FASB tees up GAAP codification cleanup for comment

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Principles Related Topics

Accounting Principles Related Topics

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Fpanda Club

JANUARY 23, 2025

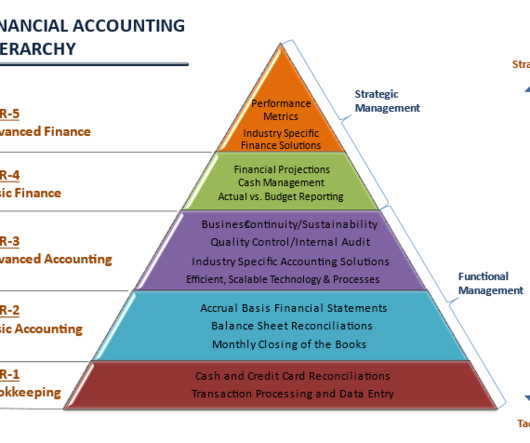

Such tasks as reconciling accounts, monthly closing, preparing financial statements are part of the accounting cycle and are typically managed by accounting departments.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Bramasol

JUNE 10, 2022

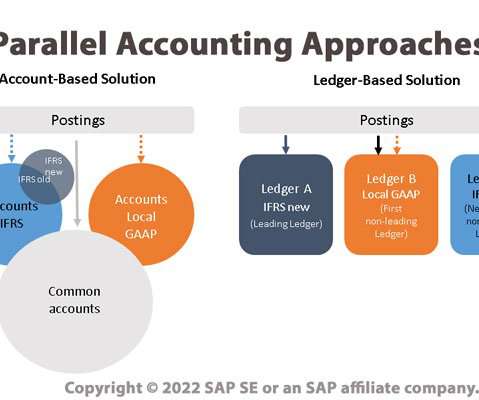

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger.

The Charity CFO

DECEMBER 30, 2021

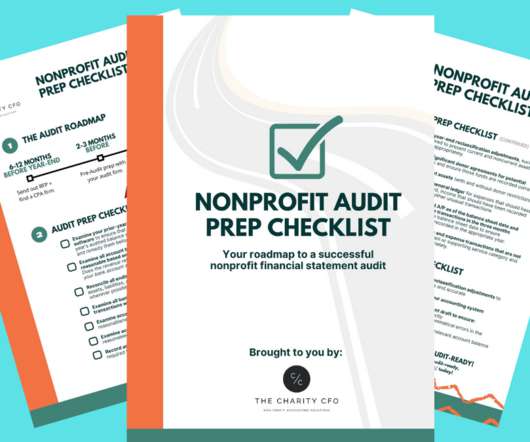

When you pass the audit, you’ll receive a clean bill of health from your auditor and a professional opinion stating the accuracy and validity of your accounting records. It assures outside observers that “the organization’s financial records meet generally accepted accounting principles.”

CFO Talks

NOVEMBER 29, 2024

For newly qualified accountants aspiring to become CFOs, mastering technical skills early on is essential. When you’re young, focus on deeply understanding the core accounting principles, financial reporting, and regulatory compliance.

CFO News Room

JANUARY 23, 2023

Stanley Black & Decker, which was able to carry out a $290 million inventory reduction in the quarter, cut its annual guidance for diluted earnings per share under generally accepted accounting principles to between 10 cents and 80 cents per share from a range of 80 cents to $2.05

PYMNTS

SEPTEMBER 24, 2018

Errors can be anything from a misapplication of accounting principles to an error in inputs in accounting software or an error in [Microsoft] Excel schedules,” said Michael Burke, partner at accounting firm UHY LLP, according to The Wall Street Journal. percent stake in CWGS Enterprises.

The Charity CFO

JANUARY 17, 2022

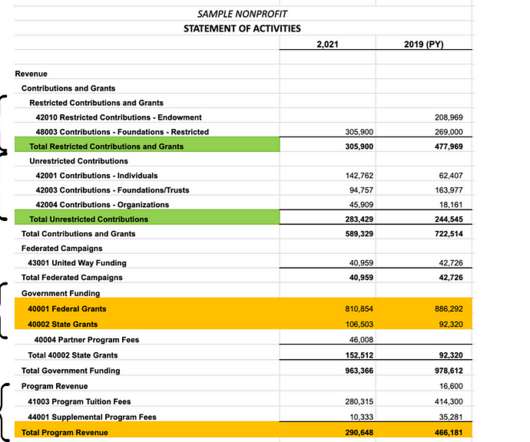

The basic accounting principles for nonprofit organizations are the same as accounting for for-profit companies. . So let’s start with the basics, and later we’ll dig into some of the things that make nonprofit accounting unique. . Cash accounting may be a good choice for some small nonprofits with funding challenges.

The Charity CFO

APRIL 5, 2022

Cash accounting does not comply with Generally Accepted Accounting Principles (GAAP) for nonprofit organizations. So if you expect to grow or search for new sources of funding, you’ll probably need to graduate to accrual-basis accounting.

Future CFO

JULY 21, 2024

While we need accountants with a strong foundation in accounting principles, data analysis skills, business acumen, we also need them to have a willingness to adapt to constant change. Attracting and retaining qualified professionals with the right skillsets remains a challenge," he says.

The Charity CFO

JANUARY 11, 2023

All these sources must be carefully managed to ensure compliance with Generally Accepted Accounting Principles (GAAP) and guidelines. Revenue recognition is an accounting process of properly identifying when income has been earned. Your organization’s accounting method really impacts the timing of recognizing transactions.

The Charity CFO

OCTOBER 9, 2024

This makes it challenging to create technology that tracks data for fundraising purposes while still following accounting principles. Instead, accounting software prioritizes accuracy, standardization, and regulatory compliance. The short answer: these two datasets serve different purposes.

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP.

Boston Startup CFO

APRIL 3, 2023

They prepare the income statement, balance sheet, and statement of cash flows using the accrual accounting method. Familiarity with Generally Accepted Accounting Principles (GAAP) is essential. Leave the Minotaur of financial confusion in your wake as you sail towards success, guided by the wisdom of skilled Fractional CFOs.

Future CFO

APRIL 18, 2022

DOWNLOAD NOW. The post IBM Cognos Controller: Financial close management managed by the office of finance appeared first on FutureCFO.

The Charity CFO

MAY 10, 2022

The changes to in kind donation reporting are specifically for organizations that follow generally accepted accounting principles (GAAP) in preparing their financial statements. And if you’ve already implemented the changes below, you’re in luck because the FASB did specify that early adoption of these standards is okay.

Global Finance

JULY 29, 2024

And they typically boast a deep understanding of accounting principles, analysis, and business strategy—essentials in guiding an organization toward its goals. Indeed, it’s hard to make accounting sexy when “Instagram influencer” is a viable career option. There’s just one problem, Bokhari says: “We’re competing with glamour.”

The Charity CFO

JANUARY 31, 2022

To comply with Generally Accepted Accounting Principles (GAAP), you must separate your revenue into at least 2 categories: Restricted Revenue shows funds with donor-placed restrictions on how or when you can spend the money.

The Charity CFO

JANUARY 18, 2022

In doing so, Zack will help ensure that our clients’ financials are prepared in accordance with general accepted accounting principles (GAAP) and their 990s meet IRS guidelines. His primary role will be to lead the organization’s quality control and training programs.

PYMNTS

DECEMBER 3, 2019

The company used generally accepted accounting principles (GAAP) to essentially turn a $1.9 Using this cash-flow metric, WeWork was able to deduct about $900 million in leasing costs and building expenses from the revenue it took in from members and services. billion net loss into a $142 million profit.

The Charity CFO

APRIL 29, 2022

A financial statement audit is a thorough review of your financial statements to determine if your financial statements present fairly, in all material respects, in accordance with generally accepted accounting principles. The purpose of a financial statement audit is NOT to detect fraud.

The Charity CFO

JANUARY 21, 2022

If you’re looking for info on fund accounting in government here is a great resource for you. Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit.

The Charity CFO

FEBRUARY 4, 2022

Nonprofits must maintain thorough and accurate financial records to comply with both Generally Accepted Accounting Principles ( GAAP ) and maintain their tax-exempt status with the IRS. And it’s impossible to do that without accurate bookkeeping.

Future CFO

AUGUST 4, 2024

While accounting relies on doing the same things consistently, how they are done is always evolving because of legal and regulatory changes and the constant change in how accounting principles are reflected in processes.

Future CFO

SEPTEMBER 15, 2021

An understanding of the Generally Accepted Accounting Principles (GAAP) and of compliance with them. In addition to Greater Mumbai, Gurgaon and Bengaluru — the Indian cities of Chennai, Delhi, Pune and Hyderabad are good options for this skill. Knowledge of GAAP.

The Charity CFO

JULY 19, 2024

They also help nonprofit leaders maintain compliance with legal standards and tax regulations.

Future CFO

MARCH 30, 2021

Yes, they all follow the same accounting principles, manufacturing processes follow the same workflow, and likely they compete for the same customers. Every business is unique even if the customer or industry is the same.

PYMNTS

JUNE 10, 2019

Reports in The Block Crypto late last week said a group of California CPAs has sent a letter to the Financial Accounting Standards Board, a federal board that sets Generally Accepted Accounting Principles (GAAP), requesting that it consider establishing a task force to address a lack of clarity in cryptocurrency accounting standards.

https://trustedcfosolutions.com/feed/

SEPTEMBER 15, 2022

It’s hard to keep up with changing laws and constant updates of current GAAP (Generally Accepted Accounting Principles) standards and financial regulations. If your accounting system can’t keep up, it’s time for a change. With robust software capabilities, the headache of maintaining compliance is a thing of the past.

The Charity CFO

JANUARY 19, 2023

Because of their unique structure and operational model, nonprofits must comply with various accounting standards that are, in many ways, different from for-profit organizations. In the United States, these Generally Accepted Accounting Principles (or GAAP) are set by the Financial Accounting Standards Board (FASB).

The Charity CFO

FEBRUARY 25, 2022

For that reason, your account numbering, category names, and structure should follow standard guidelines and numbering conventions established by Generally Accepted Accounting Principles (GAAP). . Those number and name conventions are as follows: . Assets-1000s. Liabilities-2000s. Equity-3000s. Revnue-4000s. Expenses-5000s+.

Bramasol

MAY 13, 2024

The PCAOB and AICPA essentially interpret and enforce accounting rules as promulgated by the Financial Accounting Standards Board (FASB) , which is responsible for establishing and improving accounting standards for financial reporting in the United States.

The Charity CFO

JANUARY 5, 2022

Reporting functional expenses has been required by Generally Accepted Accounting Principles (GAAP) since 2017, as detailed in ASU 2016-14. So you really don’t have a choice, but if you want more reasons…. To pass an independent audit. That means you’ll need to present a Functional Expense Report to pass an audit. To build public trust.

Future CFO

OCTOBER 16, 2022

Anomaly detection uses a series of machine learning (ML) models to highlight transactions or balances that are in error or potentially violate accounting principles or policies. Anomaly and error detection.

PYMNTS

MARCH 6, 2019

Many of those mistakes were discovered as corporate accounting teams adjusted reports to comply with revised tax and accounting rules, though some resulted from intentional manipulation.

The Charity CFO

JANUARY 13, 2022

Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. . Prepare financial statements per Generally Accepted Accounting Principles (GAAP). You need to track and report in-kind donations if your organization is required to… . Submit to an annual audit.

CFO Share

MARCH 14, 2022

Significant and/or unusual accounting policies such as: Changes in accounting methods. Changes in accounting principles. Changes in accounting policies. Changes in accounting practices or procedures. Examples of findings include: Unusual financial trends and variances. Transactions with related parties.

CFO Plans

AUGUST 5, 2020

Accounting principles. You need to recognize the unearned income portion in the Balance Sheet as a deferred revenue liability. Because you owe service (an obligation) to your client. Why is deferred income essential to implement? There are several important reasons. Management Information.

The Finance Weekly

MARCH 25, 2024

The CFO plays a key role in ensuring these statements are accurate and in line with standard accounting principles (GAAP). Reporting Financial reports like balance sheets, P&L, and cash flow statements are crucial for both insiders and outsiders to grasp a company's financial health.

PYMNTS

AUGUST 7, 2017

Nowadays, companies report for both generally accepted accounting principles (GAAP) and non-GAAP numbers, as mandated by the Securities and Exchange Commission. Ostensibly, the onus is on the investor to choose which type of accounting they prefer to use — and which earnings — when assessing the financial snapshot of a company.

PYMNTS

NOVEMBER 15, 2019

“In this respect, our process for recognizing revenue and recording returns and other allowances has not changed and has always been in compliance with generally accepted accounting principles,” the company said in an official statement.

PYMNTS

DECEMBER 20, 2016

CtW Investment Group had requested that the Security and Exchange Commission investigate the reporting behind T-Mobile’s non-standard accounting efforts as well as how it records and presents info tied to customers who have defaulted on phone installment payment plans.

CFO Share

NOVEMBER 17, 2023

The Future of AI Bookkeeping with Professional Insight AI bookkeeping tools holds immense potential for small businesses, but its success relies on the strategic oversight of professionals skilled in both accounting principles and AI technology.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content