FASB shifts to prioritize 'rapidly evolving' crypto assets

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. A description of the valuation techniques and inputs you used to determine the fair market value of the gifts (in accordance with Topic 820 ). .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Musings on Markets

JANUARY 10, 2025

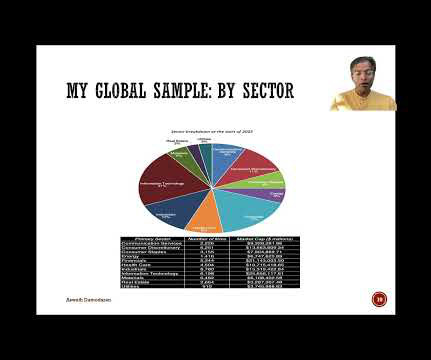

Not surprisingly, the company listings are across the world, and I look at the breakdown of companies, by number and market cap, by geography: As you can see, the market cap of US companies at the start of 2025 accounted for roughly 49% of the market cap of global stocks, up from 44% at the start of 2024 and 42% at the start of 2023.

CFO Talks

OCTOBER 2, 2024

Chinese Study highlights limitations on IAS 38, accounting for intangible assets A recent study from China highlighted the limitations of IAS 38 —the International Accounting Standard that governs intangible assets—and its impact on innovation, particularly in high-tech industries.

Bramasol

JUNE 10, 2022

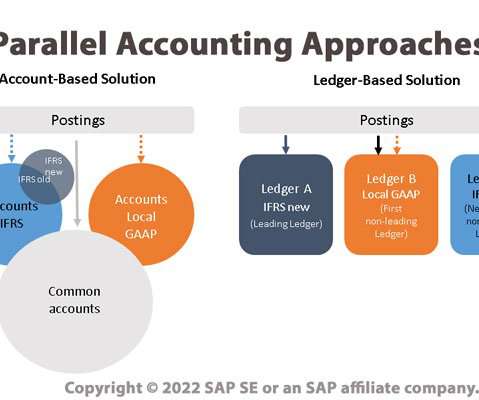

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

Musings on Markets

JANUARY 5, 2024

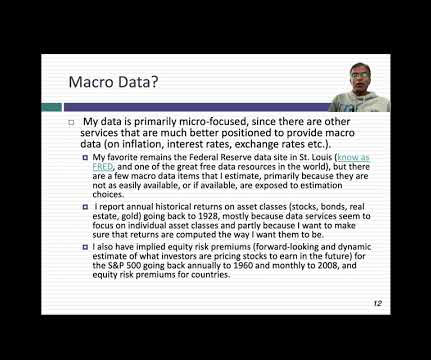

That year, I computed these industry-level statistics for five variables that I found myself using repeatedly in my valuations, and once I had them, I could not think of a good reason to keep them secret. Valuation Pricing Growth & Reinvestment Profitability Risk Multiple s 1. Historical Growth in Revenues & Earnings 1.

CFA Institute

DECEMBER 29, 2020

The explanatory power of the financial information reported to investors for market valuation has plummeted in recent decades.

Let's personalize your content