FASB revisits GAAP cleanup

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

CFO Dive

JUNE 13, 2024

Like crypto rules FASB recently finalized, the environmental credit accounting standards would provide specific guidance where GAAP is currently silent.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

The Charity CFO

MAY 10, 2022

If your nonprofit uses donations of supplies, services, and even time to help fund your operations, you need to know about recent changes in accounting standards for in kind donations. So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. Get the free guide!

Cube Software

APRIL 3, 2025

The consolidation process typically includes aggregating financial results, eliminating intercompany transactions, handling currency conversions, and ensuring compliance with accounting standards like the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles GAAP.

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations.

CFA Institute

MARCH 5, 2021

You can find significant alpha in the mechanics that drive GAAP accounting.

Bramasol

JULY 31, 2023

It can quickly become unmanageable to try and handle lease contract management, lessor accounting, maintenance services, sales of consumables, revenue recognition and disclosure reporting all with different siloed software. In addition, global companies need the flexibility to comply and report according to multiple accounting standards.

Future CFO

DECEMBER 31, 2021

Their responsibilities already entail ensuring that the financial report is accurate, complete and verifiable, according to GAAP accounting standards and disclosures. CFOs are the logical candidate to lead the ESG initiative.

Bramasol

MAY 13, 2024

The PCAOB and AICPA essentially interpret and enforce accounting rules as promulgated by the Financial Accounting Standards Board (FASB) , which is responsible for establishing and improving accounting standards for financial reporting in the United States. Why Should You Care?

PYMNTS

JUNE 10, 2019

Reports in The Block Crypto late last week said a group of California CPAs has sent a letter to the Financial Accounting Standards Board, a federal board that sets Generally Accepted Accounting Principles (GAAP), requesting that it consider establishing a task force to address a lack of clarity in cryptocurrency accounting standards.

Bramasol

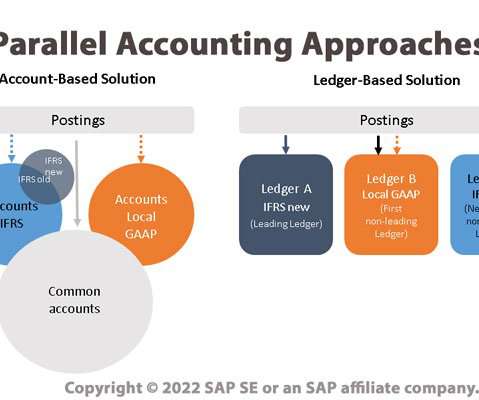

JUNE 10, 2022

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

The Charity CFO

JANUARY 21, 2022

If you’re looking for info on fund accounting in government here is a great resource for you. Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit.

PYMNTS

DECEMBER 16, 2016

This is especially true when multinationals must reconcile data across different accounting standards, such as GAAP and IFRS. Thus, the report concluded, firms would benefit from what is known as continuous accounting, where traditional month-end processes would be accelerated to occur more often and more rapidly.

The Charity CFO

OCTOBER 9, 2024

Instead, accounting software prioritizes accuracy, standardization, and regulatory compliance. The Impact of GAAP on Integration Efforts We’ve mentioned GAAP several times, but why do these principles affect integration so much? For nonprofits, GAAP ensures transparency, accuracy, and consistency in financial statements.

Future CFO

APRIL 18, 2022

DOWNLOAD NOW. The post IBM Cognos Controller: Financial close management managed by the office of finance appeared first on FutureCFO.

CFA Institute

APRIL 5, 2021

GAAP sometimes misrepresents business reality. We can use that fact to generate some alpha.

The Charity CFO

JANUARY 18, 2022

In this new role, he will serve as one of our in-house experts on existing and emerging nonprofit accounting standards and auditing best practices. In doing so, Zack will help ensure that our clients’ financials are prepared in accordance with general accepted accounting principles (GAAP) and their 990s meet IRS guidelines.

CFO Leadership

OCTOBER 10, 2023

SEC filings, GAAP documentation, FASB accounting standards, IFRS standards, PCAOB, FINRA, etc.), a model could be trained to become an expert in finance and accounting. In a world that embraces and rewards AI, “Leaning in” to this technology is not optional for finance and accounting.

Planful

JULY 5, 2016

However, the revenue recognition guidance offered under US GAAP vs. IFRS has differed and was in need of improvement. So for a number of years, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) have been working to converge their guidelines for revenue recognition.

The Charity CFO

JANUARY 5, 2022

Reporting functional expenses has been required by Generally Accepted Accounting Principles (GAAP) since 2017, as detailed in ASU 2016-14. Being clear, consistent, and accountable in your reporting of expenses is a big step toward earning their trust. . So you really don’t have a choice, but if you want more reasons….

CFO Share

NOVEMBER 11, 2023

Similar to depreciation, amortization has different treatment for taxes versus GAAP financial statements. As a result, when given the option, your accountant should amortize an intangible asset faster for taxes and slower for company books. This tactic maximizes book earnings while minimizing tax burdens.

CFO Share

NOVEMBER 15, 2023

An audit evaluates: Compliance with accounting standards (GAAP or IFRS.) What Do Financial Auditors Look For? Auditors assess your financial statements’ accuracy, ensuring they are free of material misstatements. The validity and accuracy of financial transactions and records. The efficacy of internal controls.

CFO Share

MARCH 14, 2022

Audited financial statements focus on compliance with GAAP accounting standards, whereas Quality of Earnings reports focus on the company’s earnings history and potential. What is the difference between a quality of earnings report and an audit?

The Charity CFO

APRIL 13, 2023

Accounting Standards In the United States, all organizations must adhere to the Generally Accepted Accounting Principles (GAAP). For nonprofits, however, there is an additional and specific set of standards that organizations must follow, as set out by the FASB 117.

E78 Partners

SEPTEMBER 21, 2023

This is not just because of the intricacies and specificities required by the auditing standards but also due to the numerous challenges faced by organizations in the run-up to an audit. Furthermore, in an era of intricate financial landscapes, preparing for compliance with complex accounting standards becomes non-negotiable.

PYMNTS

OCTOBER 25, 2019

Top accountancy firms are asking the Financial Accounting Standards Board (FASB) to clarify how corporates should report on supplier finance programs that are in place, according to Compliance Week reports on Friday (Oct. As the letter notes, U.S.

VCFO

NOVEMBER 1, 2023

Assessing Accounting For entities preparing GAAP compliant financial statements, adoption of Revenue Recognition Standard (ASC 606) and Lease Accounting Standard (ASC 842) is now mandatory. Evaluating the carrying value of intangible assets such as goodwill and intellectual property.

CFO Share

JUNE 27, 2024

In general, financial statement compliance involves adhering to established standards and regulations, such as Generally Accepted Accounting Principles (GAAP) and the Financial Accounting Standards Board (FASB) guidelines. What is Financial Statement Compliance?

PYMNTS

MARCH 7, 2016

GAAP and international accounting standards, is another boon to efficiency, said Bres. One key rests with expanded functionality that lets users across departments deploy commentary and content tied to social networking features, which fosters real-time collaboration across departments.

The Charity CFO

DECEMBER 28, 2022

You have a primary responsibility to your donors, grantmakers, and other stakeholders to find ways to share these statements while still following the highest accounting standards. It helps you comply with GAAP standards and IRS regulations. This financial report contains three segments: 1.

Future CFO

NOVEMBER 2, 2020

Many jurisdictions are moving towards international accounting standards such as International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP). However, APAC and EMEA take a much more localised approach.

The Charity CFO

AUGUST 15, 2023

For accountants, this means the profit-generating strategies and investment ideas you bring to the table are still applicable and can make a massive impact. One key differentiator is that what is recorded following GAAP is what will show up on the audit and may not show up on the IRS tax form, Federal Form 990.

The Charity CFO

NOVEMBER 10, 2022

Yes, they might have a board member or volunteer who takes care of the finances, but they often lack specific expertise in nonprofit accounting. As a result, the organization might not adhere to Generally Accepted Accounting Principles (GAAP), which can trip them up come tax time or during an audit.

Spreadym

AUGUST 10, 2023

When choosing the best financial reporting software solution, it's important to consider factors such as ease of use, scalability, integration with existing systems, compliance with accounting standards, cost, customer support, and any unique requirements your organization might have.

CFO Leadership

OCTOBER 18, 2023

SEC filings, GAAP documentation, FASB accounting standards, IFRS standards, PCAOB, FINRA, etc.), a model could be trained to become an expert in finance and accounting. In a world that embraces and rewards AI, “Leaning in” to this technology is not optional for finance and accounting.

The Charity CFO

MAY 11, 2023

When determining your needs, be sure to consider what your complete financial package looks like and where you might need some help.

The Finance Weekly

APRIL 6, 2024

This measure is a direct product of fair value reporting, a principle insisting that assets be reported at their market value, which forms the bedrock of financial reporting standards under US GAAP. Determining Eligibility for Depreciation To accurately apply depreciation, it is essential to first determine which assets are eligible.

BlueLight

JULY 30, 2020

These are complex questions to answer and few companies would have an in-house expert on this subject, especially in light of the new accounting rule for revenue recognition. GAAP Revenue Recognition Rules Effective December 2018, FASB changed the guidelines to recognizing revenue under ASC 606.

CFO Talks

OCTOBER 1, 2024

The conversation about the underinvestment in intangible assets in South Africa, and the challenges of accounting for these assets (due to subjective accounting treatments), directly impacts how CFOs approach financial reporting. IFRS, US GAAP). The interview highlights how companies that invest more in intangible assets (e.g.,

CFA Institute

AUGUST 18, 2020

Low accounting comparability can be costly for both firms and managers.

CFA Institute

DECEMBER 29, 2020

The explanatory power of the financial information reported to investors for market valuation has plummeted in recent decades.

CFA Institute

JUNE 2, 2021

Cost of capital is a tenuous concept. Charlie Munger amusingly calls it a “perfectly amazing mental malfunction.”.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content