Rivian swipes Tesla vet for CAO

CFO Dive

MARCH 11, 2025

Former Tesla VP of Finance Sreela Venkataratnam will receive a $20,000 cash bonus from Rivian as part of her compensation package, the company said.

CFO Dive

MARCH 11, 2025

Former Tesla VP of Finance Sreela Venkataratnam will receive a $20,000 cash bonus from Rivian as part of her compensation package, the company said.

Navigator SAP

MARCH 14, 2025

The task of managing a companys supply chain used to be relatively straightforward: Find predictable partners that met quality and specification standards, ensure reliability, and fine-tune the phasing. Bringing products or components from China, or manufacturing in Asia or South America, was relatively routine business.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

MARCH 10, 2025

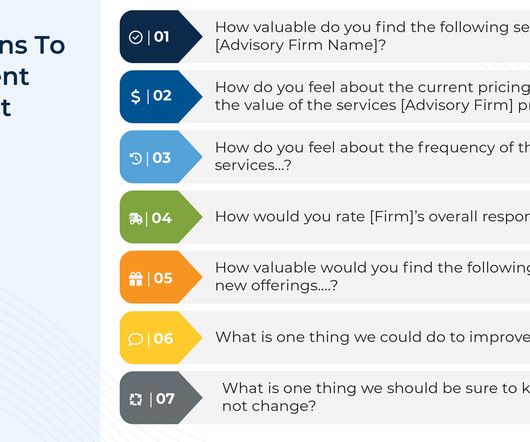

Financial advicers often market their comprehensive financial services as a way to differentiate themselves from other advisory firms and to stand out in the broader landscape of financial advice. These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. In a firm's early years, there tends to be more room for experimentation, with advisors adding new services to provide value and attract clients.

Barry Ritholtz

MARCH 10, 2025

Money Delusions: What Do People Get Wrong About Money? David Nadig, “ Rabbithole ” March 7, 2025 I had fun chatting with Dave Nadig about philosophy, behavior, and investing ( video after the jump). His new podcast is called “Rabbithole” because Dave does not do broad and shallow; rather, he picks a narrow topic and goes deep down the rabbithole for 30 minutes — which is only a few questions.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

CFO Talks

MARCH 13, 2025

Financial Reports That Dont Age Like Milk: The Power of Real-Time Data Imagine running a business where financial decisions feel like guessworkwaiting weeks for reports, struggling with outdated data, and constantly fearing human error. Now, picture the opposite: instant access to real-time financial insights, automated compliance checks, and AI-driven forecasts guiding your next move.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CSC Advisors

MARCH 14, 2025

Merchant cash advance loans offer quick access to funds, but many business owners discover that this convenience comes at a steep price. With high interest rates and inflexible repayment terms, escaping this financial burden often feels impossible. However, with the right strategies, merchant cash advance debt relief is within reach. Let’s explore practical solutions to help you regain control over your business finances.

Future CFO

MARCH 10, 2025

In 2025, the integration of AI into the finance function in Asia has the potential to reshape operational frameworks and decision-making processes. Current industry research suggests that AI technologies are gaining traction among finance professionals navigating a complex landscape marked by rapid change. At FutureCFO , we will likely see finance practitioners dabble in emerging technologies to enhance real-time decision-making, optimise invoice-to-cash and source-to-pay workflows, and allow CF

Barry Ritholtz

MARCH 14, 2025

This week, I speak with Stephanie Kelton , Professor of Economics and Public Policy at Stony Brook University and Senior Fellow at the Schwartz Center for Economic Policy Analysis. We discuss US fiscal policy, recession risks, and her New York Times bestseller “ The Deficit Myth: Modern Monetary Theory and the Birth of the Peoples Economy.” She has made virtually all the ‘top 50 lists’ including POLITICO’s 50 Most Influential Thinkers in 2016 and Bloomberg Businessw

CFO Talks

MARCH 11, 2025

From Panic to Progress Turning Workplace Change into Success Change is an unavoidable part of any business. Whether its adopting new technology, restructuring the organisation, updating processes, or shifting company culture, businesses must evolve to stay competitive. However, change can be challenging. It disrupts familiar routines, creates uncertainty, and can lead to resistance from employees who feel uneasy about what lies ahead.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CFO Dive

MARCH 12, 2025

Utah joins Virginia and Ohio in passing legislation providing a route to CPA licensure that doesn’t require 150 hours of college credit.

CSC Advisors

MARCH 14, 2025

Managing and growing a daycare or preschool business often requires significant financial resources. Whether updating your facilities, hiring skilled staff, or purchasing new equipment, youll need access to funds. But how do you decide between grants vs. loans? In this article, well break down the key differences, advantages, and challenges so you can make the best decision for your daycare.

Future CFO

MARCH 11, 2025

The role of the Chief Financial Officer (CFO) has undoubtedly moved outside the traditional accounting function and into a strategic leadership position. This evolution is particularly pronounced in Asia, driven by factors such as rapid economic growth, increasing regulatory complexity, and the accelerating pace of technological change. Gartner defines " performance management " as the combination of methodologies and metrics that enables users to define, monitor and optimise outcomes necessary

CFO News

MARCH 9, 2025

The National Financial Reporting Authority (NFRA) has called for enhanced communication between auditors and audit committees regarding complex tax estimates under Ind AS 12, particularly Deferred Tax Assets (DTAs) and Liabilities (DTLs). Highlighting the importance of standards like SA 540, NFRA emphasises the need for rigorous scrutiny of managements tax assumptions.

Advertiser: GEP

Procurement leaders are at a pivotal moment. With CPOs playing an increasingly strategic role, it’s time to leverage innovation and technology to drive resilience and efficiency. Download The 2025 Annual ProcureCon CPO Report to uncover key insights to thrive in a dynamic procurement landscape. What’s Inside: How CPOs are driving strategic decision-making and technology adoption The top priorities and challenges for procurement in 2025 Why AI, sustainability, and data analytics are essential for

Barry Ritholtz

MARCH 13, 2025

I have known Scott Galloway since way before his first book, The Four , came out in 2017. He had been on MiB prior, and it was my pleasure to intro it at NYU Stern when it first was published. As always, it was so much fun chatting with Scott on the Prof G podcast: Barry Ritholtz, the co-founder, chairman, and chief investment officer of Ritholtz Wealth Management and the host of the Masters in Business podcast, joins Scott to discuss his new book, How Not to Invest: The Ideas, Numbers, and Beha

CFO Dive

MARCH 13, 2025

The company’s introduction of new AI-enabled products is encouraging, although monetization is still “in the early stages,” a Morningstar analyst said.

CSC Advisors

MARCH 14, 2025

Merchant Cash Advance (MCA) loans can be a lifeline for businesses, but they come with their share of controversystarting with their legality. Business owners often wonder: Are MCA loans legal? The answer isn’t a simple yes or no. While MCA loans are legal, there are complexities to consider. Understanding Merchant Cash Advances (MCA Loans) MCA loans differ from traditional loans in that they aren’t actually loans at all.

Future CFO

MARCH 12, 2025

Fraud has always been a battle, if not a mortal enemy, of the Finance function, as one wrong move or decision can cripple the organisation's operations and finances. That is why it is only customary that chief finance officers and finance leaders have mastered how to get around risks, handling the evolving landscape of fraud and payments to always be prepared amid emerging technologies and shifting regulatory demands.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Nerd's Eye View

MARCH 14, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Securities and Exchange Commission (SEC) Commissioner Hester Peirce suggested in a recent interview that she would like to see the SEC give advisors more leeway to provide customized solutions to clients (rather than feeling required to take a regulator-prescribed "check-the-box" approach) and would like to ease the compliance burden on smaller investment advisers (p

The Charity CFO

MARCH 13, 2025

Is Your Nonprofit Ready for Increased Funding Scrutiny? Heres How to Prepare The financial landscape for nonprofits is shifting, and the pressure is mounting. With government funding and donor contributions facing heightened scrutiny, nonprofit leaders must ensure their financial systems are rock solid. Every dollar spent is under the microscope, and transparency is no longer optionalits essential.

CFO Dive

MARCH 10, 2025

Companies that were anticipating lower interest rate cuts may have to rethink their strategies amid falling rate-cut expectations.

CSC Advisors

MARCH 14, 2025

Merchant Cash Advances (MCAs) are popular funding options for small businesses needing fast cash. Unlike traditional loans, an MCA lets businesses receive an upfront lump sum in exchange for a percentage of future sales. While this can be a lifeline, failing to meet the repayment termscommonly known as defaultingcan have serious repercussions. Business owners struggling with their finances need to understand what happens if they default on a merchant cash advance and what options they have to re

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Future CFO

MARCH 14, 2025

Chief financial officers are expected to ensure their organisations are 'shored up' from fluctuations in interest rates and yields in 2025, according to Forvis Mazars. George Lagarias , chief economist at Forvis Mazars Group, says in terms of macroeconomic indicators, leaders should be focusing on credit spreads and sovereign yields, amid a positive yet challenging growth outlook for 2025.

Lime Light

MARCH 13, 2025

The True Cost of Spreadsheet Errors Spreadsheets have long been the foundation of financial planning and analysis (FP&A) for businesses. They are used for everything from budgeting and forecasting to tax reporting and financial close processes. However, their convenience comes at a price: errors, inefficiencies, and financial losses that cost businesses billions every year.

CFO Thought Leader

MARCH 11, 2025

The moment 2X secured private equity backing in March 2023, CFO Brandon Sullivan knew expectations would shift overnight. Theres gonna be a press release, he remembers thinking. Our new PE partners will open up a treasure chest of relationships for uswe need to be ready. In anticipation, Sullivan and his team ramped up hiring, ensuring 2X had the supply of talent needed to meet the expected surge in demand.

CFO Dive

MARCH 14, 2025

Federal Reserve officials, scheduled to assess monetary policy during a March 18-19 meeting, will likely zero in on a jump in long-term inflation expectations.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Let's personalize your content