Accounts payable: Why CFOs should pay attention

CFO Dive

APRIL 18, 2022

Over one-third of your invoices have errors, and costs to process these may be up to ten times greater than a "clean" invoice.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

APRIL 18, 2022

Over one-third of your invoices have errors, and costs to process these may be up to ten times greater than a "clean" invoice.

CFO Dive

MAY 26, 2023

Leveraging intelligent automation to process invoices can help, Steven Cronin writes. CFOs are under growing pressure to drive efficiencies at zero cost.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Future CFO

FEBRUARY 2, 2025

E-invoicing mandate and ESG compliance add further complexity dimensions to the priorities and challenges faced by the Office of the CFO. E-invoicing mandate and ESG Reporting add further complexity dimensions to the priorities and challenges faced by the Office of the CFO.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Navigator SAP

MARCH 18, 2024

In this video demonstration, we'll show you the difference between the traditional, manual way of processing invoices in SAP and the power of automating this process using SAP Business Technology Platform (BTP). Get ready to see how SAP AP Automation can transform your Accounts Payable department, boosting efficiency and accuracy!

Speaker: Danny Gassaway and Wayne Richards

Join Wayne Richards and Danny Gassaway for a practical guide on bringing accounts payable (AP) automation to your organization. 💡 Streamline the Purchase-to-Pay Process: Learn how automation simplifies approvals, invoice management, and payment processing.

https://trustedcfosolutions.com/feed/

MARCH 22, 2023

Are you tired of the countless hours spent managing your accounts payable (AP)? Do you want to streamline your accounting process to save the time and money spent on manual tasks on Quickbooks? With a growing business, it’s easy to outgrow the accounting systems you’ve relied on since the conception of your company.

PYMNTS

SEPTEMBER 22, 2020

To automate the transformation of machine-readable PDFs to digital invoices, Basware has rolled out SmartPDF AI in the newest expansion of its SmartPDF offering. The tool uses information taken from past invoices through a cutting-edge machine learning (ML) model, according to a Tuesday (Sept. 22) announcement.

PYMNTS

JULY 3, 2020

Accounts payable (AP) teams and other financial functions of the enterprise were some of the hardest hit by the disruption caused by the global pandemic. “Companies are increasingly looking to more efficiently manage the accounts payable process,” he said.

PYMNTS

DECEMBER 13, 2020

Paymerang , which works in accounts payable (AP) automation, has debuted its new Invoice Automation Solution, which a press release stated will help organizations with efficiency, accuracy, visibility and getting rid of manual paper processes.

PYMNTS

DECEMBER 10, 2020

Increasingly, FinTechs and the businesses they serve are pulling double duty with solutions that tackle both accounts receivable and accounts payable friction for each end of the B2B transaction. Digitizing and modernizing B2B payments cannot be a one-sided effort. Wells Fargo, Bill.com Pull Double Duty With Partnership.

PYMNTS

MARCH 18, 2020

Employing accounts payable (AP) automation solutions can help smooth onboarding and streamline the data collection and analyzing processes, removing the many friction points that are prone to legacy systems. Automated services could cut an average of 40 days from their invoice processing time.

PYMNTS

DECEMBER 3, 2020

Intelligent automation supplier Kofax has announced new innovations for its invoice and accounts payable (AP) solutions, according to a press release. That, according to Kofax, shows a focus among business leaders on using more automation to boost operational efficiency, according to the release.

CFO Plans

OCTOBER 29, 2024

This article explores effective strategies for accounts receivable and payable management, offering actionable insights to enhance financial stability and promote growth. Improving Liquidity through Accounts Receivable Efficiency Optimizing accounts receivable efficiency is crucial for improving liquidity.

CFO Share

DECEMBER 14, 2022

What is accounts payable ? What is accounts payable? Accounts payable is short-term obligations (aka bills) due to vendors for services or goods received. AP statements are a standard report out of all accounting systems. What are examples of accounts payable? Accounts Payable Tools.

PYMNTS

OCTOBER 6, 2020

The pandemic has upended supply chains, and upended accounts payable (AP) processes – requiring companies of all sizes and types to move toward digital (and high-tech-powered) means to transform back-office functions. The updates, the company said, will speed invoice processing by 10 times and cut processing costs by 80 percent.

PYMNTS

JULY 27, 2020

Although there are countless ways a cybercriminal can swindle funds from a company — either from the outside or within — it’s often the invoice at the center of the crime. This week’s Data Digest looks at the latest in B2B payments fraud and the invoice’s role in supplier payment redirect scams, credential theft and more.

Future CFO

JANUARY 26, 2024

Systems powered by artificial intelligence are without a doubt revolutionising invoice processing in finance departments. There are nine ways AI-powered systems can transform invoice processing in Accounts Payable (AP) departments.

PYMNTS

NOVEMBER 10, 2020

Accounts payable (AP) and payment automation provider AvidXchange has rolled out a connection with Concur® Invoice for vendor payments. Concur Invoice lets companies ingest and digitize invoices via machine learning, integrating the payments in one system to supervise expenditures. 10) announcement.

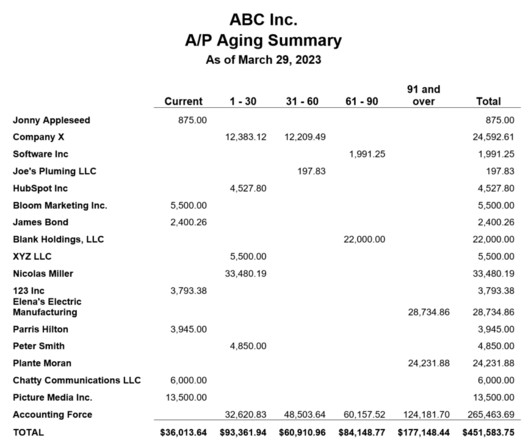

CFO Share

MARCH 31, 2023

The accounts payable aging (AP) report shows when and how much you owe vendors. Why is an Accounts Payable Report valuable? The AP aging report summarizes and totals vendors’ bills by age, easily allowing you to see how much you owe each vendor and how much total cash you would need to catch up on all invoices.

PYMNTS

NOVEMBER 25, 2020

Companies long-used to sending and receiving paper invoices and checks are finding that digital methods can deliver funds and billing information at a far faster clip. This could mean adopting new accounts payable (AP), accounts receivable (AR) and other treasury strategies and technologies, for example.

Future CFO

AUGUST 14, 2024

AP (Accounts Payable) automation empowers organisations to regain control over their finances by automating tedious manual tasks that burn through staff time, such as line-item matching for invoices, payment reviews, and approvals, Sanford says. "By

CFO Share

JULY 19, 2023

The biggest challenges facing accounts payable are chaos, maintenance cost, and fraud. Bring order to Accounts Payable. Accounts payable is a non-revenue-generating expense which best in class businesses minimize. Minimize fraud risk Accounts payable is the number one source of fraud in small businesses.

PYMNTS

MARCH 10, 2020

“In order to provide its customers with even better service, Cegid wanted to give them the opportunity to fully automate their supplier invoicing management processes. The integration with Esker provides all the functions necessary for reliable and efficient processing of supplier invoices,” the release said.

PYMNTS

DECEMBER 28, 2020

Nacha is issuing a warning to accounts payable professionals with regards to the rising threat of fraud. But accounts payable is far from the only back-office financial workflow at risk of fraud. The DOJ accuses the individual of fraudulently invoicing more than $1.5 Department of Justice revealed. 577,577.63

PYMNTS

DECEMBER 9, 2020

Bill.com and Wells Fargo are partnering on a new feature called Bill Manager to help small- to medium-sized businesses (SMBs) access automation for the accounts payable (AP) and accounts receivable (AR) process, according to a press release emailed to PYMNTS.

PYMNTS

APRIL 20, 2020

Finnish software firm Basware has announced an upgrade of its accounts payable (AP) automation solution to allow increased functionality for invoicing. AP Pro delivers a completely new user interface allowing easy tracking of invoices in all stages of processing,” said Basware Director of AP Automation Products Olav Maas.

PYMNTS

FEBRUARY 26, 2020

That means emerging services are multitasking, easing friction for both accounts payable and accounts receivable. Below, PYMNTS explores the latest initiatives and finds that innovators are looking at the accounts receivable side to tackle accounts payable friction. Tipalti Reallocates The Workload.

Future CFO

APRIL 6, 2022

Accounts Payable is responsible for so much more than just paying incoming bills and invoices, particularly given today's global challenges. In partnership with Kofax , SSON ran an industry-wide AP Automation Maturity survey, gaining insights from all over the world into how companies are growing their payables efficiency.

Future CFO

MARCH 27, 2023

To curb rogue spending, businesses need to rethink how the accounts payable (AP) process can be improved. Today, many businesses still rely on manual invoice processing, for example, using e-mails to gain approval for payment, and using Excel spreadsheets to keep track of the progress of each payment.

PYMNTS

DECEMBER 14, 2020

Amid market volatility, organizations are finding it imperative to accelerate their accounts receivables while extending accounts payables and still maintaining positive buyer-supplier relationships. Accounts receivable and accounts payable are two key functions of the enterprise with significant impact on cash flow.

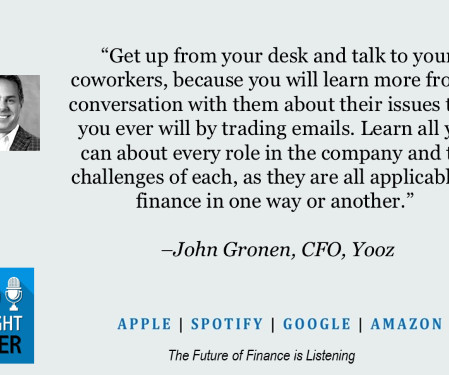

CFO Thought Leader

OCTOBER 29, 2024

Gronen: Yooz is an AP (accounts payable) automation and payments company. Right now, many companies receive invoices in paper envelopes. They open the envelope, scan the invoice, manually input the data, and attach the invoice to the system. Automation shortens this process to just a minute or two.

PYMNTS

JUNE 24, 2020

The accounting world was as caught off-guard and unprepared as most other industries when COVID-19 came to town. One fact has clearly surfaced in the interval between pandemic lockdowns and phased reopenings, and it’s this: accounts payable (AP) can’t cut it manually anymore. Invoice processing is expensive on paper.

PYMNTS

NOVEMBER 4, 2020

Even with the digitization of the invoice, fraud remains a rampant problem, and it's not only the buy-side of the B2B equation faced with the consequences. Deepfake technology means criminals can masquerade their own voices to convince unwitting employees to approve an invoice for payment, for instance. It's just inefficient.".

PYMNTS

MAY 12, 2020

To automate accounts payable (AP) procedures, Ephesoft, Inc. rolled out its Semantik Invoice cloud-based data acquisition product. ” The reader technology of Ephesoft recognizes important fields like invoice date, ship date and terms, among other data. .” days, AP processing is ripe for innovation.”

PYMNTS

MAY 13, 2020

Accounts payable (AP) tools that provide quick, detailed oversights of businesses’ financial statuses and payments obligations can help pick up the pace of payments by keeping invoice approval processes on track. Three-Way Invoice Matching Brews Up Better AP Processes. Around The AP Automation World.

PYMNTS

JANUARY 13, 2021

Expense management technology provider Medius and international eDocument service company Pagero have collaborated to help companies handle digital invoices. The new collaboration lets their joint customer base get and handle digital invoices in different formats throughout the world, according to a Wednesday (Jan. 13) announcement.

PYMNTS

MAY 14, 2020

Invoice inaccuracies caused by either honest mistakes or deliberate fraud quickly add up if not caught and corrected, and unexpected monetary drains cause budgets to fall short of projections. Three-Way Invoice Matching. Forry noted that automating invoice processing and using three-way matching help prevent billing mistakes.

CFO Thought Leader

JANUARY 29, 2025

Collis career began in accounting, where he spent seven years honing technical expertise in public accounting. The first is our accounts payable automation solution. Many AP solutions require users to leave their ERP environment, process invoices externally, and then sync the data back via API.

PYMNTS

JUNE 25, 2020

As accounts payable (AP) and accounts receivable (AR) operations continue to converge for many organizations, buyers and suppliers are increasingly acknowledging the value of using each other’s technology platforms to promote stronger B2B relationships. Peasy recently launched in the U.K.

The Charity CFO

APRIL 5, 2022

If you’re like many people, you probably think that there is a single set of accounting rules that every company must follow. . But that’s not quite true—nonprofits face a decision between 2 different accounting methods for tracking their financial activity: cash accounting vs. accrual accounting.

PYMNTS

MAY 4, 2020

Office closures and remote working mandates have created an uncomfortable wakeup call for accounts payable (AP) and accounts receivable (AR) departments that continue to rely on manual, paper-based processes. And there are a lot of them. “Any strategic CFO will recognize the need for digital transformation.”

CFO Share

MAY 31, 2023

Accounts payable is an annoyance at best, a disaster at worst. More and more businesses use accounts payable outsourcing as a solution to this problem. What to look for in an accounts payable company. Accounts payable outsourcing should include setting your business up with an automated solution.

The Charity CFO

JANUARY 17, 2022

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. with this overview of nonprofit accounting basics. . What is nonprofit accounting? Investopedia defines accounting as “the process of recording financial transactions pertaining to a business.” .

PYMNTS

JULY 14, 2020

American Express has launched a new automated accounts payable solution, American Express One AP, to help businesses digitize B2B payment processing, according to a press release. And the digital shift is going to be permanent for many areas of life, with companies exploring new ways to digitize payment processes.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content