FASB tees up GAAP codification cleanup for comment

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

The Charity CFO

DECEMBER 30, 2021

The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. It’s a cost-effective option for organizations that need a GAAP report. Get the free guide!

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP. This is your projected income tax.

The Charity CFO

MAY 10, 2022

So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. The changes to in kind donation reporting are specifically for organizations that follow generally accepted accounting principles (GAAP) in preparing their financial statements. Who do the changes impact?

The Charity CFO

APRIL 5, 2022

Cash accounting does not comply with Generally Accepted Accounting Principles (GAAP) for nonprofit organizations. So if you expect to grow or search for new sources of funding, you’ll probably need to graduate to accrual-basis accounting. Is Accrual Accounting a Requirement For You? Get the free guide!

The Charity CFO

JANUARY 18, 2022

In doing so, Zack will help ensure that our clients’ financials are prepared in accordance with general accepted accounting principles (GAAP) and their 990s meet IRS guidelines. Zack is a CPA and graduate of one of the nation’s top 3 accounting programs at the University of Illinois. Louis and nationwide.

The Charity CFO

JANUARY 17, 2022

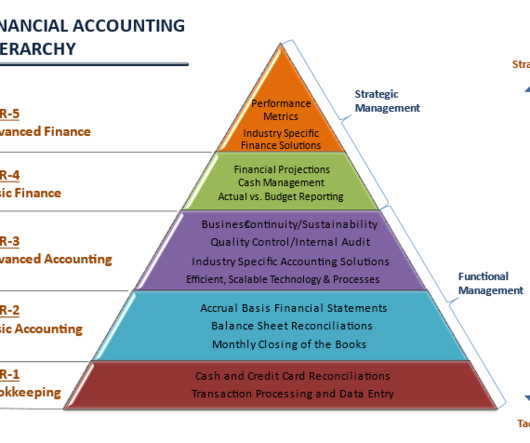

The basic accounting principles for nonprofit organizations are the same as accounting for for-profit companies. . So let’s start with the basics, and later we’ll dig into some of the things that make nonprofit accounting unique. . The #1 accounting mistake that nonprofits make is hiring the wrong people to help them.

The Charity CFO

JULY 19, 2024

What is a Chief Financial Officer (CFO)? A Chief Financial Officer (CFO) is a senior executive in charge of the strategic direction and goal setting of a nonprofit’s accounting and financial management. As an executive-level role, the CFO is in charge of guiding the overall financial strategy of the organization.

The Charity CFO

JANUARY 21, 2022

If you’re looking for info on fund accounting in government here is a great resource for you. Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit.

CFO Share

JUNE 27, 2024

How a CFO Ensures Compliance in Financial Reporting Reliable financial statements are crucial for business management, but ensuring compliance may feel like a luxury in the resource-constrained world of small business. How can a small business ensure compliance in reporting without overspending on accounting staff and audits?

The Charity CFO

OCTOBER 9, 2024

This makes it challenging to create technology that tracks data for fundraising purposes while still following accounting principles. Instead, accounting software prioritizes accuracy, standardization, and regulatory compliance. For nonprofits, GAAP ensures transparency, accuracy, and consistency in financial statements.

The Charity CFO

FEBRUARY 25, 2022

For that reason, your account numbering, category names, and structure should follow standard guidelines and numbering conventions established by Generally Accepted Accounting Principles (GAAP). . Here’s how the Equity section might look on your Chart of Accounts: Account #. Assets-1000s. Equity-3000s.

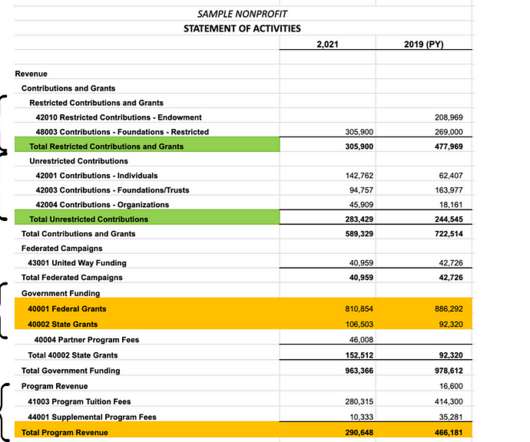

The Charity CFO

JANUARY 31, 2022

To comply with Generally Accepted Accounting Principles (GAAP), you must separate your revenue into at least 2 categories: Restricted Revenue shows funds with donor-placed restrictions on how or when you can spend the money. At The Charity CFO, we help 150+ nonprofits get audit-ready financial reports monthly, like clockwork.

The Finance Weekly

MARCH 25, 2024

Big companies used to hog all the CFO action, but now even small and medium-sized businesses are jumping on the bandwagon. Why the sudden CFO craze? In a nutshell, companies are starting to view CFOs as smart investments rather than just expenses. Highest Paid CFOs in the World in 2024 1. As the Director of Amyris Inc.,

The Charity CFO

JANUARY 11, 2023

All these sources must be carefully managed to ensure compliance with Generally Accepted Accounting Principles (GAAP) and guidelines. Revenue recognition is an accounting process of properly identifying when income has been earned. Trust The Charity CFO Revenue Recognition for Nonprofits. Receive grants.

The Charity CFO

FEBRUARY 4, 2022

Nonprofits must maintain thorough and accurate financial records to comply with both Generally Accepted Accounting Principles ( GAAP ) and maintain their tax-exempt status with the IRS. At The Charity CFO, we handle the books and all of your accounting needs. Get the free guide!

Future CFO

APRIL 18, 2022

It also helps finance teams deliver financial results, create informative financial and management reports, and provide the chief financial officer (CFO) with an enterprise view of key financial ratios and metrics. It enables finance teams to automate and accelerate the financial close with minimal IT support. DOWNLOAD NOW.

The Charity CFO

JANUARY 13, 2022

Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. . Prepare financial statements per Generally Accepted Accounting Principles (GAAP). For the purposes of GAAP, donations of goods and services are valid revenue. Because nonprofit accounting is all we do. .

The Finance Weekly

DECEMBER 18, 2021

The job description for a financial controller and a CFO are eerily similar. A controller (or comptroller in government roles) is the company’s lead accountant and the one in charge of running day-to-day activities of the accounting department. According to Payscale , the average salary for a CFO is 1.5

The Charity CFO

JANUARY 19, 2023

Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations. In the United States, these Generally Accepted Accounting Principles (or GAAP) are set by the Financial Accounting Standards Board (FASB).

The Charity CFO

JANUARY 5, 2022

The #1 accounting mistake that nonprofits make is hiring the wrong people to help them. Get this FREE guide to discover what you need to do to ensure you hire the right accountant, bookkeeper, or CFO the FIRST time. The post Understanding Functional Expenses for Nonprofits appeared first on The Charity CFO.

Future CFO

SEPTEMBER 15, 2021

Knowledge of GAAP. An understanding of the Generally Accepted Accounting Principles (GAAP) and of compliance with them. In addition to Greater Mumbai, Gurgaon and Bengaluru — the Indian cities of Chennai, Delhi, Pune and Hyderabad are good options for this skill.

Boston Startup CFO

OCTOBER 29, 2012

CFO: If your company has closed a seed round of funding or is earning more than $250K per year, you need a CFO to handle your financial strategy and run your accounting team. Even if you’re not yet funded or earning significant revenue, you may still be in need of CFO services.

Boston Startup CFO

APRIL 3, 2023

They prepare the income statement, balance sheet, and statement of cash flows using the accrual accounting method. Familiarity with Generally Accepted Accounting Principles (GAAP) is essential.

CFO Share

MARCH 14, 2022

Audited financial statements focus on compliance with GAAP accounting standards, whereas Quality of Earnings reports focus on the company’s earnings history and potential. Significant and/or unusual accounting policies such as: Changes in accounting methods. Changes in accounting principles.

https://trustedcfosolutions.com/feed/

SEPTEMBER 15, 2022

It’s hard to keep up with changing laws and constant updates of current GAAP (Generally Accepted Accounting Principles) standards and financial regulations. If your accounting system can’t keep up, it’s time for a change. With robust software capabilities, the headache of maintaining compliance is a thing of the past.

The Charity CFO

JULY 12, 2024

Adopting the accrual method ensures compliance with Generally Accepted Accounting Principles (GAAP) and other relevant standards. Moving from cash-basis to accrual-basis accounting can help your nonprofit better manage its financial health and improve transparency. Get the free guide!

The Charity CFO

JANUARY 5, 2023

When creating your fiscal policy, ensure that it complies with the Generally Accepted Accounting Principles (GAAP). Bring GAAP compliance. Create transparency and accountability required by the board and IRS. The post 7 Essentials Of Nonprofit Financial Management appeared first on The Charity CFO.

The Charity CFO

APRIL 13, 2023

This is why at The Charity CFO , we strive to provide relevant resources and support to ensure that your organization runs smoothly and efficiently. Accounting Standards In the United States, all organizations must adhere to the Generally Accepted Accounting Principles (GAAP). Get the free guide!

The Charity CFO

NOVEMBER 10, 2022

Yes, they might have a board member or volunteer who takes care of the finances, but they often lack specific expertise in nonprofit accounting. As a result, the organization might not adhere to Generally Accepted Accounting Principles (GAAP), which can trip them up come tax time or during an audit. Get the free guide!

Planful

JUNE 22, 2017

But in the accounting world, “financial consolidation” is a well-defined process that includes several complexities and accounting principles. Here are the key accounting consolidation steps in the finance consolidation process : Collecting trial balance data (e.g.,

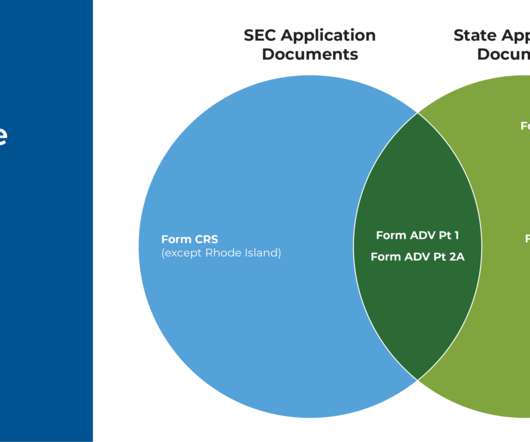

CFO News Room

NOVEMBER 2, 2022

It should also be noted that, at least for state-registered advisers, financial statements must typically be prepared in accordance with GAAP. This is why most advisers do not collect more than $1,200 in fees per client, 6 months or more in advance, so as to avoid the requirement to prepare and publicly report their balance sheet.

Spreadym

AUGUST 10, 2023

Compliance: Adherence to accounting standards and regulations, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Data Visualization: Graphs, charts, and visual representations of financial data to help users better understand trends, patterns, and insights.

Future CFO

NOVEMBER 2, 2020

Many jurisdictions are moving towards international accounting standards such as International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP). Across these regions, local GAAP is more common than international standards, required in 71% and 44% of jurisdictions respectively.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content