FASB backs off bigger software accounting revamp

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

CFO Dive

JUNE 16, 2022

accounting standard-setter shelved a proposal recasting how companies account for an estimated $3.6 trillion in goodwill on their balance sheets.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

CFO Dive

APRIL 5, 2023

accounting standard setter is revisiting accounting for software costs. The new project marks the first time in decades that the U.S.

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

CFO Dive

JANUARY 19, 2023

The project to improve software accounting standards is a long time coming. At least one element of the current standards has remained largely unchanged since 1985.

CFO Dive

APRIL 11, 2025

Existing accounting standards have led to “scope creep,” with derivative standards being applied too often, FASB Chair Richard Jones said.

CFO Dive

JANUARY 16, 2025

accounting standard setter decided against adding a new project to its priority agenda that would have required banks to disclose more information about CRTs.

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. Check out our blog on accounting for in-kind donations for more details. Or watch our webinar on the topic for even more actionable tips.

CFO Dive

JUNE 13, 2024

Like crypto rules FASB recently finalized, the environmental credit accounting standards would provide specific guidance where GAAP is currently silent.

CFO Dive

JANUARY 6, 2025

Narrower projects could be in store for the accounting-standard setter as some stakeholders want more guidance on hot- button issues like crypto and goodwill.

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

CFO Dive

MARCH 29, 2024

The proposed accounting standards update is one of several initiatives that have been a priority for FASB under the general theme of disaggregation.

CFO Dive

DECEMBER 15, 2023

standard setter has issued nine new accounting standards updates so far this year, compared to six in all of 2022.

CFO Dive

JANUARY 6, 2023

Fed efforts to curb inflation, an imbalance in the demand and supply of workers and clarification of accounting standards are among the CFO trends this year.

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

CFO Dive

DECEMBER 13, 2024

The new accounting standard will fundamentally change how businesses track and report compensation, especially with regards to bonuses and commissions, Mark Schopmeyer writes.

CFO Dive

MARCH 27, 2023

The changes to lease accounting standards (Topic 842) provide narrowly targeted relief for some companies grappling with the guidance from 2016.

CFO Dive

OCTOBER 1, 2022

exchanges comply with the country’s accounting standards. The penalty is the latest sign of regulators’ battle to ensure foreign companies on U.S.

CFO Dive

MARCH 15, 2023

While previous FASB efforts to update accounting standards for taxes have fizzled, Chair Richard Jones has said tweaks to the project’s scope have made it achievable.

CFO Dive

JUNE 29, 2023

The FASB is poised to tweak existing accounting standards which originally sought to address calls for timelier loss reporting after the 2008 financial crisis.

CFO Dive

APRIL 21, 2022

accounting standards setter will likely affirm the proposed two-year extension of LIBOR-related accounting relief unless it gets new feedback during the public comment period, according to a FASB spokesperson.

CFO Dive

JULY 17, 2023

The current expected credit losses accounting standard was aimed at fostering timelier reporting of deteriorated assets. It’s been controversial.

CFO Dive

MARCH 14, 2022

Although the Financial Accounting Standards Board took no action on the matter at its early-March meeting, members signaled they’d like to stop counting a company’s customer relationships as an asset.

Bramasol

AUGUST 13, 2023

Specific issues addressed in the PIR are: Which terms and conditions should be considered when determining whether a lease exists and, if so, the classification and accounting for the lease. The accounting for leasehold improvements associated with leases between entities under common control.

PYMNTS

JUNE 24, 2019

Financial regulators are considering allowing smaller businesses (SMBs) more time to comply with sweeping changes in lease accounting standards, which experts have said will place a significant burden as organizations work to comply with the requirements. We’ll ask you for input on this as well.”

PYMNTS

OCTOBER 9, 2018

Banks and businesses alike are heading toward the 11th hour of changes in accounting standards, which will have a major impact on how companies report financial metrics and performance. Experts say the move will not go unnoticed when the accounting standards begin to take effect for public companies in 2021.

Reval

JULY 13, 2017

accounting standard that makes it easier to account for hedges is likely to encourage more corporates to hedge. The Financial Accounting Standards Board voted last month to finalize the new hedge accounting standard, and the final standard is due out in August. Treasury & Risk.

CFO News

JULY 17, 2023

The ministry of corporate affairs (MCA) has received recommendations by the National Financial Reporting Authority (NFRA) on the Indian Accounting Standard (Ind AS) 117 for insurance contracts, he told ET."The The standards will soon be notified under the Companies (Indian Accounting Standards) Rules 2015," he added.

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations.

CFO News

APRIL 27, 2023

NFRA will share its recommendations with the ministry of corporate affairs, which will consider the Ind AS 117 and notify the standards under Companies (Indian Accounting Standards) Rules 2015. Once notified, Ind AS 117 will replace the current Ind AS 104, Insurance Contracts.

Embark With Us

MAY 19, 2022

It wasn't so long ago when the very thought of accounting for convertible debt sent shivers down the spines of even veteran accountants. Thankfully, the FASB heard the screams and night terrors, giving the guidance a much-needed overhaul in the form of Accounting Standards Update (ASU) 2020-06.

CFO Dive

SEPTEMBER 20, 2023

For the first time in nearly 40 years the Financial Accounting Standards Board is working to update its guidance on software costs

The Charity CFO

APRIL 20, 2023

How can nonprofit accounting software help your organization with efficiency? In today’s digital age, technology has revolutionized almost every aspect of business operations, including accounting and finance. For-profit companies have long used accounting software to track their financial transactions and monitor their bottom lines.

PYMNTS

OCTOBER 1, 2019

have led the Financial Reporting Council (FRC) to enact more stringent accounting standards, The Guardian reported on Monday (Sept. According to reports, the FRC issued an updated going concern standard, adding “significantly stronger requirements” for U.K. More high-profile corporate collapses in the U.K.

Cube Software

APRIL 3, 2025

The consolidation process typically includes aggregating financial results, eliminating intercompany transactions, handling currency conversions, and ensuring compliance with accounting standards like the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles GAAP.

CFO Dive

JUNE 30, 2022

accounting standard setter drew a three-fold jump in investor feedback after launching an initiative in 2020 to get more input on where it should focus its efforts.

PYMNTS

SEPTEMBER 26, 2019

The Securities and Exchange Board of India will reportedly give non-bank financial companies (NBFCs) two years to adopt and implement changes to accounting standards, the Financial Express reported Wednesday (Sept. regulators have given small businesses more time than other firms to adopt the accounting standard changes.

CFO Dive

MARCH 23, 2022

The 2022 reporting taxonomies include updates to accounting standards on credit losses and balance sheet offsets, among other things, the Financial Accounting Standards Board says.

PYMNTS

OCTOBER 18, 2019

The Financial Accounting Standards Board (FASB), which establishes accounting standards in the U.S., is offering corporates more time to adopt some revised standards, The Wall Street Journal said on Thursday (Oct. 15, 2022 to adopt CECL. 15, 2019 deadline for large public lenders has not changed.

The Charity CFO

JANUARY 21, 2022

And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face. This accounting system is called fund accounting. This accounting system is called fund accounting. Who’s Required to Use Fund Accounting? .

CFO News

NOVEMBER 29, 2024

India stands poised to reshape its accounting standards, integrating global best practices with its unique needs. Sunil Kanoria, Co-Founder of Srei Group and former President of Assocham, explores this pivotal transformation.

CFO News

MARCH 18, 2025

Chopra said that treasury operations and foreign exchange liabilities should have been thoroughly reviewed otherwise where is the need of Accounting Standards, an area where the CFO, auditors did not pay attention and the crisis landed.

The Charity CFO

JULY 28, 2022

Updated standards on accounting for nonprofit leases ( ASC 842 ) go into effect this year for most organizations–and next year for the few remaining exceptions. If you’re not sure that your organization has adopted the new standards detailed in ASC 842, then keep reading. What is ASC 842 for nonprofit lease accounting?

CFO Talks

OCTOBER 2, 2024

Chinese Study highlights limitations on IAS 38, accounting for intangible assets A recent study from China highlighted the limitations of IAS 38 —the International Accounting Standard that governs intangible assets—and its impact on innovation, particularly in high-tech industries.

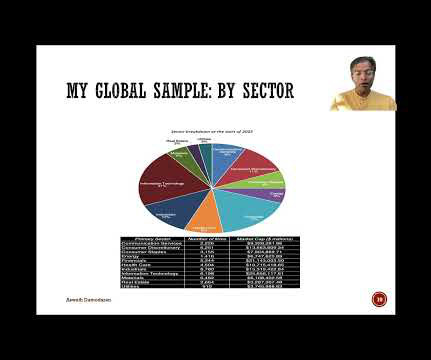

Musings on Markets

JANUARY 10, 2025

Not surprisingly, the company listings are across the world, and I look at the breakdown of companies, by number and market cap, by geography: As you can see, the market cap of US companies at the start of 2025 accounted for roughly 49% of the market cap of global stocks, up from 44% at the start of 2024 and 42% at the start of 2023.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content