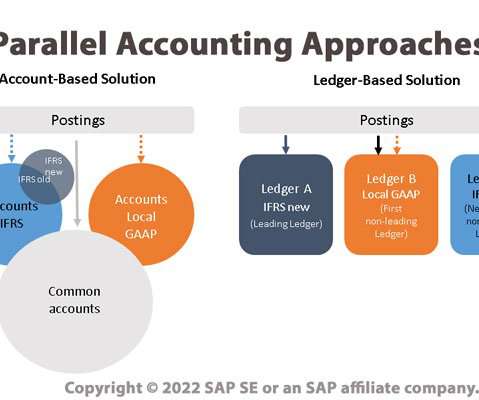

Parallel Accounting is a Key Tool for Global Companies with Multiple Reporting Requirements

Bramasol

JUNE 10, 2022

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

Let's personalize your content