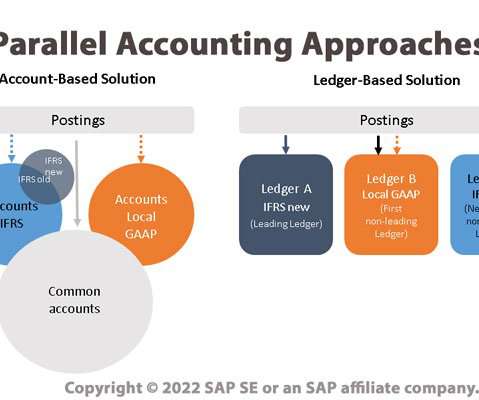

The Role of IFRS in Simplifying Cross-Border Financial Reporting

CFO Talks

FEBRUARY 25, 2025

IFRS provides a universal financial language, ensuring that businesses across the world speak the same accounting dialect. And how can businesses ensure they meet these standards while operating across different countries? If a company operates in just one country, it might only need to follow local accounting rules.

Let's personalize your content