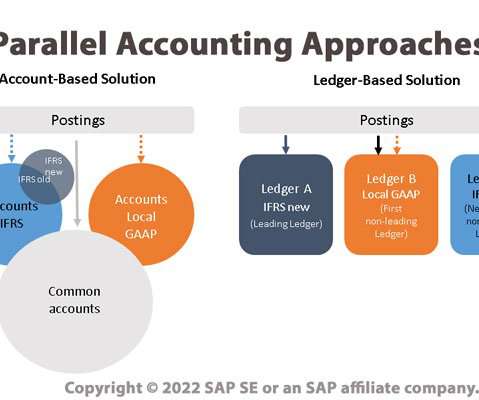

JUNE 10, 2022

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

The Charity CFO

OCTOBER 9, 2024

One of the most sought-after tools is a platform or software to integrate your fundraising and accounting data seamlessly. This makes it challenging to create technology that tracks data for fundraising purposes while still following accounting principles. So why does it seem so hard to find this unicorn platform?

CFO Leadership

OCTOBER 10, 2023

AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals. However, they still have a place in corporate finance and accounting.

The Charity CFO

DECEMBER 30, 2021

Don't hire the wrong accountant for your nonprofit! The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. Get the free guide! What is a nonprofit financial audit? .

CFO Selections

AUGUST 28, 2024

By proactively preparing for GAAP changes, CFOs can position their business for success. As a CFO or Controller, staying at the forefront of accounting best practices and standards is crucial for maintaining financial integrity , advancing innovation in accounting, and ensuring compliance.

PYMNTS

JUNE 10, 2019

Certified Professional Accountants (CPAs) in California are calling on an industry watchdog to clarify standards for cryptocurrency accounting, with expectations that corporations will increase their use of cryptocurrencies moving forward. GAAP,” the letter stated.

The Charity CFO

JANUARY 22, 2025

Financial Management Moving from basic bookkeeping to GAAP-compliant accounting became necessary as the organization grew. About The Charity CFO We are an accounting partner that truly understands nonprofits. If you need help with your accounting and bookkeeping, lets talk. Book a FREE consultation here.

The Charity CFO

MARCH 13, 2023

Fundraising ideas will impact your accounting When raising money through fundraising, you need to consider how this affects your nonprofit’s accounting. The way revenue and expenses are recorded can differ for GAAP purposes and tax purposes ( Form 990 ). It will not be reported on Form 990.

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations.

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP. Indirect materials and supplies (such as???).

Future CFO

DECEMBER 31, 2021

What does this mean to the finance and accounting team of 2022? Increasingly more Finance & Accounting (F&A) functions will adopt a hybrid work model in which CFOs provide the tools to finance staff to productively work from anywhere. CFOs are the logical candidate to lead the ESG initiative.

https://trustedcfosolutions.com/feed/

JUNE 2, 2022

In that case, you may be looking for more powerful real-time accounting solutions to provide you with a better view of your entire operation and help with things like taxation, HR, multiple currencies, and more. Secure access to your key data from anywhere, at any time, because your accounting solution is cloud-based.

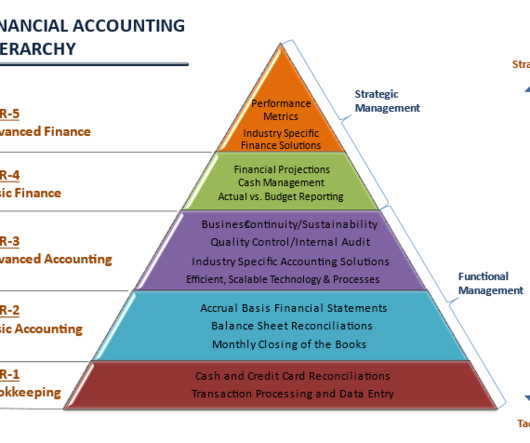

Boston Startup CFO

APRIL 3, 2023

Financial accounting: A topic that can easily disorient even the most driven entrepreneurs. Fortunately, we present you with a compass – a diagram that demystifies the functions of financial accounting. In this tier, a double-entry accounting system is employed to ensure the accurate recording of all transactions.

https://trustedcfosolutions.com/feed/

SEPTEMBER 15, 2022

As your business grows, your accounting solution should scale and grow with you, but this isn’t the case with older, outdated software. Spreadsheets can only tell you so much at a glance and cannot address complex accounting issues. If your accounting system can’t keep up, it’s time for a change. Lack of Financial Visibility.

The Charity CFO

NOVEMBER 10, 2022

What should you look for when evaluating nonprofit accounting services? Yes, they might have a board member or volunteer who takes care of the finances, but they often lack specific expertise in nonprofit accounting. Benefits of Nonprofit Accounting Services. Nonprofit organizations exist to further a mission or goal.

Proformative

SEPTEMBER 16, 2022

The company that I work for was just acquired by a private equity firm. The comp.

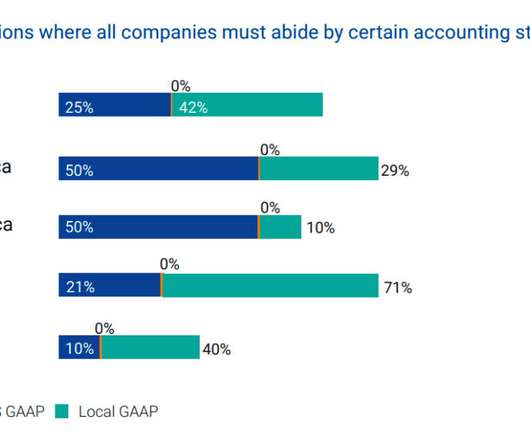

Future CFO

OCTOBER 27, 2020

New report Accounting & tax: the global and local complexities holding multinationals to account analyses and ranks 77 jurisdictions based on the complexity of their accounting and tax laws and practices. Source: TMF 2020.

The Charity CFO

JULY 12, 2024

The type of accounting your organization uses could be holding you back from getting the most out of your accounting system. While many nonprofits start with cash-basis accounting due to its simplicity, this method often falls short of providing a comprehensive view of a nonprofit’s financial health.

The Charity CFO

JULY 19, 2024

When most people think of an organization’s financial department, they think of accountants. Bookkeepers, accountants, and Chief Financial Officers (CFOs) all serve critical roles in managing an organization’s finances. What is an Accountant? Accountants run reports to help determine if the bookkeeping is done correctly.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content