FASB tees up GAAP codification cleanup for comment

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

Cube Software

APRIL 3, 2025

The consolidation process typically includes aggregating financial results, eliminating intercompany transactions, handling currency conversions, and ensuring compliance with accounting standards like the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles GAAP.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Smart Tech + Human Expertise = How to Modernize Manufacturing Without Losing Control

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

Fpanda Club

JANUARY 23, 2025

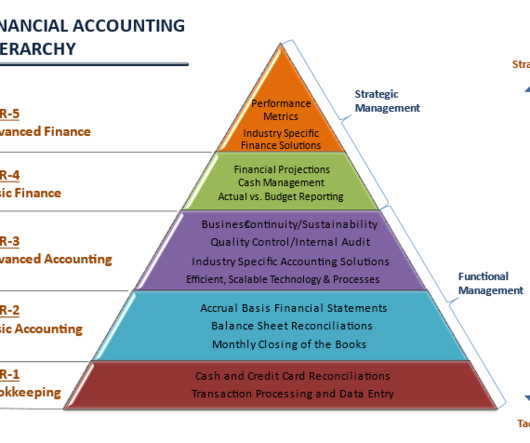

Such tasks as reconciling accounts, monthly closing, preparing financial statements are part of the accounting cycle and are typically managed by accounting departments. This misunderstanding often leads them to make requests that are outside the FP&A scope, such as transactional accounting tasks or detailed data pulls.

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Smart Tech + Human Expertise = How to Modernize Manufacturing Without Losing Control

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Talks

NOVEMBER 20, 2024

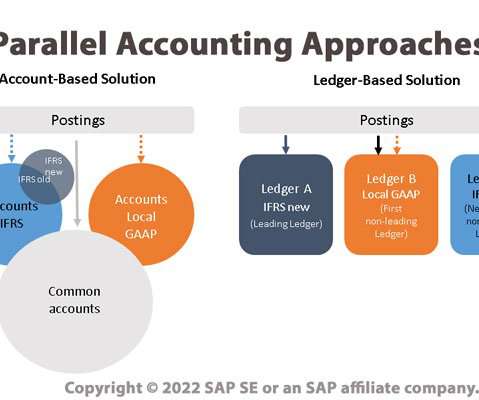

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

Bramasol

JUNE 10, 2022

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

The Charity CFO

APRIL 5, 2022

If you’re like many people, you probably think that there is a single set of accounting rules that every company must follow. . But that’s not quite true—nonprofits face a decision between 2 different accounting methods for tracking their financial activity: cash accounting vs. accrual accounting.

The Charity CFO

JANUARY 21, 2022

And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face. This accounting system is called fund accounting. This accounting system is called fund accounting. Who’s Required to Use Fund Accounting? .

The Charity CFO

JANUARY 17, 2022

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. with this overview of nonprofit accounting basics. . What is nonprofit accounting? Investopedia defines accounting as “the process of recording financial transactions pertaining to a business.” .

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. The changes impact the presentation of your data, so you may not need to change the process for how you track or account for in kind contributions internally.

The Charity CFO

FEBRUARY 25, 2022

If you’re brand new to nonprofit accounting, the Chart of Accounts might be the best place to start. Because even if you only have one bank account, bill, investment, or expense, you’ll need one. What is a Chart of Accounts? How to Organize a Nonprofit Chart of Accounts . Account Description.

The Charity CFO

JANUARY 13, 2022

But accounting for in-kind donations presents its own unique challenges. In this article, we’ll dig into how to account for in-kind donations on your nonprofit’s books. Why accounting for in-kind donations matters. Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. .

PYMNTS

SEPTEMBER 24, 2018

A research firm has discovered that the number of material accounting mistakes made by U.S. For many, the mistakes were discovered when corporate finance teams were changing accounting paperwork to comply with the new U.S. tax law and revenue accounting rules. public companies has gone up this year.

CFO Talks

NOVEMBER 29, 2024

These experiences introduced me to the broader business world and significantly accelerated my career. Following my articles, I moved into the corporate sector as a Group Accountant at Datacentrix, gaining insight into private sector finance. What key skills should a newly qualified accountant develop on their path to becoming a CFO?

The Charity CFO

OCTOBER 9, 2024

One of the most sought-after tools is a platform or software to integrate your fundraising and accounting data seamlessly. This makes it challenging to create technology that tracks data for fundraising purposes while still following accounting principles. So why does it seem so hard to find this unicorn platform?

The Charity CFO

DECEMBER 30, 2021

Don't hire the wrong accountant for your nonprofit! The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. Get the free guide! What is a nonprofit financial audit? .

Boston Startup CFO

APRIL 3, 2023

Financial accounting: A topic that can easily disorient even the most driven entrepreneurs. Fortunately, we present you with a compass – a diagram that demystifies the functions of financial accounting. In this tier, a double-entry accounting system is employed to ensure the accurate recording of all transactions.

Future CFO

AUGUST 4, 2024

New research report from global technology research and advisory firm Information Services Group ( ISG ) finds that the desire among enterprises to shorten accounting cycle drives greater adoption of software. The post Enterprises seek greater software adoption to shorten accounting cycle appeared first on FutureCFO.

The Charity CFO

JULY 19, 2024

When most people think of an organization’s financial department, they think of accountants. Bookkeepers, accountants, and Chief Financial Officers (CFOs) all serve critical roles in managing an organization’s finances. What is an Accountant? Accountants run reports to help determine if the bookkeeping is done correctly.

PYMNTS

JUNE 10, 2019

Certified Professional Accountants (CPAs) in California are calling on an industry watchdog to clarify standards for cryptocurrency accounting, with expectations that corporations will increase their use of cryptocurrencies moving forward. GAAP,” the letter stated.

https://trustedcfosolutions.com/feed/

SEPTEMBER 15, 2022

As your business grows, your accounting solution should scale and grow with you, but this isn’t the case with older, outdated software. Spreadsheets can only tell you so much at a glance and cannot address complex accounting issues. If your accounting system can’t keep up, it’s time for a change. Lack of Financial Visibility.

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations.

Future CFO

JULY 21, 2024

Given the advent of artificial intelligence and machine learning, the accounting profession faces challenges in talent as it continues to navigate its way around digitisation and shifts in the market. AI allows room for improvement like focusing on higher-level tasks and upskilling," he notes.

PYMNTS

AUGUST 7, 2017

When it comes to earnings, a bit of accounting can make all the difference. The key element deserving of scrutiny here, the Times pointed out, comes with the way PayPal — and, to be fair, other tech companies — account for employee stock-based compensation. The implication here is that doing so would lower corporate profits.

The Charity CFO

JULY 12, 2024

The type of accounting your organization uses could be holding you back from getting the most out of your accounting system. While many nonprofits start with cash-basis accounting due to its simplicity, this method often falls short of providing a comprehensive view of a nonprofit’s financial health.

The Charity CFO

NOVEMBER 10, 2022

What should you look for when evaluating nonprofit accounting services? Yes, they might have a board member or volunteer who takes care of the finances, but they often lack specific expertise in nonprofit accounting. Benefits of Nonprofit Accounting Services. Nonprofit organizations exist to further a mission or goal.

The Charity CFO

APRIL 29, 2022

A financial statement audit is a thorough review of your financial statements to determine if your financial statements present fairly, in all material respects, in accordance with generally accepted accounting principles. Do your bank account and/or loan balances look accurate?

The Charity CFO

FEBRUARY 4, 2022

Do a Google search on nonprofit bookkeeping, and you’ll find page after page of articles on nonprofit accounting. Because while nonprofit bookkeeping and accounting are related, they’re not the same thing. A bookkeeper records and organizes financial data; an accountant interprets and presents that data. . And that’s a problem.

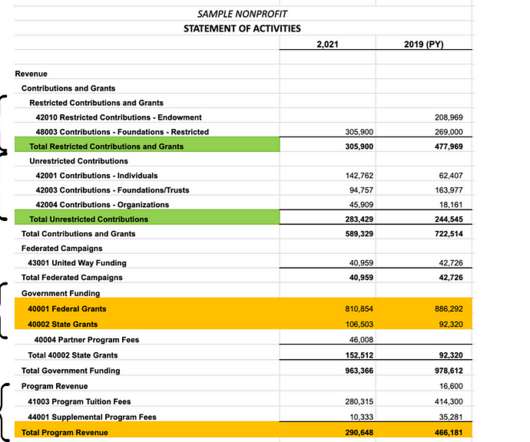

The Charity CFO

JANUARY 31, 2022

Like all nonprofit financial statements , the central role of the Statement of Activities is to provide transparency and accountability to your donors and board. If you use cash-based accounting, you’ll only record cash deposited into your bank during the reporting period. . Don't hire the wrong accountant for your nonprofit!

Global Finance

JULY 29, 2024

And they typically boast a deep understanding of accounting principles, analysis, and business strategy—essentials in guiding an organization toward its goals. Indeed, it’s hard to make accounting sexy when “Instagram influencer” is a viable career option. There’s just one problem, Bokhari says: “We’re competing with glamour.”

CFO News Room

JANUARY 23, 2023

Stanley Black & Decker, which was able to carry out a $290 million inventory reduction in the quarter, cut its annual guidance for diluted earnings per share under generally accepted accounting principles to between 10 cents and 80 cents per share from a range of 80 cents to $2.05

Bramasol

MAY 13, 2024

Overview of the PCAOB and AICPA The Public Company Accounting Oversight Board (PCAOB) is a regulatory body established by the Sarbanes-Oxley Act of 2002 in response to corporate accounting scandals like Enron and WorldCom.

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Proper cannabis accounting must recognize these costs on regular financial statements to comply with 280E tax code.

The Charity CFO

JANUARY 11, 2023

All these sources must be carefully managed to ensure compliance with Generally Accepted Accounting Principles (GAAP) and guidelines. Revenue recognition is an accounting process of properly identifying when income has been earned. Your organization’s accounting method really impacts the timing of recognizing transactions.

The Charity CFO

JANUARY 5, 2022

Don't hire the wrong accountant for your nonprofit! The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. Get the free guide! To build public trust.

Future CFO

SEPTEMBER 15, 2021

There are 10 most sough-after shared services skills in the finance and accounting function in the past year, said Gartner recently. These shared services skills, according to GartnerTalentNeuron analysis of job postings in the finance and accounting function between July 2020 and July 2021, are as follows. Accounting experience.

Planful

JUNE 22, 2017

Financial Consolidation in the Accounting World. But in the accounting world, “financial consolidation” is a well-defined process that includes several complexities and accounting principles. Here are the key accounting consolidation steps in the finance consolidation process : Collecting trial balance data (e.g.,

Future CFO

APRIL 18, 2022

DOWNLOAD NOW. The post IBM Cognos Controller: Financial close management managed by the office of finance appeared first on FutureCFO.

The Charity CFO

JANUARY 18, 2022

Zack joins us after two decades as a not-for-profit accountant in both public accounting and the nonprofit industry. In this new role, he will serve as one of our in-house experts on existing and emerging nonprofit accounting standards and auditing best practices. Louis and nationwide.

CFO Leadership

AUGUST 12, 2021

Kim Ngyuen came to the US from Vietnam to further her education and obtained her MBA with a concentration in Accounting at Albertus Magnus College. Indri holds a bachelor’s degree in Accounting and a Master’s degree in Professional Accounting from the University of Texas at Austin. Joy is our first Ascend Honoree.

PYMNTS

MARCH 6, 2019

Corporate accounting standards are changing, with the Financial Accounting Standards Board adopting new standards in ways companies report on leases, hedging and other financial activity. A recent report from CFO.com shed light on another factor driving accounting and financial transparency within corporate America.

PYMNTS

DECEMBER 3, 2019

The company used generally accepted accounting principles (GAAP) to essentially turn a $1.9 Using this cash-flow metric, WeWork was able to deduct about $900 million in leasing costs and building expenses from the revenue it took in from members and services. billion net loss into a $142 million profit.

Future CFO

OCTOBER 16, 2022

FP&A Leaders should take into account the maturity and needs of their own finance organisation because the applicability may vary across organizations and industries,” McDonald advised. . POC revenue forecasting or POC accounting. Using the predictions from these models, collections staff focus their efforts on at-risk accounts.

The Finance Weekly

MARCH 25, 2024

His main job is to handle all money matters at SoFi, like planning, accounting, and dealing with investors. His main gigs included handling all the financial operations like accounting and financial planning, crafting financial strategies to boost the business, and managing relationships with investors and banks.

Future CFO

MARCH 30, 2021

Yes, they all follow the same accounting principles, manufacturing processes follow the same workflow, and likely they compete for the same customers.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content