Spirit Airlines CFO, COO, GC to step up after CEO exits

CFO Dive

APRIL 7, 2025

The budget airline, recently emerged from bankruptcy, picked the trio of senior executives to handle CEO responsibilities until a new chief executive is found.

CFO Dive

APRIL 7, 2025

The budget airline, recently emerged from bankruptcy, picked the trio of senior executives to handle CEO responsibilities until a new chief executive is found.

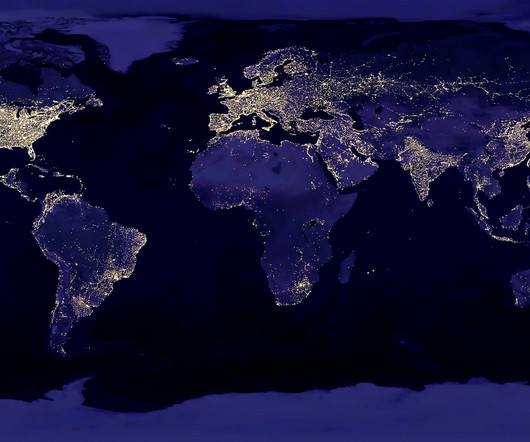

Musings on Markets

APRIL 7, 2025

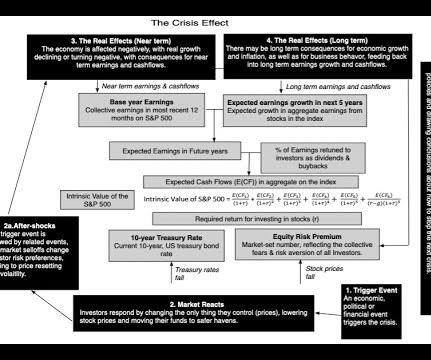

I was boarding a plane for a trip to Latin America late in the evening last Wednesday (April 2), and as is my practice, I was checking the score on the Yankee game, when I read the tariff news announcement. Coming after a few days where the market seemed to have found its bearings (at least partially), it was clear from the initial reactions across the world that the breadth and the magnitude of the tariffs had caught most by surprise, and that a market markdown was coming.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Finance

APRIL 6, 2025

Faced with low yields, insurers are deepening ties with private equity and asset managers, turning to alternative investments amid regulatory headwinds. Life insurance companies used to be conservative investors. For decades, they relied on long-term bondssafe, steady, and predictableto match their policy obligations. But as interest rates plunged following the 2008 financial crisis, traditional investment models no longer delivered sufficient returns.

Nerd's Eye View

APRIL 9, 2025

It's natural for advisors to begin discovery meetings by asking questions about a client's current financial situation – understanding cash flow, debt, investments, risk tolerance, or even the burning tax concern that brought them to the advisor's door in the first place is crucial for financial planning. However, starting with these questions can have unintended consequences.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Tips Watch

APRIL 9, 2025

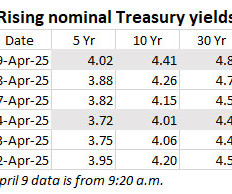

By David Enna, Tipswatch.com Just a week ago, in the early stages of our brand-new “Tariff Crisis,” the stock market was falling sharply and the U.S.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO Dive

APRIL 7, 2025

Several Wall Street leading lights on Monday flagged the economic disruptions from tariffs imposed on virtually all U.S. trading partners.

CFO Talks

APRIL 8, 2025

Making Sense of Complexity: How CFOs Build Clarity Across the Business In todays fast-paced and data-rich environment, the role of the Chief Financial Officer has evolved into something far more dynamic than traditional financial oversight. While accuracy, control, and compliance remain core responsibilities, the modern CFO is also a strategic communicator someone who can turn financial complexity into actionable insight.

CSC Advisors

APRIL 10, 2025

Business owners often consider Merchant Cash Advance (MCA) loans a fast and flexible option. However, their high costs and daily repayment structures can quickly become burdensome for many business owners. Fortunately, the MCA refinancing process offers a way to reduce these financial pressures. By refinancing, business owners can regain control of their cash flow and ensure long-term financial stability.

E78 Partners

APRIL 10, 2025

The webinar “Driving M&A Success: Insights for Corporate Development Executives,” hosted by E78, featured experts Scott Whitaker and Stefan Hofmeyer, who shared their extensive experience in M&A integration and transaction advisory. This session aims to enhance attendees understanding of post-merger integration (PMI) considerations and best practices, drawing from a global M&A success survey conducted with 115 senior executives, primarily from mid-market and Fortune 500 c

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

CFO Thought Leader

APRIL 9, 2025

It was the kind of boardroom moment that separates finance professionals from finance leaders. Tony Jarjoura, now CFO of Gigamon, found himself surrounded by audit committee members as a dense, highly technical tax strategy unraveled before them. Despite having pored over legal memos and internal reviews, the room still looked puzzleduntil Tony spoke.

CFO Dive

APRIL 8, 2025

The Tysons Corner, Virginia-based company’s report comes on the heels of a bitcoin slump and newly effective crypto accounting rules from FASB.

CFO Talks

APRIL 10, 2025

Fraud Happens Hopefully Not on Your Watch You dont need a full-blown scandal to put your career on the line. Sometimes, all it takes is one case of fraud missed under your watch. As CFO, you’re not just managing the numbersyou’re the last line of defense between your organisation and reputational, regulatory, or even criminal fallout. Fraud is rarely dramatic at first.

CSC Advisors

APRIL 10, 2025

Expanding your preschool or upgrading facilities is a significant step toward long-term growth and success. However, preschool financing can often be a challenge. Strategic planning on how to finance these upgrades becomes essential since financial hurdles can delay or deter exciting opportunities. With expert guidance, such as from Cornerstone Capital Advisors, preschool owners can access practical and tailored funding solutions.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Future CFO

APRIL 9, 2025

Amid the pool of priorities that finance leaders have to juggle in 2025, innovation initiatives came on top. In a poll conducted by Cxociety during the recently concluded 5th Annual FutureCFO Conference in the Philippines, with the theme Pathways Towards Differentiated Success, 37% of the respondents believe innovation initiatives require the most focus to balance strategic priorities in the Finance function.

Global Finance

APRIL 5, 2025

The infrastructure sector is fertile ground for dealmakers, as producers around the world seek to expand. Throughout 2024, the infrastructure sector was highly active for investment bankers, with robust deal flow across renewable energy, digital transformation, and critical infrastructure projects. Major banks like Absa Bank, ICBC, OTP Bank, Bradesco BBI, J.P.

CFO Dive

APRIL 11, 2025

The pair, who served as Democrats on the commission, said they were “deeply concerned” that DOGE may access confidential business data at the FTC.

CFO Talks

APRIL 9, 2025

What Every CFO Should Know to Protect the Business (and Their Career) You dont need to be an actuary or compliance expert to understand risk. But if youre a Chief Financial Officer, you absolutely need to know how to spot it, shape it, and shield your organisation from it. Risk management isnt a luxury, its a core leadership function. And ignoring it can be the fastest way to damage not only your business, but your own professional credibility.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

CSC Advisors

APRIL 10, 2025

Securing a business loan can be pivotal for growth, operations, or overcoming financial hurdles. However, obtaining financing isn’t always straightforward. Lenders assess numerous factors to determine business loan readiness. Preparing ahead ensures you meet their expectations and increases your chances of getting approved. Let’s explore the essential components lenders consider when evaluating your business loan readiness.

Future CFO

APRIL 9, 2025

Finance heads are now expected to elevate their tools and processes as they navigate their way around new models for revenue recognition. According to automated revenue recognition software developer RightRev , modern solutions allow businesses to support evolving models, adapt fast, and stay competitive, but these models bring complexity which end up making finance teams to rethink their strategies.

Global Finance

APRIL 5, 2025

Advisers enjoy an uptick in M&As and IPOs despite geopolitical uncertainty; whether 2025 maintains the energy remains to be seen. The global mergers and acquistions (M&A) market might not have fulfilled every dealmakers fantasy of a roaring comeback in 2024. Still, every major region posted double-digit gains despite being tossed about by waves of geopolitical uncertainty.

CFO Dive

APRIL 11, 2025

Existing accounting standards have led to “scope creep,” with derivative standards being applied too often, FASB Chair Richard Jones said.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

CFO Talks

APRIL 8, 2025

Members Profile: Julius Katanaka In this edition of our CFO Spotlight series, we feature Julius Katanaka, Head of Finance at Wazalendo SACCO Ltd, a seasoned finance professional with a strong accounting and strategic financial management background. Holding an MSc, BSc, and FCCA qualification, Julius has made a remarkable impact in the finance sector, earning multiple prestigious awards, including the Chief Finance Officer of the Year Sustainability Award (2023) and the Financial Reporting Awa

CSC Advisors

APRIL 10, 2025

Merchant Cash Advance (MCA) loans can be a lifeline for businesses needing quick cash. However, their high costs and frequent repayment schedules often leave owners overwhelmed. Refinancing could be your solution if you’re struggling with an MCA loan. This guide will help you recognize when to consider an MCA loan refinance and how it can benefit your business.

Nerd's Eye View

APRIL 8, 2025

Welcome everyone! Welcome to the 432nd episode of the Financial Advisor Success Podcast! My guest on today's podcast is Seth Scott. Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

Global Finance

APRIL 5, 2025

The top three sectors when it comes to dealmaking, according to McKinsey, are global energy and materials (GEM); telecom, media, and technology (TMT); and financial services. You saw some big [TMT] deals in the US, but also here in Europe, McKinseys Mieke Van Oostende, a senior partner in Brussels and co-leader of the consultancys global M&A practice, tells Global Finance.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Let's personalize your content