FASB shifts to prioritize 'rapidly evolving' crypto assets

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. A description of the valuation techniques and inputs you used to determine the fair market value of the gifts (in accordance with Topic 820 ). .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Musings on Markets

JANUARY 10, 2025

I know that this classification is at odds with the industry classifications based upon SIC or NAICS codes, but it works well enough for me, at least in the context of corporate finance and valuation. Since I teach corporate finance and valuation, I find it useful to break down the data that I report based upon these groupings.

CFO Talks

OCTOBER 2, 2024

Chinese Study highlights limitations on IAS 38, accounting for intangible assets A recent study from China highlighted the limitations of IAS 38 —the International Accounting Standard that governs intangible assets—and its impact on innovation, particularly in high-tech industries.

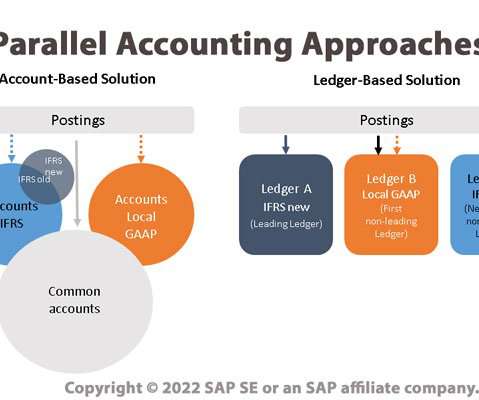

Bramasol

JUNE 10, 2022

In contrast, the ledger-based approach groups all accounts for a particular principle into a non-leading ledger, with all non-leading ledgers then rolling up into a single Leading Ledger. Other key factors include where the company stands with regard to implementing new accounting standards (ASC 606, IFRS 15, ASC 842, IFRS, 16, etc.)

E78 Partners

JANUARY 5, 2024

Audits are an essential part of ensuring that a company’s financial statements are accurate and compliant with accounting standards. Engage Third Parties Early: Engage valuation firms and appraisers early in the process, as these experts can help support audit preparation and reduce hassles later on.

Future CFO

JUNE 22, 2022

The total cost faced by the global insurance industry to implement the accounting standard is now estimated by WTW to be US$18 billion to US$24 billion, survey report indicates. People: More than 10,000 people will be required to deliver the accounting standard in the next two to three years.

Let's personalize your content