FASB backs off bigger software accounting revamp

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

From Start to Scale: Driving Growth Through Seamless Payments Implementation

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

CFO Dive

JUNE 13, 2024

Like crypto rules FASB recently finalized, the environmental credit accounting standards would provide specific guidance where GAAP is currently silent.

From Start to Scale: Driving Growth Through Seamless Payments Implementation

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. Get the free guide!

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations.

The Charity CFO

JANUARY 21, 2022

And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face. This accounting system is called fund accounting. This accounting system is called fund accounting. Who’s Required to Use Fund Accounting? .

CFA Institute

MARCH 5, 2021

You can find significant alpha in the mechanics that drive GAAP accounting.

Bramasol

JULY 31, 2023

This new post provides a deeper look at how the leasing of medical equipment along with other bundled services or products presents particular challenges for meshing contracts and lessor accounting with DSE management and revenue recognition. According to Allied Market Research, "The global medical equipment rental market was valued at $56.0

Bramasol

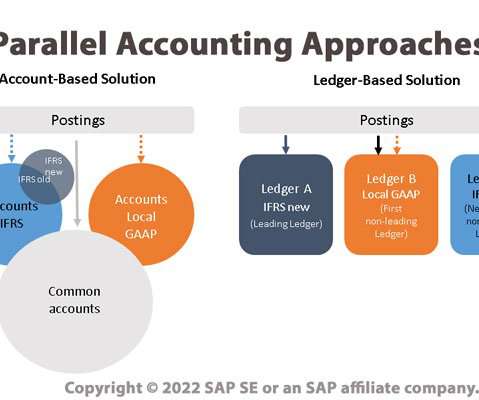

JUNE 10, 2022

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

CFO Leadership

OCTOBER 10, 2023

AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals. However, they still have a place in corporate finance and accounting.

PYMNTS

JUNE 10, 2019

Certified Professional Accountants (CPAs) in California are calling on an industry watchdog to clarify standards for cryptocurrency accounting, with expectations that corporations will increase their use of cryptocurrencies moving forward. GAAP,” the letter stated.

The Charity CFO

OCTOBER 9, 2024

One of the most sought-after tools is a platform or software to integrate your fundraising and accounting data seamlessly. This makes it challenging to create technology that tracks data for fundraising purposes while still following accounting principles. So why does it seem so hard to find this unicorn platform?

Future CFO

DECEMBER 31, 2021

What does this mean to the finance and accounting team of 2022? Increasingly more Finance & Accounting (F&A) functions will adopt a hybrid work model in which CFOs provide the tools to finance staff to productively work from anywhere. CFOs are the logical candidate to lead the ESG initiative.

Bramasol

MAY 13, 2024

Overview of the PCAOB and AICPA The Public Company Accounting Oversight Board (PCAOB) is a regulatory body established by the Sarbanes-Oxley Act of 2002 in response to corporate accounting scandals like Enron and WorldCom.

PYMNTS

DECEMBER 16, 2016

In a survey conducted by the Institute of Management Accountants (IMA), and sponsored by Blackline, titled “Process Automation in Accounting and Finance,” examining the attitudes and concerns of 750 financial professionals surrounding accounting and month-end closing processes, manual activities remain prevalent — at the cost of time and money.

The Charity CFO

NOVEMBER 10, 2022

What should you look for when evaluating nonprofit accounting services? Yes, they might have a board member or volunteer who takes care of the finances, but they often lack specific expertise in nonprofit accounting. Benefits of Nonprofit Accounting Services. Nonprofit organizations exist to further a mission or goal.

The Charity CFO

AUGUST 15, 2023

Myths of Nonprofit Accounting and Why They Matter to Job Seekers Unfortunately, many job seekers fall victim to the stereotypes and believe the myths surrounding nonprofit accounting. In this section, we will debunk the three most common nonprofit accounting myths. Ready to dive deep into this exciting realm?

The Charity CFO

JANUARY 5, 2022

Don't hire the wrong accountant for your nonprofit! The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. Get the free guide! To build public trust.

Future CFO

APRIL 18, 2022

DOWNLOAD NOW. The post IBM Cognos Controller: Financial close management managed by the office of finance appeared first on FutureCFO.

CFO Leadership

OCTOBER 18, 2023

AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals. However, they still have a place in corporate finance and accounting.

The Charity CFO

JANUARY 18, 2022

Zack joins us after two decades as a not-for-profit accountant in both public accounting and the nonprofit industry. In this new role, he will serve as one of our in-house experts on existing and emerging nonprofit accounting standards and auditing best practices. Louis and nationwide.

CFA Institute

AUGUST 18, 2020

Low accounting comparability can be costly for both firms and managers.

CFA Institute

APRIL 5, 2021

GAAP sometimes misrepresents business reality. We can use that fact to generate some alpha.

Planful

JULY 5, 2016

To date, most of the focus has been on the transactional accounting impact of the new guidelines. However, the revenue recognition guidance offered under US GAAP vs. IFRS has differed and was in need of improvement. As a result, different industries use different accounting for economically similar transactions.

CFO Share

NOVEMBER 15, 2023

This article includes small business accounting tips to prepare for an audit while minimizing its expenses and findings. An audit evaluates: Compliance with accounting standards (GAAP or IFRS.) Consider them accounting tips from unbiased outsiders customized for your business. What Do Financial Auditors Look For?

E78 Partners

SEPTEMBER 21, 2023

This is not just because of the intricacies and specificities required by the auditing standards but also due to the numerous challenges faced by organizations in the run-up to an audit. Furthermore, in an era of intricate financial landscapes, preparing for compliance with complex accounting standards becomes non-negotiable.

CFO Share

NOVEMBER 11, 2023

Amortization of intangible assets is a routine accounting procedure, not a strategic focus for small businesses. Instead, they are created as an accounting “plug” to facilitate double-entry bookkeeping standards. This is tracked in an amortization schedule and maintained by your internal accountants.

CFO Share

MARCH 14, 2022

Audited financial statements focus on compliance with GAAP accounting standards, whereas Quality of Earnings reports focus on the company’s earnings history and potential. Significant and/or unusual accounting policies such as: Changes in accounting methods. Changes in accounting principles.

VCFO

NOVEMBER 1, 2023

These actions might include: A blitz on collection of past due receivables to reduce cash tied up in past due accounts, reduce bad debt exposure and improve DSO (days sales outstanding – a metric often scrutinized by lenders). Read more in our blog about Lease Accounting Updates.)

The Charity CFO

APRIL 13, 2023

Accounting Standards In the United States, all organizations must adhere to the Generally Accepted Accounting Principles (GAAP). For nonprofits, however, there is an additional and specific set of standards that organizations must follow, as set out by the FASB 117.

PYMNTS

OCTOBER 25, 2019

Top accountancy firms are asking the Financial Accounting Standards Board (FASB) to clarify how corporates should report on supplier finance programs that are in place, according to Compliance Week reports on Friday (Oct. As the letter notes, U.S.

CFO Share

JUNE 27, 2024

How can a small business ensure compliance in reporting without overspending on accounting staff and audits? In general, financial statement compliance involves adhering to established standards and regulations, such as Generally Accepted Accounting Principles (GAAP) and the Financial Accounting Standards Board (FASB) guidelines.

The Charity CFO

DECEMBER 28, 2022

You have a primary responsibility to your donors, grantmakers, and other stakeholders to find ways to share these statements while still following the highest accounting standards. Let’s discuss them in detail so you can know what you need to do to stay compliant and accountable. Accounts = $100,000.

CFA Institute

DECEMBER 29, 2020

The explanatory power of the financial information reported to investors for market valuation has plummeted in recent decades.

Future CFO

NOVEMBER 2, 2020

China’s financial environment is the region’s most complex, followed by Vietnam, South Korea, Malaysia and Indonesia, according to TMF Group’s report titled Accounting & tax: The global and local complexities holding multinationals to account. However, APAC and EMEA take a much more localised approach.

The Charity CFO

MAY 11, 2023

When utilizing outsourced accounting services, you only pay for the services you need and you may have access to more premium software than you could purchase on your in-house budget. Outsourced bookkeeping can provide peace of mind knowing experts are on top of the accounting so your staff can focus on what matters most.

CFA Institute

JUNE 2, 2021

Cost of capital is a tenuous concept. Charlie Munger amusingly calls it a “perfectly amazing mental malfunction.”.

Spreadym

AUGUST 10, 2023

When choosing the best financial reporting software solution, it's important to consider factors such as ease of use, scalability, integration with existing systems, compliance with accounting standards, cost, customer support, and any unique requirements your organization might have.

PYMNTS

MARCH 7, 2016

With the newest software iteration, personalization allows CFOs to choose how accounting information is maintained and also should be differentiated from customization, which Bres said can typically include more time spend on changing software and training users.

The Finance Weekly

APRIL 6, 2024

This accounting principle offers an insightful perspective into a business's worth , underlining the importance of financial reporting in today's market dynamics. The concept of NBV stands out as a fundamental metric for both accountants and business professionals. What Is Net Book Value?

BlueLight

JULY 30, 2020

My motivation was to understand the responsibility of the CFO suite, the process of billing to accounting, and the software tools available to run an effective finance office. One is accounting: you need this done properly to inform the next two. It connects with bank accounts and corporate credit cards to track financial information.

Michigan CFO

MARCH 21, 2023

In accounting, indefinite lifespan refers to an asset where its rate of capital depreciation isn’t known or cannot be easily calculated. A Challenging Endeavour in Practice While the above formula appears simple enough, accountants struggle to find consistency when determining goodwill asset value.

Musings on Markets

JANUARY 9, 2021

While the universe of companies is diverse, with approximately half of all firms from emerging markets, it is more concentrated in market capitalization, with the US accounting for 40% of global market capitalization at the start of the year.

CFO Dive

NOVEMBER 10, 2023

Accounting standards and financial statements play key roles in the $250 million civil fraud case against former President Trump.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content