FASB to borrow from international rules for government grants

CFO Dive

APRIL 5, 2024

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

APRIL 5, 2024

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Global Finance

MARCH 2, 2025

Weve got what we think is a rather exciting model, which we describe in a working paper, that helps forecast in advance the likelihood that a firm will go on to commit accounting fraud. But mostwell, allof the research into accounting fraud has focused on detection rather than prevention. Joanne Horton: Yes.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

E78 Partners

MARCH 3, 2025

Despite these favorable conditions, successful IPOs require meticulous preparation, robust financial reporting, and a governance framework that instills investor confidence. Companies must ensure they are operationally, financially, and strategically ready for the transition to public markets.

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. But the deadline for making the changes has passed, and the FINAL deadline (for interim reporting periods) is coming up next month.

The Charity CFO

JANUARY 21, 2022

And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face. This accounting system is called fund accounting. This accounting system is called fund accounting. Who’s Required to Use Fund Accounting? .

The Charity CFO

APRIL 5, 2022

If you’re like many people, you probably think that there is a single set of accounting rules that every company must follow. . But that’s not quite true—nonprofits face a decision between 2 different accounting methods for tracking their financial activity: cash accounting vs. accrual accounting.

The Charity CFO

JANUARY 17, 2022

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. So you can understand what’s happening in your business and communicate effectively with your board members, donors, and financial team. with this overview of nonprofit accounting basics. . It’s a necessity.

E78 Partners

NOVEMBER 12, 2024

By proactively managing your “prepared by client” (PBC) list, you can structure documentation to align with audit testing phases – as mentioned in our previous post , preparing for a financial audit. This timeline should account for potential delays and include contingency plans in high-risk areas.

The Charity CFO

FEBRUARY 25, 2022

If you’re brand new to nonprofit accounting, the Chart of Accounts might be the best place to start. Because even if you only have one bank account, bill, investment, or expense, you’ll need one. What is a Chart of Accounts? How to Organize a Nonprofit Chart of Accounts . Account Description.

The Charity CFO

OCTOBER 9, 2024

One of the most sought-after tools is a platform or software to integrate your fundraising and accounting data seamlessly. This makes it challenging to create technology that tracks data for fundraising purposes while still following accounting principles. So why does it seem so hard to find this unicorn platform?

CFO Share

JUNE 27, 2024

How a CFO Ensures Compliance in Financial Reporting Reliable financial statements are crucial for business management, but ensuring compliance may feel like a luxury in the resource-constrained world of small business. How can a small business ensure compliance in reporting without overspending on accounting staff and audits?

CFO Leadership

OCTOBER 10, 2023

AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals. However, they still have a place in corporate finance and accounting.

The Charity CFO

JANUARY 22, 2025

Financial Management Moving from basic bookkeeping to GAAP-compliant accounting became necessary as the organization grew. Blackwell is now focused on developing more sophisticated financial management skills. About The Charity CFO We are an accounting partner that truly understands nonprofits. Get the free guide!

The Charity CFO

DECEMBER 30, 2021

Don't hire the wrong accountant for your nonprofit! The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. What is a nonprofit financial audit? .

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP. Indirect materials and supplies (such as???).

CFA Institute

DECEMBER 29, 2020

The explanatory power of the financial information reported to investors for market valuation has plummeted in recent decades.

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations.

The Charity CFO

MARCH 13, 2023

Fundraising ideas will impact your accounting When raising money through fundraising, you need to consider how this affects your nonprofit’s accounting. The way revenue and expenses are recorded can differ for GAAP purposes and tax purposes ( Form 990 ). It will not be reported on Form 990. Get the free guide!

PYMNTS

JUNE 10, 2019

Certified Professional Accountants (CPAs) in California are calling on an industry watchdog to clarify standards for cryptocurrency accounting, with expectations that corporations will increase their use of cryptocurrencies moving forward. GAAP,” the letter stated.

Future CFO

DECEMBER 31, 2021

In response, 82% of CFOs report that investments in digital are accelerating faster than in other areas, including talent, supply chain, business services or fixed assets. What does this mean to the finance and accounting team of 2022? CFOs are the logical candidate to lead the ESG initiative.

The Charity CFO

NOVEMBER 10, 2022

What should you look for when evaluating nonprofit accounting services? Yes, they might have a board member or volunteer who takes care of the finances, but they often lack specific expertise in nonprofit accounting. Sound financial management helps avoid jeopardizing tax-exempt status and the success of your operation. .

Spreadym

AUGUST 10, 2023

When choosing the best financial reporting software solution, it's important to consider factors such as ease of use, scalability, integration with existing systems, compliance with accounting standards, cost, customer support, and any unique requirements your organization might have. What is financial reporting software?

The Charity CFO

JULY 12, 2024

The type of accounting your organization uses could be holding you back from getting the most out of your accounting system. While many nonprofits start with cash-basis accounting due to its simplicity, this method often falls short of providing a comprehensive view of a nonprofit’s financial health.

Bramasol

MAY 13, 2024

Overview of the PCAOB and AICPA The Public Company Accounting Oversight Board (PCAOB) is a regulatory body established by the Sarbanes-Oxley Act of 2002 in response to corporate accounting scandals like Enron and WorldCom.

The Charity CFO

JULY 19, 2024

When most people think of an organization’s financial department, they think of accountants. But did you know there are a variety of financial professionals that are essential to the financial well-being of an organization? What is an Accountant?

The Charity CFO

FEBRUARY 4, 2022

Do a Google search on nonprofit bookkeeping, and you’ll find page after page of articles on nonprofit accounting. Because while nonprofit bookkeeping and accounting are related, they’re not the same thing. A bookkeeper records and organizes financial data; an accountant interprets and presents that data. .

The Charity CFO

AUGUST 15, 2023

Myths of Nonprofit Accounting and Why They Matter to Job Seekers Unfortunately, many job seekers fall victim to the stereotypes and believe the myths surrounding nonprofit accounting. In this section, we will debunk the three most common nonprofit accounting myths. Ready to dive deep into this exciting realm?

Planful

SEPTEMBER 6, 2021

In an ideal world, financial reports should build shareholder trust by offering accurate data about the performance of the company. In reality, a company’s financial report can be more flimsy—involving estimates and judgment from leadership that’s far from the truth. at its peak to $0.26

PYMNTS

DECEMBER 16, 2016

A key part of business life is getting the books closed on time, with clean financial reporting that allows a high-level and granular view of what needs to be done next. The optimization of the accounting process, he said, is difficult at times with limited staff.

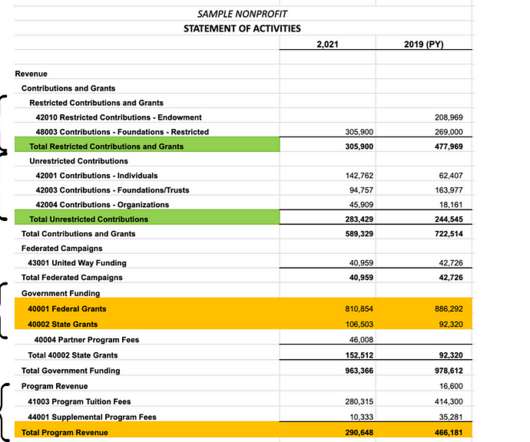

The Charity CFO

JANUARY 31, 2022

Like all nonprofit financial statements , the central role of the Statement of Activities is to provide transparency and accountability to your donors and board. If you use cash-based accounting, you’ll only record cash deposited into your bank during the reporting period. . What’s on the Statement of Activities? .

CFO Talks

SEPTEMBER 5, 2024

Whether it’s streamlining financial reporting, enhancing data accuracy, or ensuring compliance with South African regulatory standards, clearly defining these objectives will guide the entire design process. Choosing the Right Software and Technology Selecting the appropriate financial software is a critical decision.

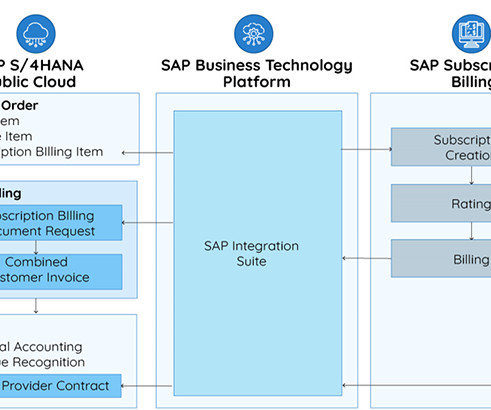

Bramasol

JULY 26, 2024

As the SAP partner with the most revenue recognition implementations and deepest involvement in the ongoing refinement of solutions such as SAP Revenue Accounting and Reporting (RAR) and Automated Revenue Management solutions, Bramasol can help you navigate the most complex RevRec scenarios.

The Charity CFO

JANUARY 5, 2022

For example, “salary” is a straightforward line-item on a for-profit financial report. . To complete your IRS 990, you’ll need to report your expenses based on how they fall within 3 categories, they are: . Don't hire the wrong accountant for your nonprofit! But what is a function, anyway? Get the free guide!

The Charity CFO

JANUARY 11, 2023

All these sources must be carefully managed to ensure compliance with Generally Accepted Accounting Principles (GAAP) and guidelines. Revenue recognition is an accounting process of properly identifying when income has been earned. Your organization’s accounting method really impacts the timing of recognizing transactions.

Centage

DECEMBER 7, 2022

Once configured, Planning Maestro pulls all dimensions from QuickBooks – pulling in data at not only the account level, but at the class level as well. Automate Key Reports. In a matter of minutes, users will have a detailed budget to actual variance report right within Planning Maestro. Want to see it in action?

Future CFO

JUNE 4, 2024

launched its Financial Reporting Analytics solution, which will be sold as an SAP Solution Extension under the name SAP Account Substantiation and Automation by BlackLine, financial review option. SAP Account Substantiation and Automation by BlackLine, financial review option, is sold and supported by SAP.

The Finance Weekly

MARCH 25, 2024

His main job is to handle all money matters at SoFi, like planning, accounting, and dealing with investors. His main gigs included handling all the financial operations like accounting and financial planning, crafting financial strategies to boost the business, and managing relationships with investors and banks.

Future CFO

APRIL 18, 2022

Click on the link to download to discover in detail a list of the benefits that IBM Cognos Controller provide for finance teams: Data collection and validation Reconciliations Workflow and tasks to improve the close cycle Currency conversion Minority interest calculations Inter-company eliminations Group closing adjustments Management adjustments Allocations (..)

Planful

JUNE 22, 2017

Financial Consolidation in the Accounting World. But in the accounting world, “financial consolidation” is a well-defined process that includes several complexities and accounting principles. Here are the key accounting consolidation steps in the finance consolidation process : Collecting trial balance data (e.g.,

CFO Leadership

OCTOBER 18, 2023

AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals. However, they still have a place in corporate finance and accounting.

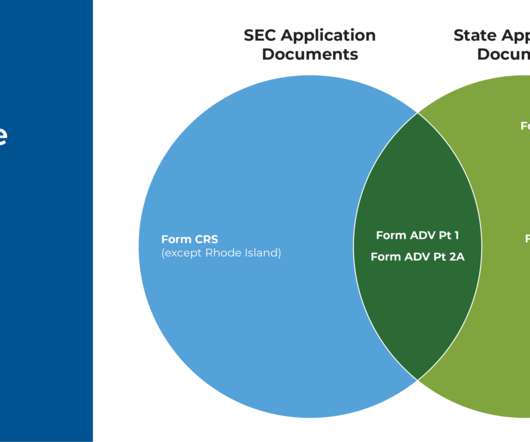

CFO News Room

NOVEMBER 2, 2022

Though Section 203(c)(1)(D) of the Advisers Act contemplates the possible adoption of a rule that requires the submission of a balance sheet certified by an independent public accountant and “other financial statements,” the SEC has to-date not adopted such a rule. RIA Fee Itemization And Surprise Custody Audits.

The Charity CFO

JANUARY 5, 2023

Maintaining healthy financial management is critical for the organization’s sustainability, stability, and flexibility, now and in the future. Poor financial reporting. They should clarify the roles, authority, and responsibilities for essential financial management activities and decisions. . Timely reporting.

VCFO

NOVEMBER 1, 2023

These actions might include: A blitz on collection of past due receivables to reduce cash tied up in past due accounts, reduce bad debt exposure and improve DSO (days sales outstanding – a metric often scrutinized by lenders). Read more in our blog about Lease Accounting Updates.) audited or reviewed financial statements).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content