DOGE poses danger to FTC data, fired commissioners say

CFO Dive

APRIL 11, 2025

The pair, who served as Democrats on the commission, said they were “deeply concerned” that DOGE may access confidential business data at the FTC.

CFO Dive

APRIL 11, 2025

The pair, who served as Democrats on the commission, said they were “deeply concerned” that DOGE may access confidential business data at the FTC.

Nerd's Eye View

APRIL 9, 2025

It's natural for advisors to begin discovery meetings by asking questions about a client's current financial situation – understanding cash flow, debt, investments, risk tolerance, or even the burning tax concern that brought them to the advisor's door in the first place is crucial for financial planning. However, starting with these questions can have unintended consequences.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Navigator SAP

APRIL 4, 2025

Innovation requires data and flexible tools for understanding market dynamics, experimenting, and adjusting product offerings. A modern enterprise resource planning solution (ERP) serves as the foundation for this innovation, and industry solutions from SAP make it easy for organizations both to adopt this foundation and fully utilize it. An ERP, of course, is company-wide backend software that encompasses all applications and processes within a company and both stores and connects business data

CFO Dive

APRIL 7, 2025

The budget airline, recently emerged from bankruptcy, picked the trio of senior executives to handle CEO responsibilities until a new chief executive is found.

Global Finance

APRIL 6, 2025

Faced with low yields, insurers are deepening ties with private equity and asset managers, turning to alternative investments amid regulatory headwinds. Life insurance companies used to be conservative investors. For decades, they relied on long-term bondssafe, steady, and predictableto match their policy obligations. But as interest rates plunged following the 2008 financial crisis, traditional investment models no longer delivered sufficient returns.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

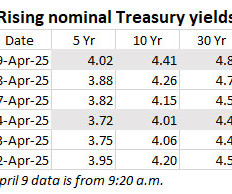

Tips Watch

APRIL 9, 2025

By David Enna, Tipswatch.com Just a week ago, in the early stages of our brand-new “Tariff Crisis,” the stock market was falling sharply and the U.S.

Global Finance

APRIL 4, 2025

Pending regulatory approval, Google plans to acquire multi-cloud security platform provider Wiz in an all-cash deal worth $32 billion. Once the transaction closes, Wiz will be incorporated into Google Clouds business line. The two companies share a joint vision to make cybersecurity more accessible and simpler to use for organizations of any size and industry, said Thomas Kurian, CEO of Google Cloud, during the announcement.

Future CFO

APRIL 7, 2025

Chief financial officers, with their role continuously evolving , are expected to champion sustainability initiatives, integrating ESG factors into their financial planning and reporting processes. Finance leaders now are faced with the task of identifying and mitigating ESG-related risks, allocating resources towards sustainability initiatives and communicating the organisation's ESG performance to stakeholders.

CFO Talks

APRIL 8, 2025

Making Sense of Complexity: How CFOs Build Clarity Across the Business In todays fast-paced and data-rich environment, the role of the Chief Financial Officer has evolved into something far more dynamic than traditional financial oversight. While accuracy, control, and compliance remain core responsibilities, the modern CFO is also a strategic communicator someone who can turn financial complexity into actionable insight.

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

CSC Advisors

APRIL 10, 2025

Business owners often consider Merchant Cash Advance (MCA) loans a fast and flexible option. However, their high costs and daily repayment structures can quickly become burdensome for many business owners. Fortunately, the MCA refinancing process offers a way to reduce these financial pressures. By refinancing, business owners can regain control of their cash flow and ensure long-term financial stability.

CFO Dive

APRIL 7, 2025

Several Wall Street leading lights on Monday flagged the economic disruptions from tariffs imposed on virtually all U.S. trading partners.

Global Finance

APRIL 4, 2025

On March 21, Ethiopia issued its first-ever investment banking licenses, marking a historic shift in the nations financial sector. The Ethiopian Capital Market Authority (ECMA) granted the licenses to CBE Capital S.C. and Wegagen Capital Investment Bank S.C., both linked to major Ethiopian banks. CBE Capital, a subsidiary of the state-owned Commercial Bank of Ethiopia (CBE), became the countrys first public-sector-backed investment bank.

E78 Partners

APRIL 10, 2025

The webinar “Driving M&A Success: Insights for Corporate Development Executives,” hosted by E78, featured experts Scott Whitaker and Stefan Hofmeyer, who shared their extensive experience in M&A integration and transaction advisory. This session aims to enhance attendees understanding of post-merger integration (PMI) considerations and best practices, drawing from a global M&A success survey conducted with 115 senior executives, primarily from mid-market and Fortune 500 c

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

CFO Talks

APRIL 10, 2025

Fraud Happens Hopefully Not on Your Watch You dont need a full-blown scandal to put your career on the line. Sometimes, all it takes is one case of fraud missed under your watch. As CFO, you’re not just managing the numbersyou’re the last line of defense between your organisation and reputational, regulatory, or even criminal fallout. Fraud is rarely dramatic at first.

CSC Advisors

APRIL 10, 2025

Expanding your preschool or upgrading facilities is a significant step toward long-term growth and success. However, preschool financing can often be a challenge. Strategic planning on how to finance these upgrades becomes essential since financial hurdles can delay or deter exciting opportunities. With expert guidance, such as from Cornerstone Capital Advisors, preschool owners can access practical and tailored funding solutions.

CFO Dive

APRIL 8, 2025

The Tysons Corner, Virginia-based company’s report comes on the heels of a bitcoin slump and newly effective crypto accounting rules from FASB.

Global Finance

APRIL 4, 2025

Salah Al Fulaij, CEO-Kuwait at National Bank of Kuwait (NBK), discusses Kuwaits path toward economic and banking reform and NBKs strategy in a period of change. Global Finance: In fall 2023, the government of Kuwait released its Master Plan 2040, focused on modernizing company law, economic openness, and encouraging non-oil development. In parallel, it passed a new law loosening restrictions on foreign ownership of businesses.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Future CFO

APRIL 4, 2025

It has been an imperative for accountants to keep up with the technological advancements in the market, and understanding artificial intelligence now raises key challenges for finance professionals. This is the findings of the Association of Chartered Certified Accountants in a recent report, revealing that accounting professionals are posed with three hurdles: identifying and managing AI risk as a user in any role, supporting a collaborative approach to risk management, and helping to understan

CFO Talks

APRIL 9, 2025

What Every CFO Should Know to Protect the Business (and Their Career) You dont need to be an actuary or compliance expert to understand risk. But if youre a Chief Financial Officer, you absolutely need to know how to spot it, shape it, and shield your organisation from it. Risk management isnt a luxury, its a core leadership function. And ignoring it can be the fastest way to damage not only your business, but your own professional credibility.

CSC Advisors

APRIL 10, 2025

Securing a business loan can be pivotal for growth, operations, or overcoming financial hurdles. However, obtaining financing isn’t always straightforward. Lenders assess numerous factors to determine business loan readiness. Preparing ahead ensures you meet their expectations and increases your chances of getting approved. Let’s explore the essential components lenders consider when evaluating your business loan readiness.

CFO Dive

APRIL 11, 2025

Existing accounting standards have led to “scope creep,” with derivative standards being applied too often, FASB Chair Richard Jones said.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Global Finance

APRIL 4, 2025

Shayne Nelson, group CEO of Emirates NBD, Dubais government-owned bank and one of the largest banks in the Middle East by assets, shares how NBD aims to maintain last years standout performance. Global Finance: Emirates NBD posted record profits in 2024. To what does it owe this success? Shayne Nelson: Emirates NBD Group delivered a record-breaking financial performance in 2024, driven by a clear strategic focus, agile IT infrastructure, a strong balance sheet, and exceptional execution.

CFO Thought Leader

APRIL 9, 2025

It was the kind of boardroom moment that separates finance professionals from finance leaders. Tony Jarjoura, now CFO of Gigamon, found himself surrounded by audit committee members as a dense, highly technical tax strategy unraveled before them. Despite having pored over legal memos and internal reviews, the room still looked puzzleduntil Tony spoke.

Future CFO

APRIL 9, 2025

Amid the pool of priorities that finance leaders have to juggle in 2025, innovation initiatives came on top. In a poll conducted by Cxociety during the recently concluded 5th Annual FutureCFO Conference in the Philippines, with the theme Pathways Towards Differentiated Success, 37% of the respondents believe innovation initiatives require the most focus to balance strategic priorities in the Finance function.

CSC Advisors

APRIL 10, 2025

Merchant Cash Advance (MCA) loans can be a lifeline for businesses needing quick cash. However, their high costs and frequent repayment schedules often leave owners overwhelmed. Refinancing could be your solution if you’re struggling with an MCA loan. This guide will help you recognize when to consider an MCA loan refinance and how it can benefit your business.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Let's personalize your content