Cross-Listed Companies, Navigating International Reporting Standards

CFO Talks

NOVEMBER 20, 2024

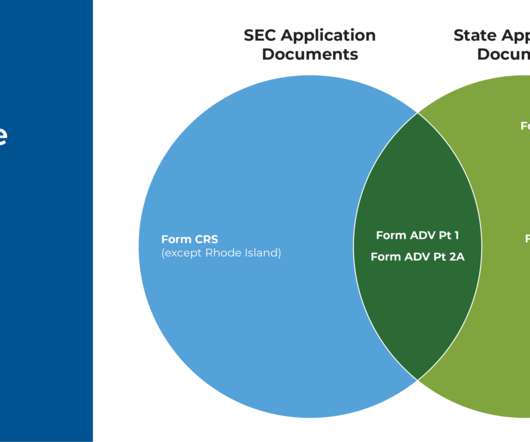

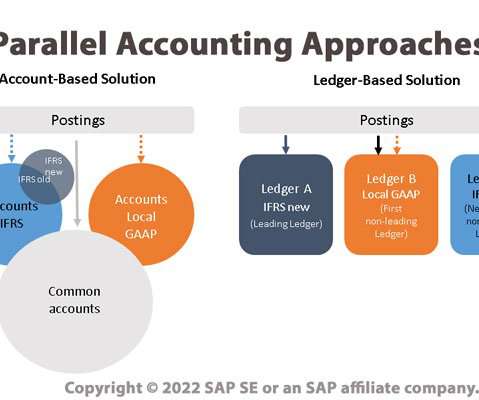

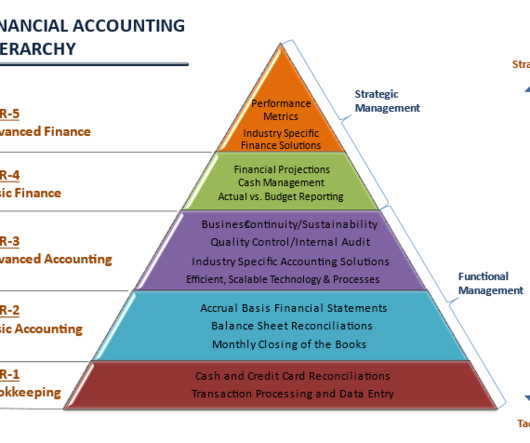

But it also comes with a unique set of challenges, particularly for CFOs tasked with ensuring compliance with international reporting standards. For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP).

Let's personalize your content