Do Nonprofits Use Cash or Accrual Accounting?

The Charity CFO

APRIL 5, 2022

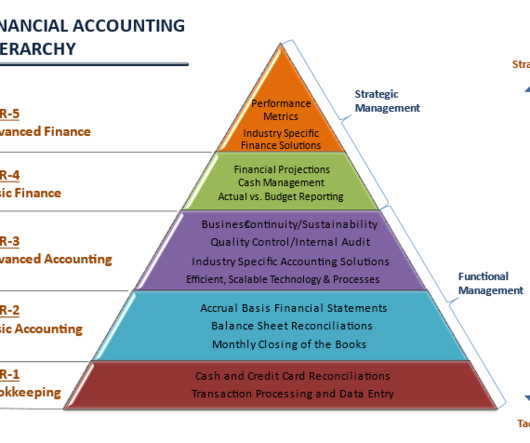

If you’re like many people, you probably think that there is a single set of accounting rules that every company must follow. . But that’s not quite true—nonprofits face a decision between 2 different accounting methods for tracking their financial activity: cash accounting vs. accrual accounting.

Let's personalize your content