Weekend Reading For Financial Planners (December 16-17)

Nerd's Eye View

DECEMBER 15, 2023

Also in industry news this week: Most businesses that operate in the U.S., Also in industry news this week: Most businesses that operate in the U.S.,

Nerd's Eye View

DECEMBER 15, 2023

Also in industry news this week: Most businesses that operate in the U.S., Also in industry news this week: Most businesses that operate in the U.S.,

CFO News Room

NOVEMBER 21, 2022

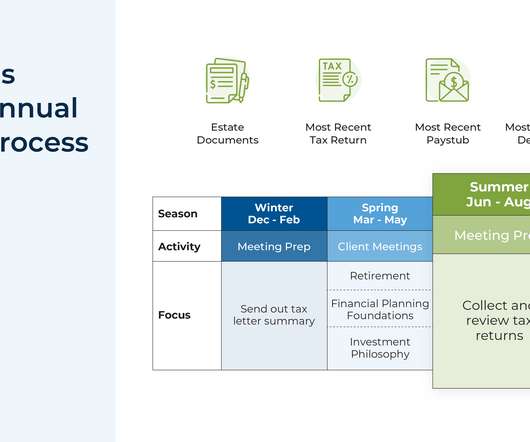

As such, client meeting seasons are held in both the spring (March through May) and the fall (September through November), with most meetings currently concentrated in April and October. Our process is thoughtfully planned around tax deadlines and includes meetings with our clients twice per year. software changes). When Clients Can’t Meet.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO News Room

NOVEMBER 28, 2022

Along with designing a client’s asset allocation , optimizing asset location is another way advisors can add value as putting different investments in taxable versus tax-deferred accounts can have a significant impact on after-tax returns. Retirement Planning.

VCFO

NOVEMBER 4, 2022

This article was co-authored by Ashford Chancelor , Dallas Practice Manager & Consulting CFO with vcfo, and Paul Hagerty , Sr. Accounts Receivables, however, often include a mix of relatively liquid and illiquid assets depending on payment terms, agreements, and other factors. What a time to be alive and in business.

CFO News Room

NOVEMBER 29, 2022

For the most part, we also have, out of those 195, a lot of those are also some legacy clients that have been around for a very long time, that maybe have brokerage accounts that are no longer advisory, right, so, but I am including that in there. Or how do we work around a concentrated stock position, right?

Let's personalize your content